Axis Bank Buzz Credit Card is added to the Axis Credit Card portfolio recently along with Axis bank Select Credit Card. While SELECT card is primarily for Axis Burgundy customers, Buzz card is for anyone. Its a beginner level card and it serves good for Online Shoppers, especially those who sop frequently on Flipkart.

Benefits of Axis Bank Buzz Credit Card:

- Joining Fee: Rs.750+Tax

- Welcome Bonus: Rs.1,000 Flipkart Voucher (on making 3 purchases within first 45 days)

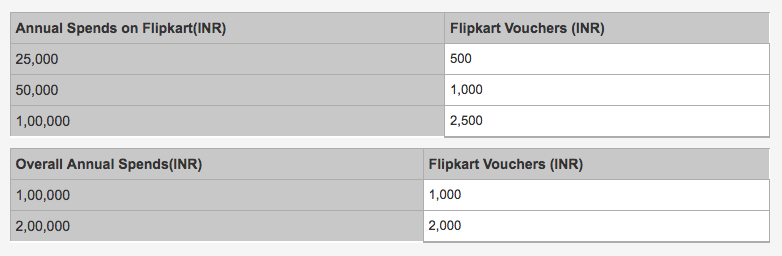

Milestone Bonus: The USP of this card is Milestone benefit that gives Flipkart Vouchers on every X Spend as below.

As you can see, there are two different types of Milestone Spends – One on Flipkart and the other on overall spend. So, the overall reward rate goes like this:

- 3.5% – If 1L spent on Flipkart and rest 1L spent elsewhere

- 1.5% – If 2L spent anywhere

With HDFC Diners Cards 10X promotions (temporary), this card can go nowhere near to it. However, 1.5% value back as Flipkart Vouchers is pretty good deal for any beginner and 2L is easy to hit for a moderate spender.

Reward Points:

- 6 eDGE Loyalty Reward Points on every Rs.200 spent online (except for online travel spends) – (Reward Rate – 0.6%)

- 2 eDGE Loyalty Reward Points on every Rs200 spent – (Reward Rate – 0.2%)

While the reward points is too less, it adds a little bit to overall reward rate combined with Flipkart vouchers. So above reward rate will now become:

- 4.1% – If 1L spent on Flipkart and rest 1L spent elsewhere

- 2.1% – If 2L spent anywhere (if spent online)

Price Protection Cover: I’ve no idea how it works, here’s what they say:

- The cover will reimburse the price difference between the price paid with Axis Bank Buzz Credit Card for an item and a lower price available for the same item (same brand, make, model name and/or number)

- Applicable only on Amazon, Snapdeal and Flipkart on a minimum purchase value of Rs.2500.

And with Additional Terms & Conditions, i see its not that big to talk about.

Axis Bank Buzz Credit Card Features:

- Card Expert Rating: 4/5 [yasr_overall_rating]

- Reward Rate: 1.5% – 4.1%

- Joining Fee: Rs.750+Tax

- Fuel Surcharge Waiver: 2.5% fuel surcharge waived off on fuel transactions of maximum Rs. 4,000 at any fuel outlet.

- Complementary Airport lounge access: No

- Foreign Exchange Markup fee: 3.5% + Service Tax

- Other Features: 5% off on Flipkart upto Rs.200/month

As you can see, Axis Bank Buzz Credit Card stands good for Flipkart Shoppers and is one of the best beginner level credit card out there. It beats HDFC Moneyback Credit Card and i would highly suggest this card for anyone who just wants to start with a credit card. As you get the welcome bonus for the joining fee you pay, you don’t lose anything by applying for the Axis Buzz Credit card.

What do you think about Axis bank’s move to introduce a dedicated card for Online Shopping? Share your thoughts in comments below.

Really good card for the begineers

Dear sir,

Balance amount how to transfer through axis my choice card.

Is it a good idea to let go of this card after 12 months are over?

Maybe issue another card to bet benefits again.

Yes you can do so.

I got this credit card and i was happy to see “round the year 5% discount on Flipkart” until i saw ‘*’ claiming that only a maximum benefit of Rs 200 can be availed in a month. That means that only a shopping of 2000 bucks per month makes sense. after that, 5% benefit cannot be availed.

Yes, its a kind of useless card for most.

I want axis bank buzz credit card

Welcome Bonus: Rs.1,000 Flipkart Voucher (on making 3 purchases within first 45 days)

which purchases flipkart or any? this is not mentioned anywhere on axis site.

Can you please confirm.

Any

Welcome Bonus: Rs.1,000 Flipkart Voucher (on making 3 purchases within first 45 days)

which purchases flipkart or any? this is not mentioned anywhere on axis site.

Can you please confirm.

Not only with flipkart ,after any 3 transaction u can get rs.1000 flipkart voucher

Hi, How many bank accounts do you have and in which bank?

Welcome Bonus: Rs.1,000 Flipkart Voucher (on making 3 purchases within first 45 days)

which purchases flipkart or any? this is not mentioned anywhere on axis site.

Can you please confirm.

how to use that voucher please guide..

When i got the call for credit card it is said that 5% cash back will be there for all transaction on flip kart but they did not tell the limit for that it is max 200Rs, it was quite disappointing.

One more thing axis bank offers is they make hurry to sale there product so they lie like anything and hide all negative things about the product.in few day after getting card i was started to getting calls for health plan,loan..etc, they will be pushing to pit by telling crap. dont believe anything they say go with reviews in google before purchase.

I have an account in axis Bank but my salary is deposite in SBI account. Can I get the axis Bank buzz credit card?

I want to stop this card. How can i do so?

Make sure there are no outstanding dues. Then ask them on phonebanking to cancel the card.

Did anyone got 1000 voucher ? Yes ? ,No ? If yes what conditions again they saying to use that voucher ? Any free movie ticket ?

What is the minimum amount of 3 purchases to avail rs.1000 flipkart gift voucher.?

Is this card only for online purchase? Can we do swipe?

I have been using Myzone CC for 5+ years. I am eligible to get Rs 2500 Amazon vouchers so far. My concern is I used amazon more than flipkart, because I feel we get cheaper rate on amazon. However I am ok to switch to flipkart if Buzz + Flipkart provides better value. Should I upgrade MyZone credit card with Buzz credit card (axis bank representative called me to ask if I want to upgrade)?

The 1000/- WC voucher will not work at all. i am struggling to get the correct one since 3 months but still i didn’t received any instead bank is saying they are working on this & no alternate. They are creating tickets each time when given time completed. Now i have almost 7 tickets, but there is no resolution yet.

i m pankaj kumar i tired to calling to axis bank i cross the annual spending of milestons 2l and filpkart 1l they not give the me vouchers pls help me