One of the best things i love about American Express is that an individual can hold 3 Amex Cards on his own name (2 Credit Cards & 1 Charge Card). Note that If you’re planning for multiple cards, you need to have 6 months gap between each Amex card application. I already have American Express Platinum Travel Credit Card with which i’ve reaped the maximum milestone benefits and hence its the right time to apply for a new Card.

I have been eying on Platinum Reserve for a while but i got a love for “charge” card recently and wanna see what’s the fuss is all about the “charge” cards concept in India. Hence i applied for it and received it within a week, yes, super fast they are.

If you’re looking for a basic review of this card, check this previous article which was reviewed by my friend, below are some additional insights from my experience.

American Express Gold Charge Card in India – Things to Know:

1. Card with No EMI:

Globally the differences between credit/charge cards are like below,

- Credit cards comes with EMI option, while Charge cards don’t

- Credit cards has a Credit Limit, while Charge cards don’t

For Detailed info, I’ve written about Difference between credit card & charge card here

However, in India, the only difference is the EMI feature. Now, as most customers started to ask for EMI options, Amex decided to release a CREDIT card with similar features & EMI option enabled. This was recently released in India – The American Express Membership Rewards Card

2. Internal Credit Limit on Gold Charge Card:

While they still say that there is no pre-set Credit limit on the account, there is something called “internal credit limit” which is different from a normal credit limit. The thing is, you wont see this limit anywhere in the statement.

Customer care can help you find it though. They can do a “test charge” on your card and tell you if it goes through or not. The max. charge that the card allows at that point of time is your internal credit limit. It changes very often right from first month of the card issuance.

My first Amex Plat travel card was given a very low limit however they simply doubled after 6 months. On Amex Charge card, i was given a decent internal credit limit at the start, maybe because they already know my spending/payment pattern on the other card.

3. Going Beyond the Internal Credit Limit:

Now i started testing the limits. Hence, i came to know below rules, especially for a Freshly opened account/card.

- Generally, if you maxed out the limit, you can make your limit available for charge in few hrs on Amex cards by sending them NEFT snapshot of the payment done to the card. I’ve done this on my Plat Travel card but this cannot be done on a fresh card.

- Sometimes, you’re allowed to go beyond the limit on a Charge card. Hence i maxed out the limit & tried charging 10% to 50% beyond the actual limit but all got denied. Its because: they can’t take temporary “limit enhancement” on fresh cards.

- On Old cards, they might approve some transactions above internal credit limit if its for Emergency purpose.

4. Limit Enhancement on Amex Charge Cards:

Just after 4 months of my fresh Gold Charge card, i’m already able to charge more than 4X of initial Internal Limit that was assigned while signing up.

I think it works like this: If you spend 2L and repay 2L on time, you will be approved for 3L-4L Charge, in short time, like 3 months or even earlier and its completely dynamic and automated.

It can’t be enhanced like a typical credit card limit, also you don’t need to wait for 6 months to charge more. Start hitting the limit every month and you can expect them to double the limit from time to time.

So More you spend = More charge you’re allowed to take.

Hence, this internal credit limit is based on your past charges made on the card, repayment history, cibil score, age of card, etc. Everything contributes to the equation.

5. Free Credit Card – Temporary offer:

If you hold a American Express Gold Charge card, you’re eligible to get the recently launched Amex Membership Rewards – Credit Card as a “companion” card at free of charge. Now what a “companion” card means is that, you can club the reward points from both credit/charge card accounts to redeem.

I was given this offer, however i denied as i’m planning to take Amex reserve card in the future and if i take this offer now, i’ll have 3 Amex cards and i can no longer be eligible for a 4th Card from Amex. Hence i had to deny this irresistible offer 😀

Bonus Tip: You can link another amex card (in same earn rate category) with Gold Charge card and avail the benefit of higher point value by redeeming 18k or 24k points for statement credit.

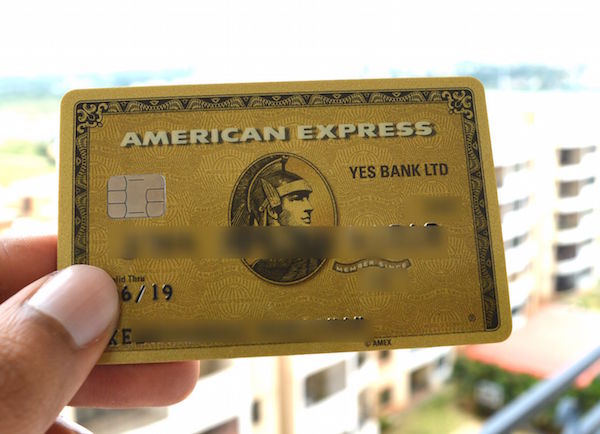

So, overall, i feel less excited of having a charge card as it more or less act like any other credit card for me, still, it looks pretty good to hold a fully gold colored shining card in hand. More info here: Link 2 Amex Credit Cards to Accrue Reward Points in Single Account

Do you have Amex Gold Charge Card? Feel free to share your experiences in comments below 🙂

As usual thank you for this article !!!

Most welcome 🙂

So last month i got amex gold charge card, am i eligible for life time free rewards card ( current offer)?

Thanks for this article

Yes Ashish,

You are eligible as far as i know.

Just call customer care to re-confirm & apply 🙂

no u r not.. as per terms and conditions

I have a corporate Amex card. They offered me Gold charge card for free. The customer rep was telling I will get 1000 points for 1000Rs spend & she was telling there is no limit in earning this. This was too good to believe. So i have asked her to mail the details. Let’s c.

The reasons she told was:

1. Its an exclusive offer for some customers

2. Amex have made some tie up with hdfc as well as sbi which will make amex card work on their pos machines. So they want to increase the card users

Siddarth,

Is it posssible to cancel the charge card after receiving the Gold credit card and still have it as a LTF card ?

Lol, Interesting Idea. But i’m not sure Krish.

You can ask the customer support about it and they’ll answer the qn politely (really)

They’re nice guys 🙂

Yes its possible.

However, this card comes free with AMEX gold charge card. But if u cancel the charge card, u will be charged annual fees for the Amex Gold credit card. U can read the terms and conditions that came with the gold credit card.

I already checked that !!! Once you cancel the charge card credit credit also gets cancelled 🙂 Those guys are clever than us ;D

My application was declined even if my annual income is almost 3x the eligibility criteria. Any tricks? Does city matter (I am from Pune). I applied using my personal email and not corporate one, could that be the reason?

Shekhar,

Didn’t they mention any reason?

There might be some problem with CIBIL report or are you new to credit system?

Using Amex gold charge card for the past 2 months . So far so good. Got 2000 instant credit for a flt ticket booked in Clear trip , 1400 cash back on MMT bookings. Accumulated 6K reward points so far:) I completely love to speak with Amex cus care guys . They are awesome!! Facing difficulties while using Amex card in POS terminals. Shop keepers decline to swipe this card ;( Even shop like $&£ they refuse it!!

Hi Siddharth, any idea if Amex has stopped giving reward points for Paytm transactions?

I’ve got zero points for a few amex transactions that I made via Paytm from my MR Card.

Some of them do say me this. Problem is not with Amex. Paytm is registered in “utility” category. Though it seems Paytm uses multiple payment systems from which only few of them are Utility type.

Oh, okay. It’s a good opportunity for manufactured spending since bank transfer charges are zero on Paytm right now. If you have a few Sims with you, you k know what to do 🙂

Its not about making payment via paytm. If any of your earlier transactions get reversed due to any reason (like ticket cancellation refund) they dont deduct/reverse the points you earned on those transactions. They simply adjust them through next rewards points you are going to earn in furure.

can we use AMEX card(gold/Platinum) on PAYumoney and accumulate points for the same ???

Yes, you can 🙂

If I use the charge card and the companion credit card 4 times each (for 1000+ transactions) will I get 1000 points on each of the cards for a total of 2000 points?

I think so you should. Pls ask Amex support. They can quite friendly as well 🙂

Hi, I hold an AMEX Gold Charge card which I took 3-4 years back as I was fascinated by the idea of having no credit limit. Frankly I just use the card to do 4 transactions of atleast 1000 as it gives me 1000 points every month. But the annual fee is 5k+. So when they charged me this year I called them and told them that I wanted to cancel the card giving the annual fee as the reason. Surprisingly they offered to reverse the annual fee completely. However, I don’t find the card useful otherwise. It has no lounge access. 🙁

Raj,

What was the approx spend for the Year on which you received the reversal?

I realized I paid my hotel bill (approx 3 lakhs) for 3 weeks of stay in the US by my personal AMEX card instead of Corporate card and that’s why the spend was high. I think the customer care considered that for waiving the annual fee.

Nice, Forex spends are always a great source of income for Amex. Makes sense!

Somewhere on this site I read that to redeem AMEX points getting a statement credit is the best option under 24 Carat Gold Collection Redemption Credit. Redemption page says “Upon successful redemption, enjoy statement credit of INR 10,000”, for 24000 points.

However, I also see an option of Amazon gift vouchers worth Rs. 11000 by using 24000 points (under 24 carat Gold Collection). I had 40k+ points and was thinking of redeeming them for Amazon coupons worth Rs. 22000 once I had 48000. But as this redemption option does not always show (last week I could not find this option), I decided to redeem 24000 points now. Now waiting for the coupons… 🙂

hi,

Really informative stuff here! thanks a ton .. I just got my Regalia card (not Regalia first) with a limit of 3 lakhs.

I’m a frequent overseas traveller.

I’d like to apply for the Amex Goldcharge card , can you tell me how to go about it

You’ve the Apply now button in the article 🙂

You’ll get some extra bonus bonus for using this link.

Hi

Whats the forex markup on the platinum charge card??

What about everyday spend gold amex

Can anyone confirm whether MRCC is still being offered as Companion Card LTF?

I got it as a companion word with gold charge card 2 months back.

@Neville, I got the same in Oct2020. MRCC LTF companion, with Plat Travel as Fee paid.

Am just curious – Has anybody been refused payment of let’s say 2K or 5K or 10K on Gold card? Is there no minimum limit that you can confidently charge to this card? I mean what if i don’t use this card for 4-5 months & try to use it for payment of dinner at a 5 star in the 6th month? Would i have to end up washing dishes? I hope not!

10K is very much doable in 6 month or even 12 months. But beyond that I doubt. They usually reduce the limit on reduced usage but not to Nill for sure.

Hi Sid,

Can we add platinum reserve or travel as a companion for amex gold charge card ? (After ban removal)

Hello Pavan,

No, they are in different tiers – gold, platinum. You can have MRCC as a companion card though.

Hi Shivi,

My payment of around 3k was decline when i called up was informed my card has been temporary blocked for non usage.

I hadn’t used my card for 2-3 months.

My Gold Card has given me a sweet surprise.

Received 5000 Bonus MR points as ‘First Year Renewal’.

Can I get gold charge.as FYF?