This article covers only the Unboxing & hands-on experience with the IndusInd Bank Indulge Credit Card. If you’re looking for a detailed review of Indulge, please check out this article: IndusInd Indulge Credit Card Review

Table of Contents

Upgrading the Card

As you might know, I’ve been holding IndusInd Pinnacle and IndusInd Iconia credit cards since past couple of years. I’ve decided to close Iconia as Amex offers were dropping since past two years.

So Iconia was closed (post redeeming the points) and the credit limit got transferred to Pinnacle. Then a credit limit enhancement was done on Pinnacle and finally the upgrade to Indulge was processed.

This was bit of a process and you would need to talk to the right person to get it done as expected. RM generally won’t know anything about this but he can connect you to the right person equipped with the knowledge.

Unboxing

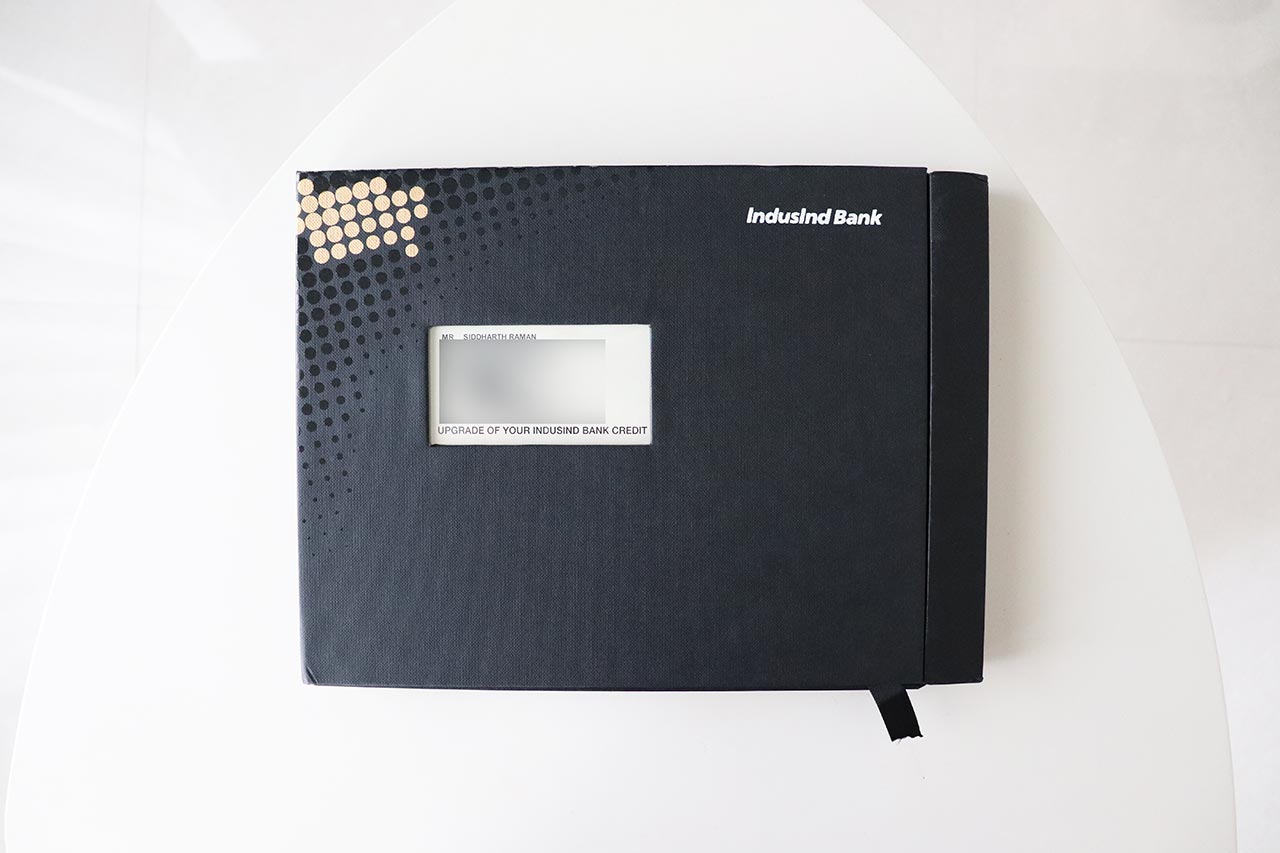

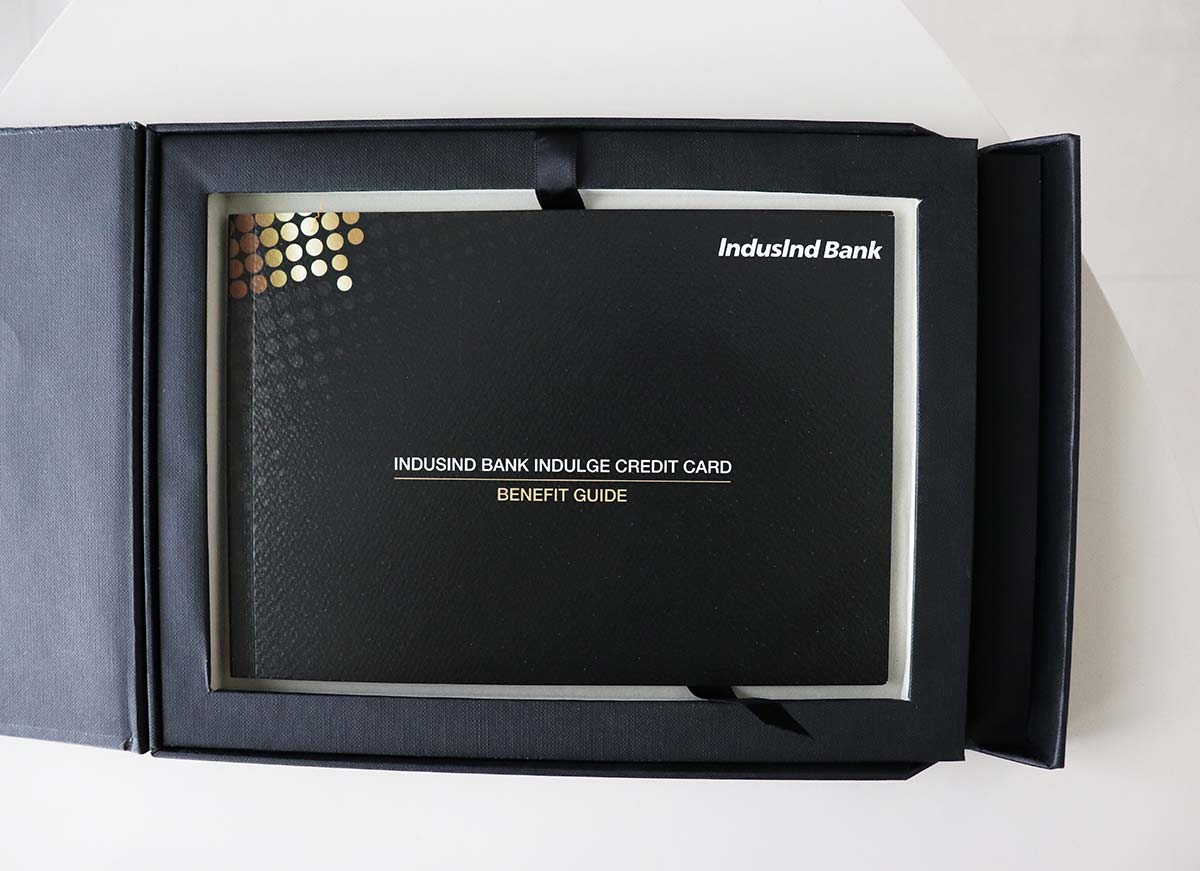

The Indulge Credit Card welcome kit comes in a decent box. The card, catalog and welcome letter are put inside the box that has white velvet lining which looks really classy.

There is no separate housing for the card though, which we usually see in other super premium credit cards like Axis Reserve.

Here’s a quick look into the unboxing pictures,

Customer Support

The easiest way to talk to customer support for all IndusInd credit card queries is the video branch. I’ve used it many times in the past and it’s extremely handy.

But the recent problem is that they’re always busy and it’s quite hard to connect to them these days. So you’ll only have to dial the regular support line and follow the IVR.

Indulge direct connect doesn’t work for me for some reason.

Though, I’ve found a shortcut. It is to call the Virtual RM number (direct line) and ask them to connect to cards team. This saves the time spent on irritating IVR.

I’m not sure if everyone gets this Virtual RM, but I do get calls from them since many years. You can just call them back via the same number they call you. I wish all banks have this useful functionality.

The executives who attend the call may differ. They usually handle the current & savings a/c and are quite knowledgable.

But this is not 24/7 service and this line too gets busy at times, though not as busy as the video branch.

Bottomline

The cards delivers most of what it promises. I think only the super premium card support can be improved – both via call & email.

Speaking of email support, SBICard Aurum has the best in class support in the industry, as I recently got a response to my email in 10 mins. I was shocked to see a real response with an answer to the query from a human that fast from a bank.

That aside, it’s indeed quite an experience to hold a credit card with gold on it.

Can i apply this card based on other bank card?

Yes, if u have an existing credit card with limit if 5 lakhs and more

Agree Sid, video branch is good. Unfortunately it gets disconnected frequently (it could be my internet issue as well), however they are good and fast unlike customer care which takes long time.

Are you able to connect to Video branch for CC as well?

I have not tried, I had reached out to them for FD related queries. They were helpful and suggested right method 🙂 First time something positive from IndusInd

Congratulations.

What is the base limit required?

~5L ideally. But I don’t think that’s a strict criteria.

This card gives very low reward points compared to HDFC INFINIA or DCB or even SBI Aurum.

Indusind really need a good card to launch to attract affluent customers.

This segment is not about rewards. But problem is there are no compelling unique features either, like Axis Reserve.

I got this card in the month of May 2022. So far good

Hi Sidharth,

I am an hard core credit card user since 1999 and presently hold 16 credit cards from various banks including HDFC Infinia, Standard Chartered Ultimate, BOB Eterna, Axis Magnus and Vistara Infinite, Amex Platinum reserve, Indusind Pinnacle, IDFC Bank First Wealth, SBI Elite, ICICI Sapphiro, etc. I was also considering upgrading to the Indusind Indulge and the ICICI Emeralde cards.

What would you advise someone who would like to 4-5 credit cards which would cover most of the required features?

Since 1999!

Well, am sure sure not the right person to advice a senior in the hobby. 🙂

On a related note, since when are you a CC user Sid ?

Also, sm with a higher number of years under the belt doesn’t always means higher experience. We call it meter running (eg whether you are really traveling or not, meter keeps running with time for auto & taxis)

I’ve been using CC since probably 2004-5. But was happily holding 1 HDFC card (whatever variant/limit they gave) and 1 SC manhatten. Till I came across your blogs. Changed a lot on CC usage since then.

Little over a decade. Glad you’re finding the content useful.

Sandipani – Just out of curiosity, how many of these are paid and how many are LTF ? Assuming some of these are paid, are you getting enough value from all these ( especially the paid one)..

I am using hdfc DCB from last 3 years. I think its best. Offering points @ 3.33% on every purchase. I don’t think any other card offers the same except infinia.

Hi Siddharth

What cibil score is required for this card to be sanctioned.

For new applications 750+ with an existing card limit of ~5L via C2C route.

Is offer LTF in any scenario ?

I got a call from an agent who said I can get it LTF basis salary / Employer

If luxe gift cards are not taken from bank,what will happen.

Is there any possibility to get this LTF? My CIBIL is 810+ and I have cards with limits of up to 15L.