- Please refer to the latest updated review here: SBI SimplyClick Credit Card Review

As told, first impression is the best impression. Even-though the piece of plastic (card) that you hold in your hand may be a higher end/ high value card, the way it is been made to look always matters. I would appreciate SBI Card in this because both the cards, the one I had and one I have are always looking good when compared to others. And they are printed/fabricated so good. If will make you feel good in your hand.

I was first issued a SBI SimplySAVE card which had 10x rewards on dining/grocery spends. My spends in those categories were never high to earn more reward points. I thought of applying for an another card and I came to know from the customer care executive that a person can hold only one SBI card.

And if wanted to have more than one, he/she can apply for a co-branded SBI card like Air India Signature Card or Air India Platinum Card and such. As I didn’t want an extra one, I was surfing through the SBI card catalogue. I came through SimplyCLICK card which was introduced the next week after my SimplySAVE card approval.

- Annual Fee: Rs.499+ ST

- Welcome Gift: Rs.500 Amazon Voucher

- Renewal fees: Rs.499+ ST (waived off on 1 Lakh INR Spend)

The card comes in two variants Visa Platinum and Mastercard Titanium (I am not sure about Mastercard variant and the information is as available on the internet). Both are international cards and come with cross currency mark up of 3.5%.

BookMyShow Offer: Rs.100 instant cashback on first movie ticket booked on BookMyShow Mobile App for first time BookMyShow users.

Cleartrip Offer:

Rs.700 instant cashback on domestic roundtrip flights worth Rs.5,000 or more booked using Cleartrip Mobile App

Rs.500 instant cashback on domestic roundtrip flights worth Rs..5,000 or more booked using Cleartrip website

Zoomcar Offer:

Rs.600 off on booking Self-Drive Zoomcar worth Rs.2,500 or more with SimplyCLICK SBI Card

(# – Terms and conditions apply and it is found on SBI card website)

SBI SimplyCLICK Credit Card Reward Points:

I looked in it and came to know that the card had tie-ups with many brands for 10x rewards on Rs.100 spends (Amazon / BookMyShow / Cleartrip / Foodpanda / FabFurnish / Lenskart / OLA / Zoomcar)

5x rewards on all other online spends for 100INR.

1 reward point on all spends for 100INR.

This card has two milestone spends rewards for every 1 Lakh INR you spend on this card cumulatively upto 2 Lakhs INR.

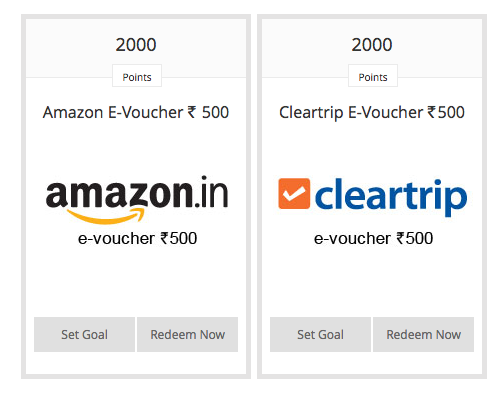

You will get 2000INR gift voucher from one of their partners that is decided by SBI Card.

I wanted to apply for this card and you have two or more methods to swap your card with new one. After several attempts, my SimplyCLICK card was approved.

It initially had offers like load 150INR into Ola money wallet and get 150INR extra in Ola money wallet and several others from its partners.

I would say that this card is too good for those who always spend online and especially use Amazon.

SimplyCLICK Reward points Redemption:

Consider when you spend 20,000INR cumulatively on amazon you will get 2000 Rewards points, for which you can get Rs.500 Amazon gift voucher from SBI cards.There are many other gift vouchers available on SBI card rewards catalogue but this one has high value of 25 Paise per reward point and can be easily used.

500/20000 = 2.5% returns

You have Rs.1000 Amazon gift voucher for 5700 points. In this case, the value of reward point becomes ~17.5 Paise.

Reward point redemption via gift vouchers with SBI card is not instant and will take around 2-3 working days to get it.

When comparing with other cards like HDFC Moneyback card,

You will get Rs.1.20 on Rs.150 spend online which is 0.8% returns whereas when you spend with SBI SimplyCLICK you will get:

- 1.25% returns on regular online spends and

- 2.5% returns when spending on partner’s site.

As Amazon getting better everyday with new sellers and more products, you can make use of this card to have better returns.

Pro Tip: If you are spending in odd figures on Amazon, I would like to recommend you to buy Amazon gift vouchers for rounded figures, so that you won’t loose reward points while spending. You will get reward points for loading money into gift card too.

Getting this card approved is easy for those who stay in metro locations and already have a credit card.

Nice to know 2.5% back on Amazon. Please throw some light on joining fee / annual charges and joining perks too

Its Rs.499+tax and you get Rs.500 worth Amazon voucher. Just updated the article as well.

The card gets free, at only 20000 rupees purchase at the preferred partners..

For 20 k spend I got value back of 2500 – 500+1500+500..

Comes to a return of over 12. 5 %.. More than any Card I have till date..

Can you please elaborate your calculations. (where is + 2500, +1500, +500 ) coming for a total spend of 20000 rs

Can U plz elaborate this. How come 12.5% return on 20K spending ?

Amazon voucher Still not i am received

The master card version also has Lounge access, as told by the customer care

# I havnt used this yet,

can anyone give their view on simply click vs save cards?

Simply save and Simply click both the cards are almost equally rewarding, the USP of SimplySave is the facility to use reward points for bill payment.

Call this number to check your mastercard credit card airport lounge access eligibility.

1800 102 6263 or 022-4200 6396

some of my frens told they had very bad experience with sbi credit card system.

lik no proper customer support,

no immediate update after payment of credit card bill ,

even after paying the bill on time, due to lack of proper update on payment, my frens were charged extra bill for late payment.

is this going on still?pls clarify

It usually takes 2-3 days for the credit payment to reflect and its normal.

Nowdays Payment reflects within 3 banking hours in your SBI Credit Card account.

I have a centcard. Payment confirmation and amended credit limit etc are reflected instantaneously.

The call back facility on Sbi credit card is one of the best currently. They respond within 1 hour maxx after senfing the sms.

Coming to the billing part, it was pathetic earlier.. I too had a gold coloured basic card in 2012, but not tjings seem seem to have improved… ( last 6 months experience)

@siddarth what can be a upgrade from Simplyclick, (as my card is 6 months old and has seen good flow)..

Elite card should be fine.

But Siddharth, Elite card has very huge charges I think like 5000 where as this is 500. Of course, elite gives free movie tickets but RBL Card does give free tickets at just 499 Annual charges.

I was thinking to upgrade to SBI elite for a while but 5000 charges and not even interesting vouchers – they are giving Jabong or some vouchers not even AMAZON like SimplyClick Card.

Ashok,

Yes, its all personal preference.

If you see value in Jabong/other voucher, go for it. Else dont.

Also, as far as i know, only Elite card has complete free Movie ticket.

RBL also gives 2 tickets based on spends.

NO,RBL gives a 2 free movie ticket for RBL FUN+ credit card.

Thanks for correcting! 🙂

RBL gives Rs. 500 BMS voucher voucher monthly on achieving Rs. 5000 spend in the last billing cyle.

Hi, what’s the difference b/w SimplyClick and SimplyClick Advantage ?

SimplyClick: Finance charges: Up to 3.35% per month, accounting to 40.2%

SimplyClick Advantage: Finance charges: 2.50% per month, accounting to 30%

Subtle, but, a big difference indeed.

Sadly, there’s no direct way to apply for the SimplyClick Advantage card online. The ‘apply’ link on the “SimplyClick Advantage” page opens up the good-old “SimplyClick” application.

Above that, there’s no explicit mention about the eligibility criteria as well, but I guess, it is provided by the bank staff, against an existing FD/savings account. Not sure though…

Guys,

Simply click gives you a more reward points trough online purchase.But when you try to redeem those you face many trouble.It offer me to change only for the vouchers of Amazon or clear trip of 500 Rs.Every redemption they will charge 99rs+Service taxes.So its totally worst. All other SBI credit cards have a cash back offers.But this card only not included.

Redemption fee of Rs99 is not applicable if you take amazon/clear trip voucher. If you get physical gifts that need to be delivered at you home then redemption fee is charged.

Haven’t tried redeeming yet but can one other person confirm if they charge redemption fee for amazon voucher?

No redemption charges for e-vouchers. I have redeemed and I wasn’t charged extra for that.

Mr. Praveen, there is no any redemption fee or any charges for amazon voucher. I have redeemed it 3 to 4 times.

Reading the last comment from Ranjith made this card totally worst.

Hi Siddharth,

I have two queries.

1. I am using HDFC Regalia currently and very happy with that. Planning to upgrade to diners’ club Premium( for 10X reward points). What is the counter credit card for Regalia from SBI card?

2. I took TATA – SBI Card. I am not using it for 4 years. It is inactive not(Despite several requests, not was not closed). Am I eligible to take another card from SBI?

One suggestion for website improvement. After you have replied to queries. I ( As a user) am not gettings alerts. I need to search for the post and see the answers (I knew, within a day query will be answered). I would be good if I get email alerts for your answers.

Thanks for your suggestions, will look into it.

1. SBI Elite card

2. Only one IT based card can be availed from SBI

1% Forex Markup on this card now till 31 jan 2017

this low markup fee for this basic card makes it a awesome card

Hi Siddharth,

Thanks for the information you shared.

Can i pay payment through paypal from this SBI SimplyCLICK Credit Card? or if you can suggest me any other credit card which can be acceptable on international payments (basic credit card only as i dont have huge balance in my account 🙁

my requirements are not very high i just need to pay maximum Rs 10,000/- mostly from paypal… Do you have any solution for me ?

Thanks a lot for all your support

please reply

Hey,

You can very well use this card for international payments on Paypal 🙂

Thanks for your reply.

i have regalica card from HDFC which highend card. if i get SBI simply SAVE/CLICK card will be useful for me? i see flipkart/amazon offerings SBI as well during festival sale. Thought of having one.

I have simply save Card then how can I convert to simply click card

I have used for more than 1 year but no offer to convert into simply click

You will not get any offer to convert simply save to simply click. Call customer care and ask them to flip your simply save card to simply click. They will do it without any charge. I have done the same and received the simply click card.

They will close your simply save card and open a new card in CIBIL

Dude just call the customer care. They will change it.

Or go to branch and apply for simplyclick and close simplysave. That’s the way i did due to secured card.

What is the minimum CIBIL score require for simply click

if salaried person ?

Hi Sid,

I have 3 credit card as of now :

1. Axis Neo Credit Card

2. SBI Simply Click

3. HDFC Money Back

I just wanted to know to which cards I should upgrade my existing cards? And which new card I should apply for getting maximum benefit.

I am confused between SBI SIMPLY SAVE and SBI VISA PLATINUM CARD

kindly help me out as i am eligible for both the cards guide me which 1 shall i go

Hi Sid,

One question – I do a lot of expenditure on the food apps like swiggy, Foodpanda, etc. So which card would be better for me – Simplyclick or simplysave?

Simplylcick would do 🙂

If I buy any item on PayTM using SBI SimplyCLICK Credit Card, then will it be covered in 5X rewards point on online spend? And if I load my PayTM wallet to pay for Uber etc. which in not PayTM product but use PayTM as a payment method for non-PayTM product. Then will it count as 5X reward point for online spend?

Any payment made through any online payment gateway will give 5X reward point.

Hi, first thanks alot for running this informative site, i have few questions regarding this card and also hope it will solve queries of many other peoples too.

1. What is difference between simply click and simply click advantage cards?

2. If use simplyclick card for PayPal, will it covered in 5x rewards points?

3.i have simplysave card from last 2 month with 83k limit, is there any way to exchange it with simply click card?

Just for information: i called sbi to redeem 2000 point on simply save card as cashback, executive over call told me that 99+tax for redeem charge for cashback. I still requested to redeem, will see they charge any fees or not.

I got 500 inr as cashback today with 99+tax charged on card account

Read on website Rs99+st will be charged for each redemption.

Is it applicable for simply click also.

Update: redemption fee of 99+tax has be reversed automatically after 4-5 days, my friend also got refund of fees automatically in same simply save card

Hi Sid,

I applied for this card and it got declined. I got an SMS later from SBI saying “we regret to inform you that since you do not have sufficient CIBIL credit history, we are unable to issue a credit card to you at this time”.

I was wondering what they mean by sufficient CIBIL credit history? I checked my CIBIL score using the link on your other post and was 776 which I think is a good enough score for this card.

Depends on various factors as well, like if the # of loans or age of report is less, they might deny too.

Just 4 credit cards on my report. One actually came on the report after they made the inquiry on CIBIL.

Same message they send to me. I never had any defaults . I applied for card on card basis ( 1.5 lakhs limit ) and my CIBIL was 769. Guess they need more than 800 .

HI

Shrey

Captain Bishuddha Bharatiya

What is age of your credit history ?

Freind SBI CC got approved CIBIL score was below 800

Got this card finally a week back. They had setup a counter in a mall where they took details of a credit card which I had been using for more than 6 months and they immediately told me the card has been approved. Quite fast in their processing and delivered the card to my place in 7 days.

My CIBIL had a history of 19 months at that time.

Today, I did an online transaction for Rs.20 and within the next 2 mins, I got a call from SBI to confirm if this is a genuine transaction. I was stumped at their speed for a such small transaction value.

lol, maybe its done at odd timings.

Not really, it was in the afternoon time 🙂

I called sbi to change my simply save card to simply click card about 18 days ago, also applied simply click card online same time, dont know which method worked but i got new simply click card today at home, simply save card was my first card with sbi and got it just 2 month ago, i am happy to get it changed to simply click card, limit is same as before (83k), no verification calls received till card arrived home, just got welcome email from sbi 3 days ago for simply click card, i live in small village near surat city.

Within how many days we will receive Amazon gift voucher or rs.500/-

Hey Sid,

can you pls suggest is there any issue redemption the cashback points through simply click card ?

and which is better simply click or simply save.. considering major spent on online transactions.

Its easy.

Simply Click is good for Online txn’s

The simply click card website says “10X” rewards but unlike HDFC Diners where you get 10 times the rewards points, this card doesn’t do that. The “X” is only for misguiding the applicants. Can you suggest an escalation route other than writing to their customer care?

They’ve an escalation system. Just a Google search away.

The value of x is 1 here.. For swiping the cards stores you get 1 point per hundred, for online spends 5 points per hundred, and 10 points for spending on partners..

Hope this clears your issue..

SId

Can a person hold 2 SBI cards? I already have simply click, Can I also hold IRCTC credit card?

One FD based, and one IT based card can be availed per person.

Hi Siddharth,

I am new to this in India and was unsure what you mean by an IT card? Which SBI cards are IT based cards? Thanks.

In addition, is it possible to product change to a different credit card a year or two after using this card?

Hi Sid

Any knowledge how SBI process new application ? Friends applied on card on card basis strangely SBI approved only 45% of currant CC credit limits another got 2X credit limits, both don’t have any relationship with SBI , though CIBIL score is almost same !

It also depends on the current/past credit line the person is exposed to.

Hi Sid,

As mentioned above there is a fee deducted when redemption is done for SimplyClick card. Any suggestions on how to avoid any fee deductions? I don’t want any vouchers. Also what will be the credit limit for this card?

1. avoid any fee deductions – I doubt

2. Also what will be the credit limit for this card? – usually 2X-3X your monthly take home

Sbi elite is only good fr spends of 8lkh plus.

Sbi platinum is good, but renewal is only on soending 2lkh

Simply click and simply save are 2 good cheap cards, with 2.5% reward on online partners and dining, grocery respectively at only rs 500, so better than regalia which is only 1.6%, that too on flights and recharge only.

1.I purchased this card on Jan and already paid the initial joining fee with tax and outstanding for the month of Feb and March…I still didn’t receive the Amazon joining voucher. When will I get it?

2. Does the 99rs charge applicable even on Amazon and Cleartrip vouchers? Is there any voucher for more than 500?

3. Is there any way to reduce the credit limit for the existing card? For eg from 2 lac to 1 lac etc

4. If I pay credit card bill through debit card will I be charged? And will I get reward points for the amt paid on debit card a/c?

To answer your first question, I have received my Simplyclick card in last week of February. I received the Amazon coupon code in first week of April. I was able to add it to my amazon pay balance immediately.

To answer your last question, you can’t pay credit card bills with debit card. Only through cash/cheque/DD/netbanking/NEFT (afaik) etc can you pay the bills.

My salary is Rs. 22,000 per month and my husband’s income is Rs. 27,000. We applied for simply click at the same day and my application got approved and my husband’s application got rejected. I got Rs. 70,000 limit and they did’t even took my salary slip. Amazing SBI.

I have applied for sbi simply click credit card.i have send my application form to their mailing address.my gross salary is 40and soing govt job.how much time and how much credit limit should i expect from??and one more thing,how much time it is needed to process the application form after they receive the hard copy??

If have applied for sbi simply click credit card.i have send my application form to their mailing address.my gross salary is 40and soing govt job.how much time and how much credit limit should i expect from??and one more thing,how much time it is needed to process the application form after they receive the hard copy??

Someone please do reply if you have any idea..

You should receive the card ( if CIBIL is good ) within 25 working days. You can expect anywhere between Rs. 40,000 to Rs. 1.5 lakhs credit limit. Please inform us if you get approved.

I have also applied online for SBI Simply Click Credit Card. They send their agent to my office and only collected photo, PAN and Aadhar Card and approved it. They didn’t ask me for salary slip or Employee ID.

On simply click SBI ATM card, can add paytm wallet balance count under 1 lac spending for renewal fee of rs 499 waived and getting evoucher/reward points

Yes, you can!

I have sent application form twice.1st time thruogh nirmal post and 2nd time via courier.but both the time they are telling that they didnt receive the applcation form.but the courier tracking system is showing that the application form has delivered on 1st june.i cant understand why they are not processing my application form.?

If i dont wanna amazon voucher the simply save is good as it can adjust against bill

One mpre doubt if i hv 500 rs voucher and i am buying 300 rs item on amazon the 200 remain or full voucher will be utilised

Hi sid,

I have applied for sbi click credit card.

While checking status online, first it shows like

“your card has been approved. You’ll receive it in next 10 working days” now “your sbi card application is in progress. we will get back to you soon.”

Could you please clarify me why it is happening?

Will my application got rejected?

Are there only two options to redeem the points i.e. Amazon & Cleartrip gift voucher ?

Also these two options are not available for the last few days. The redemption catalogue is completely empty.

Considering If one does Rs.1L spend the returns are Rs.2000 voucher + Rs.1250 (considering 5X spends)=Rs.3250 i.e.>3%. What vouchers are given for Rs.2K. Has anyone received them yet. I am planning to apply for this card.

I received 2000rs cleartrip voucher for 1lac spend redeemable on flight and hotel booking.

Can you tell me what is the validity of these vouchers? One year or less?

I recently applied for RBL Titanium delight credit card my CIBIL score is 762 but still my application was not approved. I want to apply for SBISimply click credit card. I want to know is it good to apply now or should I wait for few months as my previous application with RBL was not approved. After how many months will it be safe to apply. And by how much CIBIL score is decreased if an enquiry is made by any financial institution?

You can apply with this cibil score for simply save card. For higher level card you need more cibil score.

Sir,

I am holding SBI simply click card. How many days will it take for the reward points to get credited into the account once we have done some purchase . whether the reward points get credited instantaneously or will it take some days.

shibu

for loading money in ola will i get 10x rewards points??

I had a very strange experience with SBI Card. Although i am having HDFC Regalia, ICONIA and few other cards, but one day when in a shopping mall one SBI insisting for a Card i applied for SBI SimplySave on card on card Basis and in few days i got my card delivered.

After i got my first bill, i realized SimplyClick is better than SimplySave as my more than 80% spend is online. So i simply sent an email to customer care, what would be the process for moving to SimplyClick from SimplySave. In response to that they told, they will solve this query by 28th of August.

I was hoping a response how i can do it but i got an SMS from BlueDart saying Card is out for delivery. I checked in SBICard APP, new credit card number is coming there. I am surprised how they can do it without informing and my email was clearly asking what would be the process.

In my first Bill of SimplySave i paid 499 as joing fee. Need i pay again for SimplyClick???

I upgraded from useless Yatra SBI card to Simply Click because of 10x rewards, there was some rewards points in Yatra Card around 1300. Will rewards points from Old card will be migrated to new upgraded card. (Right now it is not showing in dashboard).

Also I’m getting MasterCard Titanium version of simply click (Still in transit). Does it have Airport Lounge access ? My Yatra card was also Titanium MC and it was having MC lounge access.

@Vishal – How did you upgrade, They denied me the new card saying u have an existing card.

which is best car SBI Prime or Simply Clck?

limit on simply save click card for a new joinee

I got only Rs.1.6 L dunno why. My wife has cibil more than 800.

Siddharth heres the next part to my silly fight with SBI. I had requested for closure of card as i told earlier, these guys requested to continue and told joining fee will be reversed and charged later. And to the surprise they said i will have to pay card replacement fee of Rs100. I was so fee up that i asked them to close the account.

But to my surprise my wife received the card last week. I logged online to check the transactions: annual fee was reversed but i was charged replacement fee. We again called the Custcare and i asked ro close the account. I was told Sir we will reverse the fees and you can keep the account active. I said ok also i will not be charged this years joining fees and i will not get the joining benefit. Thats fine i said.

So in all 2 months of silly fighting with SBI and all the time they were at fault, but they are very arrogant i must say. They dont care about the customer, the worst customer care. I had alwaylys avoided SBI card and my wife still teases why we applied and she is already fed up of Custcare.

Ah, that seems to be a tough time. I’ve had mine too 😀

Hopefully they do the needful to improve their customer support team. They should be reading our comments already. 😉

Sid,

10X amazon offer is valid for EMI purchases too??

and can we load PayTM wallet and use it to pay for fuel and enjoy 5X reward point?

awaiting your reply..

Not sure on EMI front. Pls check with CC.

Yes, you get reward points for loading all wallets. 5x for paytm and mobikwik; 10x for amazonpay.

How many credit amount it applicable in a month?

I have got the simply click card. But I have a query. In the sbi card website it is clearly mentioned that contactless facility is available for simplyclick card. But the card I received is without the contactless logo. My card looks the same as in the picture mentioned above in this blog.

I called up the customer care and they are telling that contactless facility is available in simplyclick card. But there is no logo for the same on my card. My question is will my card work for contactless payments? If not is it possible to get the contactless version of the card?

Thank you.

Is your contactless technology working or not? Mine also come without contactless logo.

What for those who are living such cities which are not in this application form?

I spend 2850 rs amazon i will get reward point 285 or 200 ..Is it rounded off?

It’ll be calculated per Rs.100, so you’ll get 280 reward points within 2-3 days from date of transaction.

@Vishnu You’ll 280 reward points for Rs.2800

Question for everyone:

You guys getting 10x on cleartrip? I am getting 5x only for now.

Ola money removed from 10x rewards partners. Hope they add some useful wallet like paytm soon. Really disappointing. I was enjoying ola money for quite a while now.

I have an Axis bank credit card with 80k limit on it can i apply for simply click creditcard on card to card basis my city is not listed on sbi card site what is the correct procedure i dont have any salary slip etc , but have above 750 Credit Score,

Your help would be appreciated

How to apply for particularly Mastercard version of SBI SimplyClick Credit Card?

So I have this SBI prime card with credit limit 90k, and its eligible for upgrade to elite, which I am not gonna do it because of high annual charges and no useful perks.

Anyway, my question is, how do i get this simply click card?almost 90% of my spends are on amazon and it looks like i missed a lot of reward points already.

When I inquired about it from customer care, they are not ready to downgrade my card,( annual charges on prime card is 3000), when i insisted, they are ready to give me an additional simple click card with limit of only 10k, that too by removing 10k limit from my main card.

So, I wanna know how to exchange my card for simply click one?or how to get a new one with logical credit limits, because 10k milit is just stupid.

Can anyone confirm whether they are being charged for reward redemption?. Has anyone redeemed cleartrip voucher.

I have redeemed for amazon voucher.. I have not been charged for redemption..

No charges. I recently redeemed points and I wasn’t charged.

Hi Prashanth Guptha,

I redeemed 20,000 points at different times. But, I wasn’t charged any. I redeemed the Cleartrip voucher for hotel booking.

Note: Only online transactions are considered for milestone benefits.

They are giving reward points for wallets loading but not considering for milestone benefits. (I suspect)

Offline transactions are also not considered for milestone benefits. (So far I spent 3.5 lacs but received only one Cleartrip voucher)

Thank you all

Thanks for info Anugu.

After removal of 10x offer from Diners, Is there any other card apart from Simplyclick which offers better reward rate on amazon?

Hi sid,

I have applied for sbi click credit card.

While checking status online, first it shows like

“your card has been approved. You’ll receive it in next 10 working days” now “your sbi card application is in progress. we will get back to you soon.”

Could you please clarify me why it is happening?

Will my application got rejected?

Hi,

I have been using SBI simly click card for the past 4 months. I am checking my statement regularly and I am unable to understand as to which transactions actually count for calculation of milestone online spends (milestone of 100000 & 200000 online spends).. I have been making most of my spending online but they are not counting all as online spending.

Do they count wallet loading (Amazon, paytm, Tapzo) as online spend or are there any particular terms and conditions to know as such.

Hi Tapish Kumar,

I’v been using this card for 6 months. They are giving reward points for all the online transactions and wallet loadings. They are counting all the online transactions for milestone benefits. But, they aren’t considering offline transactions for milestone benefits.

SBI is very fast in adding the reward points not like HDFC.

Thank you.

I am a beginner user of this card and i just want to know how much reward points this card gives for wallet loadings?

Is it 5x reward points or the regular one (1 rp for every 100 rupees)?

SBI Simply Click gives 5 points for wallet loadings and with partner sites 10 points.

I applied for this card online. Got approved ‘in principle’. But, I chose not to proceed any further. I halted them before the eKYC step.

As I read more about this card, some caveats began to reveal:

(1) Current 10x partners are: Amazon / BookMyShow / Cleartrip / Foodpanda / Lenskart / UrbanClap / Zoomcar. Ola has been kicked out of the party, which makes this card far less alluring.

(2) Rewards redemption fee is: Rs. 99 (alike HDFC). i.e. the Bank eats away 400RPs for no earthly reason. Although, some users have said they were not charged, but officially, there is this charge.

(3) There’s Rs. 500 worth amazon GV as a welcome gift upon paying the joining fee, but no such GVs are offered upon paying the annual fee. Nor is it compensated by adding bonus RPs.

(4) The annual spending criteria of Rs. 1lakh for the annual fee-waiver is difficult to meet, specially for those who are holding multiple cards (since this card has no significant offline spending benefits, people would prefer to use other cards for grocery).

In my opinion, my Amex Membership Rewards Card performs better. I earn 1000RPs every month by spending Rs. 4000/- per month online (anywhere, including loading wallets, excluding utilities).

Sid, I would love to be proven wrong. What’s your take?

Hi Siddharth,

Great post.

I used to purchase a lot on Amazon

Which credit card is best for me?

SBI Simply Click or HDFC Diners Club Black or any others?

sbi simply click for amazon, but from flipkart etc hdfc diners black.

SBI has wasted my one full year! I first applied for this card on March ’17 and one month later, I got an email saying that my application has been rejected because of “some indeferrences in my savings bank account”. I’m a government doctor and am filing my ITR properly, and I still wonder what they meant by that!

Fast forward to September, 6 months after my first application date, I tried to apply again. Two weeks later and no reply so I called the customer service and after about 3 calls, got a phone number of this lady who deals with credit card applications. She says, that it’s unusual to take such long time for getting the first call back from SBI and promised me to look into the matter. One week later, I get the first call asking for all the documents which I had already uploaded! I send it to them via email and then it’s zip for another 2 weeks. I had to call them again!

November first week, I receive a call from the head office and they have screwed up my office address including the pin code.. I have no clue, how they can do such unbelievable things and when I ask them to correct it, they can’t! Next day, they somehow found a way to correct the pin code and told me that it’ll be 526 rupees annual fee including GST and that I”ll receive more calls from Gurgaon.

After that, in the next two weeks I received 4 calls and all of them wanted to re-confirm my office address. Three months after my second application, as I didn’t receive any notification, I checked the status online and you won’t believe this! “Application denied due to pin code issue”

For God’s sake, don’t waste your time on any SBI card. They need to improve high time! Period!

Hey, just received this mail

Dear Cardholder

Get FREE Motorola Headphones worth 1,599 on spending 06 times or more

with your SBI Card ending with XXXX.

Min. trxn: 1,000

It seems like SBI is keen on getting more and more txns on the card just like AMEX Gold card offer. This is a targeted offer for those who rarely use the card and are using it as a backup option.

I guess my this year’s anual fees are compensated by it. 😀

Just checked the subject of the mail. It is Motorola Pulse 3 which is having price of Rs. 1600 after discount on amazon and has good reviews too. So it does not looks like a gimmick where they lure you with MRP of the product.

As headline mention above, I am also holding SBI SIMPLY CLICK credit card, How can I get approved AMEX membership reward cards. I want to apply.

Siddharth

What is procedure for increase of credit limit in SBICARD ? I am not getting any offer for same, Though I have another card from different bank for that I am getting regularly credit limit increase offer. I dont have any supported IT document and salary slip

Hi, i just received this mail

Dear Cardholder

Get FREE Motorola Headphones worth 1,599 on spending 06 times or more

with your SBI Card ending with XXXX.

Min. trxn: 1,000….

How i received motorola headset? Voucher or door delivery?

I got the offer 3 months back. They deliver it to home. Mine is on the way. Will review once i get it, next week.

Hi,

Would I be eligible for rewards if

1. I load PayTM / PhonePay wallet using this card ? I believe HDFC CCs have put a stop to this.

2. I pay insurance premiums using this card ? If so, is there any cap on the max rewards I can get per transaction ?

Thanks

1. You you will get 5 reward points for every 100 INR for paytm/phonepe. SBI doesn’t discriminate for wallet load transactions unlike HDFC.

2. No max cap on earning reward points.

Applied for SBI Simply click card on March 26, they collected the documents and the verification call is also done. Since then the application status shows “Your SBI Card Application is in progress. We will get back to you soon.”

How much time it usually takes to get the card?

It can take up to 21 WORKING days which usually translates into 30 or 45 regular days

Sid,

Please inform whether SBI Simplyclick mastercard variant has been withdrawn? I wanted that.

What is the use of it? Could you please explain. I actually expected contact less visa card. But I got master card. Is their any benefits compare to visa card?

Perhaps one of the most underrated card… I personally found this one quite rewarding, especially if you consider that the annual fee is so low that it compares with debit card annual charges that SBI and other levies even without informing us ;)… 5X on online spends and especially 10X on Amazon is fantastic as since I have Amazon Prime account, I keep buying lots of stuff from there… Plus you can redeem reward points to Amazon Gift Cards so for me it is as good as encashing them…

Do we get 10X reward points on payment by Amazon Pay wallet with SBI simply click credit card?

No. 10x Reward points will not accrue for wallet loading.

No. Mr shivi is wrong. I have sbi simplyclick and I always get 10 reward points for amazon pay wallet loading. Whenever I pay to any website which accepts amazon pay, I first load amazon wallet by that amount and then spend from there.

Hi Kalyan are you still getting points for wallet loading from Amazon pay. And what about other wallet specially Paytm.

Points for Amazon Pay wallet loading – 10x

Points for Paytm Wallet loading/other online spends – 5x

5x rewards on all other online spends for 100INR. Will this feature of Simplyclick Card be applicable even for Utilities payment say for Redgiraffe rental payments? Are SI or manual utilities payments categorized as online spends?

Dear, Siddharth Congratulations for your great write up/ reviews on this most happening credit card blog in India.

Today I got the Simplyclick card. I have a couple of questions in me.

(1) addon card has the same card number as the primary card?

(2) can we set the desired credit limit on the card, through the SbiCard app??

Thank you so much.

I had very ‘strange’ experience with SbiCard.

I applied for SBI simply click card through branch, I was told my application would be processed within 2-3 weeks.

For two months app status was ‘under process’ and I had more than 10 verification calls.

After that I got 8-10 calls daily for 5-6 days just to tell my verification is complete, each one assuring me this would be the last such call.

As talking on phone didn’t stop those annoying calls, I mailed them regarding the issue.

And next day I had one more verification call and after that application was rejected.

At least those calls stopped.

Drop an email to [email protected]. Ask them the reason of 10 verification calls and reason the application was declined.

I downgraded my card from SBI FBB card to SBI Simplyclick . Before My application processed I did the transaction of 11500 on flipkart. As per SBI FBB I had to received 115 point but my tranaction got settled once they issued Simplyclick and received 575point as per Simplyclick.

Hi,

I just checked my statement and found that simply click doesnt give 10x rewards on using using amazon pay as payment method for utility bills etc anymore like it used to do before..

Can someone please confirm?

yes, I noticed that too. If you use amazon pay for paying for anything outside of amazon (utility bill, or using amazon pay as a payment gateway) you will get 5x Points only instead of 10x

I think only actual shopping on Amazon gives you 10x from Amazon.

Just paid a bill using amazon and I received 10x reward points.

How can I do fund transfer in other bank through SBI simply click credit card and what are the charges

Santosh,

Fund transfer is not allowed to own account. You can use balance transfer option to pay other card bill.

The TnC shows

1.Wallet transactions done using SimplyCLICK SBI Card on any partner brand website/app will not accrue 10X Reward Points

Does this mean we will get 5x rewards? So if I simply load amazon or paytm wallet and the pay utility bills, will we get 5x points?

2.Utility Bill Payments done using SimplyCLICK SBI Card on SBI Card website/mobile app will not accrue 5X Reward Points

SO, no rewards for utility bill payments if used billdesk kind of payment gateways ?

Wallet loading at Amazon – 10x

Paytm wallet loading / other online spends – 5x

Do we receive reward points on EMI transaction on Amazon ?

Such an important thing and no one on this website ( including the Site owner) bothers to answer this query. Either that or no one knows the answer. Do we get reward points on EMI transactions?

Yes

I LOVE SBI CARD APPLICATION PROCESS TIMING. I HAVE APPLY THIS CARD FOR MY MOM ON 3rd MAY CARD 2 CARD BASIS 6 MONTH OLD AXIS PRIVILEGE CARD LIMIT OF 65000 AND THE INTERESTING THINK SBI GIVE SAME LIMIT ON THIS CARD.14th MAY RECEIVE MY CARD ONLY 11 DAYS PROCESS AND MY CARD RECEIVE ONLY TELE VERIFICATION DONE CARD APPROVED ON 10 MAY.

hello

Which credit card is giving more reward points on online spends ( not for online shopping) for shopping in thirdparty (payments through paytm, phonepe, razorpay etc., ) where we use credit card for online payments, because i will spend a lot on shopping of local merchants where i had to pay through ( paytm, razorpay etc.,)

SBI Simplyclick as it gives points on wallet loading as well and reward rate is 1.25%.

Wallet loading at Amazon – 10x and Paytm wallet loading / other online spends – 5x working very fine. No problem at all in getting reward points on these transactions. Practically tested. Information as on today.

I have been using SimplyCLICK for more than two years now and it has been a rewarding experience. Most of my spends are online and a significant portion goes on Amazon. On an average, I have been redeeming one amazon voucher every month (online monthly spend between 20k-40k)

Return Rate of ~2-2.5%

They also provide reward points for adding money in your digital wallet, which can be used for groceries/other spends nearby. There are no redemption charges.

I do have HDFC Regalia and Amex MRCC but for online transactions, I continue to rely on SimplyCLICK.

Overall, has been a good experience.

But HDFC Regalia with 13.3% reward rate via smartbuy beats any other card per my understanding. (there are some new RP limits of 5000 points per month for Regalia card)

I am very interested in getting this card, but when I have applied for it it was not approved. What to do to get this card easily. Is there are any tricks to get this card.

I asked SBI card employee and they told me that they can issue this card on FD on min. 25k. Visit the credit card section in your local sbi branch. Better put at least 50k as FD to keep using the card comfortably.

Dear SimplyCLICK SBI Credit Cardholder, earn 10X Reward Points in addition to existing offer, on purchase of TV & appliances at Amazon.Valid till:13 Sep ’19.T&C

Got this message from Sbi

Can someone please explain whether this is above the 10x spend on Amazon ( Which is provided by default on this card ) or is it the same offer?

I have taken a simple click credit card. How much time it will take to reflect the reward points in your credit card after a transaction?

I have newly got simple click card. How much time will be taken for reflecting rewards points in account after a transaction

I would be thankful if someone can clear my doubt. Is it possible to swap my existing irctc platinum sbi card to simply save/click card. I am having cr limit of 1.25L on my existing irctc credit card. Thanks in advance.

Ask SBI credit card customer care

Yes, it is very much possible, just customer care ask for card flip option

Dear SBI Credit Cardholder, w.e.f.31Jan’20,10X Reward Points on Rentomojo will be discontinued. For updated list of 10X Partners

This is one of the best cards upto 2 lakhs online spend. The reward rate of this card is 3.25-4.5% as below:

Regular Spends:

5 Points per 100 – 1.25% + Rs 2000 CLeartrip voucher on 1 Lakh & 2 Lakhs spend – 2 % => Total 3.25%

10x Partner spends (e.g Amazon):

10 Points per 100 – 2.5% + Rs 2000 CLeartrip voucher on 1 Lakh & 2 Lakhs spend – 2 % => Total 4.5%

Actually, by now, this SBI card variant is worth nothing except maybe the cheapest option to stay on SBI platform for those once-a-year spending offers. Amazon Pay card has 5% flat cashback reward.

I don’t totally agree. In fact, I find this card rewards in the range 3.25-4.5% for all online spends(upto 2 lakhs). Unlike that, Amazon Pay card rewards 5% only for Amazon purchases and 2.5% on Amazon Partners and 1% on others. So, on an average if someone spends 50-60% of their online spends outside Amazon then this card is one of the best for returns. Hence for low spenders (upto 2 lakhs) who spend a lot online, this card’s rewards are definitely among the best .. even comparable to DCB and other premium cards and unlike those high end cards, this one is easier to get approved too.

With a base reward rate of 1.25% and accelerated RP of 2.5% on Amazon and few other partners, I don’t see how it is comparable to DCB and other premium cards and i really can’t figure out how you arrived at 3.25-4.5% for all online spends? Even Axis Flipkart card holds better value with an added domestic lounge access benefit.

Shivi,

Have you looked at his earlier comment with calculation? He clearly explains it

Please see the calculation above (in my main comment). If you include the 1 Lakh and 2 Lakh spend milestone cleartrip coupons of 2k each you will notice that you get additional 2%. That brings the rewards in 3.25-4.5% range. And, agreed this one doesn’t have the lounge access.

HDFC Millennia card offers a better value than SimplyClick too at max spends of up to Rs.30 K per month.

@ Anbu & Saurabh:

Our responses are delayed in getting published so my comment was in response to my own first comment!

Wish there was an edit comment option here and an email to follow up on comment replies!

@Shivi

HDFC Millennia card requires minimum transaction of 2000 for 2.5% Rewards. Reward points’ valid for one year only and minimum redemption is 2500. Charge — 99 + tax. It’s not worth the hassles

HDFC Millennia does offer better reward points, only tht they would never credit the points that are due. One of the worst cards in terms of reward credit experience, and you can check the review of this card on Cardexpert itself, or elsewhere, users across the board have had such a terrible time with HDFC Millennia.

Ok, I don’t use Cleartrip at all so i don’t find value in that card independently.

You can sell it on zingoy at 15-20%discount and get 1500rs value easily in your bank account.

Sir i have sbi gold card.i am hagitate .suggest me sbi gold card hold or upgrade to simply click.i am spending online tickets ..travel ..shoping huse cloths ..grocery ..i also interest hdfc regalia first …i have no hdfc savings account can i get this card…also i want lounge access….what card i take……hdfc regalia first or hold sbi gold….or sbi simply click…or two(hdfc regalia first or sbi gold/simply click)…plz suggest me ..i am very much confused…i have spend 2 lakh more in a year…

Take HDFC Regalia First.

Sir I have click card and shopping exclusive partner but reward point 5 on 100 per spent why

I have existing axis bank secured credit card of 32k limit.I don’t have salary slip.How to apply card2card basis for this sbi card?Plzz Reply….

@ Md Hasib:

Go to the SBI branch in your area and ask for the credit card person. Tell him you need SimplyClick card on card-to-card basis. That will be possible only after the lockdown ends and normal everyday operations commence.

Can any one please verify, Does SBI simply click credit card give reward point on wallet transaction

after the New restriction on Wallet transaction since 1 July .

I applied for a Simply Click card through Yono app and they gave me Simply Save Card. Can I request for a card swap as most of my spendings are online.. Credit Limit given is 2.24L

Hpw many reward points will be credited for loading money in amazon wallet?

Hi,

One would usually compare this card with ICICI amazon CC. How is SBI SCcard better than amazon cc??

Hi, I have SimplyClick. I have recently got HDFC DCB. Now I am afraid I may not be able to use SimplyClick much. Is there any way I can make it LTF so that I can retain it for specific merchant offers?

Hi Sid, I have applied this card thru your link.

Shall I expect any extra reward points from SBI like we get from AMEX during new card signup thru referral?

I applied for the SBI Simply Click but it seems they have rejected after collecting documents and also after calling me verification. I have excellent credit score and hold many LTf premium cards. They asked to upload aadhaar and verify to which I declined (I dont have OTP and also dont want to provide aadhaar anyway). Is this the reason for decline?

One week back I called sbi cc to swap my 3yr old sbi irctc platinum card to simply click but they denied citing reason that being it’s a co-branded card it can’t be allowed to switch to direct sbi card. After one hour, I made a trial call again to do place the same request, but to my surprise CC converted my irctc card to simply click while conversation itself and told me as usual that existing card will be deactivated after new card arrival. After activating click card I called CC to get clarification abt old card, again surprised me by reply that I can retain both card active based on shared Limit. Can’t understand the awareness of sbi CC. but this case made me “Hopeless” to “Full satisfaction”. If anyone is facing the abv situation try this trial I made by random calling to CC. Hope it will work.

I am seriously impressed with SBI! Have been using SBI SimplySave for a year and a half, and as my transactions are more online, and as Click is more rewarding overall, I wanted to shift to it. Just called up the SBI customercare on the evening of 11 November, the executive took the request and told me that it will be processed by 24 November. Day before morning, I first got a message saying the request if approved, and then in another 10 minutes, the digital card was generated. And on 13th morning, I got the card out for delivery notification. Had the card in my hands in less than 48 hours! Seriously, from a Nationalized bank, this is unbelievable!

Dear Mahesh, thanks for sharing your experience. Can you please help with the below questions I have ?

1) Have you ever got annual fees reversed, based on 1 lac spend?

If so, Can you confirm whether they charge 590 first (499+GST) and then reverse 499 only (net loss of Rs. 91 GST). Or they simply don’t charge anything at all if you achieved spend limit 1 lac ?

2) Have you ever redeemed reward points in bill statement? Do they charge 99+GST for that everytime? Can we get that charge reversal?

## Can you confirm rewards points for below spends? ##

1) Offline Medicine Shop (Apollo Pharmacy/1med/medplus/other) gets 10x rewards in ‘department stores’ category ?

2) Online Medicine Sites (1mg/Netmeds/PharmEasy/Apollo 24×7) gets 10x rewards in ‘department stores’ category ?

3) Malls (BigBazar/Reliance Fresh/More/Spencers) gets 10x rewards in ‘grocery’ category ?

4) Swiggy/Zomato/Dineout/Dominos eligible for 10x reward points in ‘dining’ category ?

5) Offline Cloth stores / Kirana stores falls under which category ?

6) BookMyShow (BMS) eligible for 10x reward points in ‘movies’ category ?

7) Yatra/MMT/ClearTrip how much reward point they give for Simply Save, any idea ?

Any other spends, not mentioned above, which give 10x accelerated reward points based on your experience for Simply Save card ?

Good service by SBI cards. But it’s no way nationalised bank. SBI card is fully separate from SBI. SBI just holds a stake in sbi cards.

I have paid my electricity bill of 18000 on Amazon using Simple Click credit card But I got only 5x reward not getting 10x . why ?? Is any one who have same problem regarding reward point

SBI Card has devalued their reward points. Earlier, you would get a 1k Amazon voucher for 4000 points but now, it is 6800 points. As a result, the SBI Simply Click card is no longer attractive as it gives only 0.7% reward for all online transactions and 1.5% for amazon. Earlier it was 1.25% of all online transactions and 2.5% for amazon.

Aren’t they having other vouchers at previous redemption rate?

Today I have redemed 500 Amazon gift card using 2000 point there is no any devaluation . You can redeem your point using web log in of SBI credit card , There is any app issue they can’t show gift card

Bad news: SmiplyClick is badly devalued. For online spends 0.7% and for Amazon 1.5%.

There are currently no vouchers available on the app as well as website.

Very bad: point value dimished to 1/7to 1/8 than earlier 1/4. Almost 2x devalued. I’ve checked in SBI card application. I hold SBI Prime.

This card has not been devalued and all the benefits are intact as it is. There was some system issue with their servers and still the Customer care was able to redeem 500 Amazon voucher for 2000 points. Now it has started showing up again in SBI card portal.

How many points on bill payments and wallet loading on amazon?

It seems that SBI keeps on changing the T&Cs frequently regarding both these transactions…

No points for wallet reloading since July 1, 2020

And for amazon bill payments, 2.5% right?

I have paid electricity bill of 16k on amazon using this card, I got only 5x reward point , I have also register complaint but got this message

Dear SBI Cardholder, we have evaluated your complaint related to Reward Points with SR#×××××××××. We regret to inform that same could not be resolved in your favour. Kindly click here to share your feedback …..

Have you contacted the customer care again? If so, what reason they told you for the rejection?

SBI simply click card no longer beneficial.

If you have done any transaction on Amazon Pay they consider it as wallet reload and not giving points.

if you convert any online transaction into EMI they are not giving points.

Cleartrip transactions done from affiliate channels(Payment gateway) will not be eligible for 10x reward points(on which you don’t have control).

Maximum 10000/- reward points you can get in one month.

(many times I have done transaction on Cleartrip and Netmeds but not got 10x rewards)

Hi,

Is this still worth to get it in 2021?

I posted a question and it was awaiting moderation and then disappeared. I am thinking what’s wrong with question.

I asked that is SBI Simply Click is still worth to get in 2021? My friend suggested to get it, so asked here…

Wait for Sid 2021 card list. You will get your answer. Currently dont apply for this card.

But currently does not look good for sbi cards after new competition coming in.

We no longer get 5X points for online transactions. I recently did online purchase and there was no additional points. Same in mentioned on the website.

It appears that it was a technical glitch from SBI. After complaint I got back all rewards points. Looks like SBI is trying to learn the art of stealing rewards point from HDFC 😂

Where is details of Reward Redemption Fees – and Rewards expiry date??

Hi guys, can anyone please answer below questions based on experience ?

SBI Simply Click gives 10x reward on which of below transactions on Amazon?

1. Postpaid Mobile Bill Pay

2. LPG Cylinder Booking

3. Amazon Pantry

4. Amazon Shopping (other than Pantry)

5. Gift cards on Amazon

6. Electric Bill Pay

7. Gold / Jewelry Purchase on Amazon

a) Grofers & Bigbasket direct (5x or 10x ?)

b) Snapdeal direct (5x or 10x ?)

Hope many here are seeing SBI SimplyCLIK e-card instant issuance banner on various sites including cardexpert.in

I applied for it, I didnt get any instant e-card, but the page ended with “SBI staff will contact for further processing” (or something similar wordings was shown)

Did anyone really got an instant SBI SimplyCLIK card (like ICICI Amazon card)

?

SBI doesn’t do instant card except for very few who already hold other SBI card.

Yes, I have SBI BPCL card and applied with card details and OTP. As per the banner link, the process should end with new card details or should end with decline message. Instead, it ended with “SBI will contact for further processing”.

So want to know if anyone got card details instantly. If so the SBI banner link is true. Otherwise it is false ad by SBI.

It actually checks with the provided details, whether you have an additional card offer, similar to sbicard net banking offer.

Since you didn’t had the offer, now the sbi card third party people will call you and ask your card details saying that you applied online and try to fraud.

This happened with me and on escalating to sbicard customer care they informed me that they are not supposed to take card details instead basic details and documents.

They even assured me that a member of sbicard team will reach out to me for new card not a third party.

But nobody reached me and I dropped the idea of taking new card.

Note:- customer care do not take request for new card on call if u don’t have offer on sbi card NetBanking unlike àxis who take request for new card on call if you have existing card relationship

@Fahim

I will wait for calls from SBI. If they process the new card without documents, I will accept it.

If they ask the usual Aadhaar online (offline eKYC) and video call verification OR executive visit for card processing, I will decline it.

Actually, I am eligible for second SBI LTF card for long time. But not interested in this (Aadhaar or executive visit) process, which I feel too much for a card processing for an existing customer.

Hey, anyone tried paying rent using SimplyClick card ?

Is it accounted as an online transaction and do we get 5x reward points ?

Is there any limit on reward point accumulation per day or per billing cycle in SBI Simplyclick?

I didn’t get some points for transaction on Amazon.

I recently purchased a smartphone from Reliance digital’s website but didn’t got 5X rewards for it. Called CC, they told Reliance digital is not an online merchant. Seems they’re degrading this card continuously since past 2 years.

You cant buy an eGift card from amazon using credit cards including SimplyClick.

The shortcut has become a blind lane.

Edit:

The error popped up because I attempted to buy GC denomination of Rs. 10K. All credit cards including SimplyClick are supported upto denomination of Rs. 9999/-

Hello, it is said that there is a milestone benefit of Rs.2000 on spending Rs.1Lakh within a year.

But my query is how is the year defined?

Is it…

1. Financial year?

2. Calender year?

3. Card issuance month to the month next year?

Some one please clarify.

Thank you.

For milestone anniversary year is considered which is the day it was issued to you.

When I applied for this card online in May (clicking a link in Amazon, submitting SBI existing card number and OTP – Thats all), there was no response from SBI.

In June, someone from Mumbai called me (I’m in Coimbatore) to offer SBI Tata Titanium card. I submitted documents (PAN and Passport for address proof) through whatapp. As per my policy – No Aadhaar card, No Video Call verification, No Physical verification for credit cards processing – I got the card. But immediately closed it as the SBI Tata card needed a separate website for login and poor limit offered.

A week back on Sep, 21st, someone from Mumbai called me. I applied for SBI Simply click card this time. Same process. Only whatapp details (PAN and Passport for address proof) sharing. No Aadhaar card, No Video Call verification, No Physical verification. Just now I got the virtual card to start using it. I think this is new to SBI for providing virtual cards. Card processed in 7 days. Physical card will reach after few days.

A few days back dineout 10x was removed from this card and today got a mail that 10x on amazon will not accrue on spends made during any sale days on amazon from 1st Dec 2021

This card is now useless.

First they removed 10x from Amazon GV and utility payments from Amazon.in

And now removal of 10x/5x from Amazon.in during sale is a huge setback.

Time to close this cc.

Effective from 01-Jan-2023, Amazon purchases will earn only 5x reward points as opposed to current offering of 10x reward points on Amazon spend.