Many of my friends & relatives hold an SBI credit card and its usually the SBI IRCTC Platinum Credit Card because most of them travel at least once a month via train between their native and work location. As it helps to save upto 10% on IRCTC spends, its definitely a worthy card to hold. Let’s see in detail below,

Table of Contents

Joining Fees

- Joining/Renewal Fee: Rs.500+GST

- Welcome Benefit: 350 points

The welcome benefit kind of sets off the fee partially, which makes Sense for a low fee card with a very good return on spend on IRCTC train bookings.

Rewards

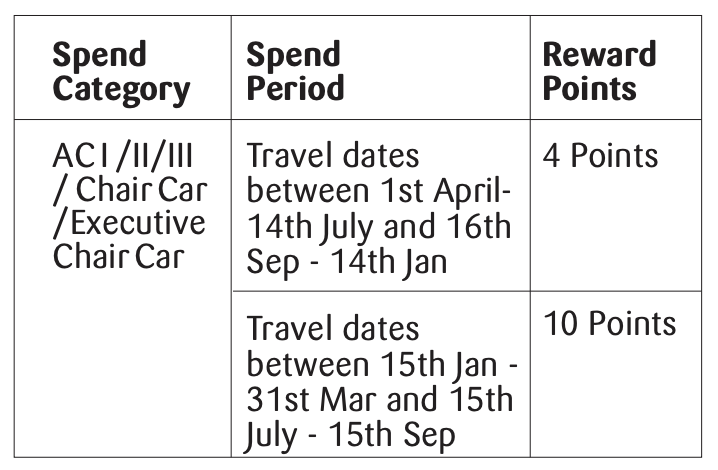

- IRCTC Train Bookings – Peak Season: 10% as points (AC1, AC2. AC3 and AC CC)

- IRCTC Train Bookings – OFF Season: 4% as points (AC1, AC2. AC3 and AC CC)

- All other spends: 0.8% as points (1 Reward point for every Rs. 125)

- 1 Reward point = Rs.1

Note: To be eligible for the rewards, booked ticket must have one Traveller same as the name on the card

Features & Benefits

- Save 1.8% transaction charges on railway ticket bookings

- 1% fuel surcharge waiver, on txns of Rs. 500 – Rs. 3,000, exclusive of GST and other charges (maximum surcharge waiver of Rs. 100 per statement cycle)

Bottomline

- Cardexpert Rating: 3.8/5 [yasr_overall_rating]

Its a very basic one and was indeed an amazing card until the launch of the new, improved & premium version of this card which is SBI IRCTC Premier Credit Card. So it now makes no sense to hold on to the platinum card unless your spends are low (or) your train travel is seasonal and falls under the period where this card gives you 10% returns.

Remember, if you spend less than 20K on train tickets a year, I wouldn’t even suggest you to go for either of the IRCTC cards, you may rather go for the newly launched entry-level cards like SBI Ola card or Axis Flipkart Card or ICICI Amazon Card which could get you rewards on all type of spends.

Do you have IRCTC Platinum credit card? Feel free to share your experiences in the comments below

The points is only for the card holder, not for companions

Quote

Note: To be eligible for the rewards, booked ticket must have one Traveller same as the name on the card

Unquote

Does is mean it is sufficient that the add-on cardholder is one of the travellers, provided that the ticket is booked on that add-on cardholders’ card. (Since card number of SBI add-on members is unique unlike in the case of HDFC).

Have this card in kitty. Planning to discontinue tbh. While would love to have continued with an SBI card in wallet, not sure if any of their credit card adds any value with DCB/StanC Ultimate already there.

Even if there was some LTF like amazon ICICI or Yes first Exclusive or such, which I am keeping for any special offers/spends, would have kept an SBI card.

But dunno if there really is any SBI card which will justify to keep against others.

@Priyansh

Get SBI simply click. SBI offers at least cost.

I just recently took the credit card of SBI which is IRCTC Platinum. I don’t know about the benefits of it. But god they fooled me very well. SO I’m just writing here to let other people know that. They offered me free card without any annual fees or anything like that. Post all the things has been done. I got my card dispatched, i got call saying the benefits and charges that I’ve to pay. THe clearly fooled me first by saying free and after charging me for the same..

So guy’s be aware for it. Luckily charges are not that much. (600). But still I’m very angry at the team.

I have SBI platinum card with 62k limit & using this for 3yr. First year I paid rs. 1999 as annual charge & without my permission I got an royal sundaram health policy near about 4K/year. I just paid the last month bill just got 1k increase in annual fees.

For 3 yes I can’t redeem my rewards.

Rs.300 fee for cash withdrawal

What a scam

Now I have ICICI Amazon Pay card with 1.4L limit & life time free card

After two month I will close sbi card because i have pay the EMI sbi don’t have the option for early payment .

In ICICI deals all thing in a single app

While SBI have lots of apps

Today, BOB launch IRCTC RuPay Credit card.

Card is also co-badged with JCB International network to support international ATM, POS & e-com payment at 195 countries.

Upto 40 Reward Points per Rs100 spend for train ticket bookings,

Book your train tickets on IRCTC Website & Mobile App and save 1% transaction charges,

Earn 4 Reward Points for every Rs100 spend spent on Grocery & Departmental stores,

2 Reward Points per Rs100 spend on other categories,

Earn 1000 bonus reward points on single transaction of ₹1000 or more within 45 days of card issuance.

1% Fuel Surcharge waived off on all fuel transactions between ₹500-₹3000 (Maximum waiver of ₹100 per statement),

Get upto 3 lifetime free add-on cards for your spouse, parents, siblings or kids (above age 18).

I applied for an SBI IRCTC Rupay card, but the bank approved IRCTC Visa card instead. The card is dispatched as well. Have raised a complaint. Is there any chance realistically that the card will be changed? I need a low fees Rupay card tbh. IRCTC was a bonus.

This card is pretty useless considering you get the points only on the cardholder ticker fare and not for the entire booking amount. Nowhere in their entire card usage booklet do they mention this. Just to clarify, if you purchase tickets for four people costing 4000 during a 10% reward period, you’ll get 100 points and NOT 400 points. This makes it pretty much useless but unfortunately came to know this only after I got the card.