For the first time in the history of ICICI Bank Credit Cards, the bank has introduced a rewarding super premium credit card named Emeralde Private Metal Credit Card. Essentially, ICICI Bank has taken feedback on the previously launched regular Emeralde Credit Card and addressed those shortcomings, such as the reward rate, by making a few changes and launching a new product.

Here’s a detailed review of the newly launched ICICI Emeralde Private Metal Credit Card, which is currently being offered on an invite-only basis.

Table of Contents

Overview

| Type | Super Premium Credit Card |

| Reward Rate | 3% |

| Annual Fee | 12,499 INR + GST |

| Best for | Welcome Benefits |

| USP | Taj Epicure Membership with 1 Night Stay |

ICICI Bank Emeralde Credit Card is a wonderful credit card not only for it’s welcome benefits but also for it’s attractive reward rate.

Joining Fees

| Joining / Annual Fee | Rs.12,499+GST |

| Welcome Benefit | – 12,500 Points (12,500 INR value) – Taj Epicure Membership with 1 Night Stay |

| Renewal Fee | Rs.12,499+GST |

| Renewal Benefit | 12,500 Points (12,500 INR value) |

| Renewal Fee Waiver | Spend Rs.10L in the card anniversary year |

As you can see, ICICI Bank has become quite generous with the ICICI Emeralde Private Metal Credit Card that gives almost 2X the value of what we pay as Joining Fee.

Taj Epicure is heavily loaded as you might know and if you use all those benefits you might even get 3X of what you’ve paid.

And fortunately there is also a renewal fee waiver condition of 10 Lakhs p.a. which is very much feasible for most in this segment.

Note: I didn’t receive the welcome points automatically despite receiving an email alert. However, raising a request with wealth support got the points added the same day.

Design

The design is beautiful just like the regular Emeralde Credit Card and it is being issued only on Mastercard network as of now.

While the design looks elegant, I wish they increase the brightness of Mastercard logo a bit as it looks little dull now, as you can see above.

It’s a metal card and it comes with a 3,500 INR card replacement fee just incase you lost it.

Reward Points

| SPEND TYPE | REWARDS | REWARD RATE (FLIGHTS/HOTELS) | Max. Cap ( Per Stmt Cycle) |

|---|---|---|---|

| Regular Spends | 6 RP / 200 INR | 3% | Nil |

| Grocery | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Utilities | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Education | 6 RP / 200 INR | 3% | 1000 RP (Max: 33K INR spend) |

| Insurance Spends | 6 RP / 200 INR | 3% | 5000 RP (Max: 1.67L spend) |

- Redemption Fee: Nil

- Tax, Fuel & Rent payments are excluded for Reward Points

- 1% fee on Rent Payments

- All capping are set as per Statement Cycle

You get to enjoy 3% reward rate on most of the spends and those that have limits are quite sensible. Note that Grocery, Utilities & Education Spends will have SEPARATE 1000 RP cap for EACH category.

We’ll have to thank the one who designed this reward system limits because this is probably one of the few cards in the industry that follows the common sense on max caps. Though, I feel Education could have had better limits.

It’s sheer stupidity of some banks to just keep on adding MCC’s every other quarter to exclusion list, instead, setting such decent caps is a good move as most regular spenders wont be affected this way. Well done ICICI Bank!

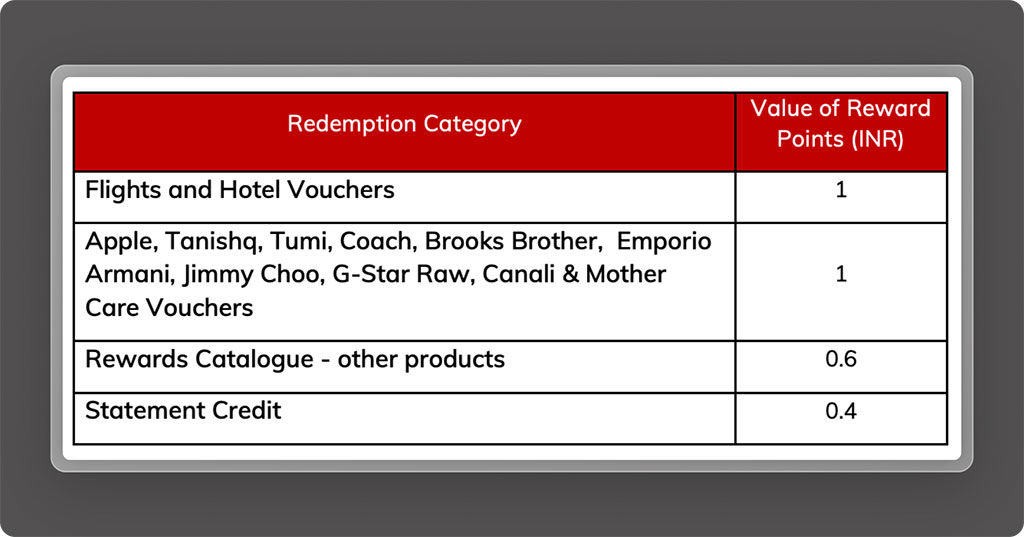

Redemption

Just like most other super premium credit cards, ICICI Emeralde Private Credit Card is also focused on Flight & Hotel redemptions to extract higher value of 1RP = 1 INR.

So if you’re not interested in travel redemptions, your reward rate will go for a toss. Though, it is to be noted that some branded vouchers like US Polo, Allen Solly, etc are still at 1:1 if redeemed for a higher amount like 10K INR.

Milestone Rewards

| SPEND REQUIREMENT | MILESTONE BENEFIT (EaseMYTrip Voucher) | REWARD RATE (AS POINTS) |

|---|---|---|

| 4 Lakhs | 3,000 INR | 0.75% |

| 8 Lakhs | 3,000 INR | 0.75% |

- EaseMYTrip Voucher can be used for Flights Only as per t&c

The milestone benefit is well-designed to provide an additional boost to the reward rate. When combined with regular rewards, it amounts to an impressive 3.75%, which is unheard of in ICICI Bank’s Proprietary Credit Cards portfolio.

The Milestone Voucher was triggered for my account within about a week of completing the transaction. So the milestone fulfillments are pretty quick too.

However, redeeming EaseMyTrip vouchers are not as smooth as I expected it to be. I wish they had partnered with some other leading travel portals instead of EaseMyTrip.

Points Transfer Partners

- Air India: 1:1

ICICI Bank has started coming up with an option to transfer your points to Air India. You can find the option on the home page of rewards portal.

This is good news, and I hope it leads to partnerships with many other international partners in the future.

However, the transfer ratio is not exciting for Air India, as I personally value Air India Miles at 50Ps/mile.

Airport Lounge Access

| ACCESS TYPE | VIA | LIMIT | GUEST ACCESS |

|---|---|---|---|

| Domestic Lounge Access | MasterCard | Unlimited | – |

| International Lounge Access | Priority Pass | Unlimited | – |

The Domestic & International airport Lounge access benefit is not only for the primary cardholder but also extends to all Add-on cardmembers as well. Upto 3 Add-on Cards are complimentary with ICICI Bank Emeralde Private Credit Card.

One amazing advantage of ICICI Emeralde Private Metal Credit Card is that it gives access to the VIP section of 080 lounge at Bangalore Airport.

Golf Benefit

- Complimentary Games/Lessons: Unlimited

- Coverage: 20 Domestic Golf Courses & 90 International Golf Courses

It’s rare to find Credit Cards with access to international golf courses, so it’s good to see that with a coverage of 90 International Golf Courses.

However, remember that only 1 booking can be held at any point in time. So, practically it’s not unlimited, that’s fine though.

Forex Markup Fee

- Foreign Currency Markup Fee: 2%+GST = 2.36%

- Rewards: 3% (3.7% if you hit milestone)

- Net return: 3% – 2.36% = 0.4% (gain)

Similar to most other super-premium credit cards, the ICICI Emeralde Private Metal Credit Card also offers a discounted forex markup fee of 2%, resulting in a net gain of about 0.5%, leaving a lot of room for improvement.

Other benefits

- Cash Advance Fee: Nil

- Late payment Fee: Nil

- Over-limit Fee: Nil

- Bookmyshow: Buy one ticket and get up to 750 off on the second ticket on movies/sport events/theatre/concert tickets, twice per month

- EazyDiner Prime Membership

My Experience

I asked my new ICICI Wealth RM to inform me about the steps to upgrade as soon as the card goes live. Once it went live, the RM patiently followed up with me almost every week for over a month, which was a bit surprising from ICICI RM’s.

One day, I decided to go for it.

The RM connected me to the representative who handles credit cards at the branch. She took the request for an upgrade from my recently issued ICICI Sapphiro Credit Card, which previously replaced my Intermiles Sapphiro card.

The service request was approved within 3 days and I was able to see the card on my app. I received the physical card in the next few days. All of this happened within a week, and it was super smooth.

Tip: For those who’re stuck with an upgrade, all you need is to find the person who can take the request. Surprisingly it can as well be done by the phone banking officers but maybe not all are aware of it.

I did use the same route to apply for an upgrade for some of my friends and most of them went through successfully, except for one, which we’ll discuss below.

Eligibility

- For Fresh Applications: Invite Only as per Bank

- For Upgrade, Credit Limit on Existing ICICI Bank Credit Card: ~10 Lakhs

Ideally, such invite-only cards are issued to existing customers with a good relationship with the bank. However, the bank may change its requirements from time to time.

For fresh applications, ICICI Bank may not issue the card easily. However, if you have other bank cards with a credit limit of over 10 lakhs, you may give it a try.

For existing ICICI Bank credit card customers, the expected credit limit on the existing card for an upgrade is in the range of 10 lakhs. However, one might need to hold premium cards like Rubyx/Sapphiro to increase the probability of an upgrade, as I’ve seen 1 case getting declined with a 15 lakh limit on the Coral Card.

If you already have the Emeralde Card, you might as well see the upgrade option on the app.

If you couldn’t get the card for any reason, you should first try to get the regular ICICI Emeralde Credit Card and then go for the upgrade, which will be lot easier.

Devaluation Meter

- Devaluation meter reading: Low

Except for the lucrative welcome benefit, all other benefits are well capped, so I’m not expecting any major devaluation. However, since they’re new to a high-rewards card, they might keep optimizing the redemption value for vouchers.

Also, as of now, the bank isn’t issuing the card easily for everyone, which is a good sign. If that continues, it may take well over 2-3 years for any major devaluation to happen.

Bottom line

- Cardexpert Rating: 4.8/5

With the Emeralde Private Credit Card, ICICI Bank has finally introduced a rewarding super premium credit card for those who have been waiting for it. Part of the reason for this achievement is likely because ICICI Bank has exited Payback Rewards and launched its own rewards program.

With pretty good rewards and wonderful joining benefits, it’s certainly one of the best credit cards in India for 2024.

While this is a good start, I hope the bank soon brings in more airline/hotel transfer partners and an accelerated reward system like HDFC Smartbuy’s 5X/10X rewards in the future to compete well with the King of Super Premium Credit Cards.

Wow. Good to know about this card.

I’ve been seeing upgrade option to the normal Emeralde in the app for a while now. I’d assume if I reach out to my RM they’ll check the possibility for this card as well?

Yes, of-course!

is domestic unlimited spa is still complimentary on this card

I have got a limit of INR 20.90 L on my ICICI Sapphiro. In my iMobile app I can see the offer to upgrade to the normal emeralde. But I am not interested in that.

Same here. Did you try checking for upgrade through customer care?

How much salary should we have to get 20 lak limit

How are you giving such high rating to this card?

It is way behind Infinia or even DCB metal. 3.3% vs 3%. No accelerated rewards, no Airline transfer partners

Things like unlimited lounge access and all is common for a super premium card. Even Yes Marquee has it. There is no guest access on this as well

Some how this card does not standout to be honest. Only differentiator is exclusivity factor as it is little hard to get. Thats all

– Upto 3.75% Reward Rate

– 2X-3X Welcome benefit

– Rewards on most type of spends for regular users

– Can be treated as good as 100% redemption

Nevertheless, I keep adjusting the rating from time to time based on updates/devaluations/feedbacks etc. Thanks for your feedback.

I must say i agree with the above comment. This card has 2x welcome benefit (which no doubt is great), but beyond that, there is absolutely nothing. Over multiple months, my spend on it is easy. I see no good reason to spend on this over Infinia.

Hi,

Will add on cards for emeralde metal also comes along with primary card if we upgrade from plastic emeralde ( i have 3 addon with plastic).

Or we have to apply again for addon

Most upgrades with ICICI are usually separate requests even though they call it as an upgrade, so I doubt about that.

It means , old cards will remain active with upgraded card. Both card will be charged.

Yes, ICICI doesn’t close old cards on upgrade unless you request to close.

I don’t have any relationship with ICICI.

Is there a way I can directly apply for this card ?

monthly salary ~2.5L pm

Hold HDFC diners black metal with ~9.25L credit limit, and few other cards

You may check with the branch.

You may want to correct that 2% plus taxes would be 2.36% not 2.2%.

Thank you, updated.

I have the LTF Emeralde card with 10L limit. Has anyone got the metal card as a free upgrade or LTF Emeralde Metal card? Looks like a long shot. Emeralde has 4 BMS p.m. offer as opposed to 2 BMS p.m offer on Emeralde Metal.

They’re not giving it as FYF or LTF as of now.

It’s effectively free with those renewal and joint benefits, of course youll have to pay for the gst part

How to apply for this card? can we apply C2C basis? Got a wealth account but its in dormant condition

They gave rewards on wallet spends (short lived) and removed it during Feb 2024. If they would have continued, it would have been go to card

If they have continued, they might have to follow Axis like devaluations. 🙂

So i’m glad they found and fixed early.

🙂 Agree. But devaluing too early gives less confidence on bank for someone getting the card. Nevertheless my usage was prior period and covered!

Hi, in eligibility you’ve mentioned “For Upgrade, Credit Limit on Existing ICICI Bank Credit Card: ~10 Lakhs”. Is this from the bank? I don’t think this is true. If it is an invite-only card, how does this make sense?

It means they’ll invite you if you’ve above 10L CL with other banks. 🙂

In a way, no card is pure invite only.

New transfer partner, Air India, 1:1 .

For other Icici cards having transfer feature, it’s 6:1 .

Big question : will AI revamp it’s FR miles program to the level of CV!

Yeah I did notice it on the rewards portal. Updated, thanks.

The thing is that all these super premium cards are insanely gatekeeped by the banks. All the Infinia, Emeralde, M4B etc. get all offered to the same very narrow set of customers. They aren’t accessible even for people who will regularly do high spends on them and more than have the capability to pay back in full what they spend. Even if they are willing to pay annual fees.

In fact, many people who get these high premium cards don’t even use them as they don’t see the need to and keep them as trophies. Indian banks should mature in their approach to credit cards as a business vertical and stop being so scared of offering cards to high spending customers who otherwise don’t see the value of uselessly parking high amounts of money in their FDs and ULIPs.

I disagree with that approach.

Deep Devaluation of Axis Magnus & Reserve are the proof of giving super premium cards to anyone easily.

That said, it’s not that tough to get these super premium cards in 2024 as long as there are good spends with decent relationship with the bank.

Agree 100% with you Siddharth. Just because of a select few people, all the other genuine users of Axis Cards had to let go of such good benefits. Indians will find out a way to exploit and game the system no matter what and the genuine users will be left stranded.

So I think it’s not a good idea to give these premium cards to every Tom, Dick and Harry. Just my 2 cents.

I was one of the honest users of Magnus. Never gamed the system or did rotation or manufactured spends. Reached the milestone every month through genuine spends only. And I got the axe too.

All was saying was that banks should be able to identify genuine customers and offer them services, while punishing frauds. Or is that banks should be inherently exclusionist, offering all premium cards to the same set of privileged folks who think they are the arbiters of the Indian credit card scene as opposed to every “Tom, Dick and Harry”?

Sorry but it still isn’t easy to get super premium cards. I have a 16 year relationship with ICICI Bank and a 18 year relationship with HDFC Bank (current salary account). I spend around a lakh on credit cards every month. Still either won’t entertain a request for Emeralde Private or Infinia (been trying for over two years) unless I make some hefty deposit with them or subscribe to ULIPs.

Does icici emeralde private has complimentary spa benefit?

No

I checked with RM and I was told you need 2 cr FD or equivalent relationship with bank. I have 49 lac limit on sapphiro and salary account still denied card upgrade to metal emaralde

I first saw invite in Netbanking and then on mobile after I got it approved, pls. check in net banking once, if you have an upgrade.

Hi,

I have 15L CL with LTF Sapphiro. 30L in FD and salary account with ICICI. Still ain’t getting an upgrade. RM is outright useless. Doesn’t even bother to push the case.

Call Center tells me, only the RM has to make a case around this.

Any workaround?

Thanks

Nandh

If they giving an emeradle pvt upgrade at 10L CL, I have to see how to get my rubyx CL increased from 8.8 to 10L, have a wealth relationship with icici. Rubyx was a very good card with reward in the range of 2.8% but ever since it moved from handpicked rewards to icici rewards, the reward rate has plunged to 0.87% . Right now app is only showing upgrade to one dual network MC/Amex Sapphiro LTF, and Makemytrip visa signature at 2.5K +gst joining free and no annual fee. There’s very little info on the dual network Sapphiro, seems it’s reward rate is 0.5 to 0.75% . Emeralde pvt seems to be the only serious card from icici, besides amazon.

Hello Sid, I think this card got unlimited Spa offer as well? If it’s not available any reason to hold his card when I got Infinia, Biz Black All 4 Amex cards, Axis Reserve etc?

I got an upgrade offer for the metal card, and the person on the phone assured me that spa benefit is there for primary cardholder only. But I can’t see it on the website as part of benefits, and most card reviews have either mentioned that it isn’t there or not spoken about it altogether.

Already decided not to take the upgrade as I have more use for the BMS offer than the epicure membership, but this much confusion on the spa benefit is concerning

There’s spa twice a year on the lower variant Sapphiro, surprising if it’s not there on emeralde pvt.

I am using Emerald Metal card for past 4 months. I am not getting any rewards for any spends and the portal for rewards shows 4:1 conversion for all the category. Customer care took request for rewards conversion and changed the portal I think(UI was different) but still shows the same. Can suggestions on want can I do?

any ideas people?

Statement generated during Apr, I have received points

Got it in December through “upgrade your credit card” on imobile app, thanks to branch team for notifying, to check if I got this offer. They offered a fresh application for this credit card as well. Have been using ever since and no complaints. Only time i didn’t use it was for travel booking and expenses as forex rate is still on the higher side when compared to other cards in the segment.

MY RM asking for salary proof of 3 lakh per month. Is this a valid ask?

Does paying income tax count in hitting the 10L spend limit to receive free renewal?

I have noticed this card doesn’t give me any reward points on transactions below 200rs.

Is that a legit thing or a bug in reward points calculation?

Correct, they give 6pts per 200 spent, and then multiples of it.

It seems the initial 199 won’t fetch any points. You need to spend 200 to qualify for points. Beyond that rounding off probably works. My spend worth 790 fetched 24 pts.

I got this card yesterday. I was getting multiple calls daily from CC team to upgrade from existing Emeralde Visa plastic. Initially I didn’t agree. last week I just said ‘Yes’ to their call and received the new Metal card in a nice box with in a week. My old Emeralde crediit limit was 8.2L. Have wealth management A/C but never kept any balance in that account. The old card is also active now. The CC guys told me that if I have paid my old plastic CC fee with in last 6 months, the new card will be first year free.

For first few months, I was getting Reward points on EMI transactions on the card. But it has been stopped since April’2024.

Does anyone know the TNC for Tanishq vouchers? Can I purchase Gold Coins using this voucher? If not, are there any other restrictions on the voucher?

I am having ICICI Emerald Visa Card .. what’s the difference between Emerald and Emerald Private card .. they’ve given me dreamfolk card for spa and lounge access but I’ve hardly been able to use it .. as very few airport in India have that option .. when I got the card that time Mastercard and American Express were ban in India so got the Visa Emerald but now they’ve also started providing it in Amex and Mastercard. Is there any substantial benifit to get it converted to master or amex. I used three cards HDFC Infinia, Marriott Bonvoy and ICICI Emerald non of them is master card .. should I go for Mastercard upgrade of this card.

I have a kotak white reserve. Should I go for HDFC INFINIA or ICICI EMARALDE PVT, when lounge access and golf are my primary requirements

Hi,

Does ICICI Emerald have any Hotel Partners for Points Transfer or is it the same as HDFC Infinia?

The redemption on these cards is very difficult for Hotels and flights.

No points transfer partners with ICICI at the moment, but I’m sure it will be in the making. And I hope they don’t reserve it for future generation. 😀

You don’t have hotel transfer partners but you can redeem points 1:1 for hotel vouchers of Taj, Marriott and ITC (multiple of 5K). Airline partner is Airindia you can transfer 1:1 to FR.

I have EMERALDE Credit card with limit of 10L. My RM(Tier-3 city), doesn’t have much clue about this Private metal card and she forwards the call to a Senior RM (Tier-2 City) and he is aware of Private Metal card and he tries to convince me that both Emeralde and Emeralde Private Metal are same :(. Later, he says will process the application, which he never does. This story has repeated for 3 times. Tired of calling them again.

What’s the best option to get an upgrade from Emeralde to Emeralde Private. PS: My annual spends amount to at least 15L per annum (incl. forex transactions).

Just last week, I got this card delivered. Previously, I had a regular plastic emeralde, but I got an upgrade offer on Friday, 17th Jan, and by the 21st, the physical card was in my hand. It’s been almost 10 years associated with ICICI Bank, and I never approached them for any card. I had just opened a savings account with them in 2004 and started using the account for my needs. Every 1 or 1.5 years, they offered me upgrades. First, we started with a Coral Visa with a 65K limit, then Rubyx, then Sapphiro, then Amazon Pay, then Emeralde Plastic, then Coral Rupay, and now Emeralde Private Metal. However, I have kept only three active: Coral Rupay, Amazon Pay, and Emeralde Private.

But, even though the bank is generous to me in offering card upgrades, on the limit enhancements, they are not much. Even though I have Emeralde Private Metal, my credit limit is currently just 5 Lakhs.

Are they offering for life time free?

Exactly opposite for me have generous limit if 49 lac but no upgrades

OMG 49L!

Cool Bhavin!

How much time it took to see the upgrade offer from normal Emerald PVC to Emerald Private Metal and what was the average expensive on PVC Emerald card?

Vikas, it was almost a year. I got upgraded to Emeralde PVC from Sapphiro on 14th Jan 2024. It was almost 5 days left for my PVC Emeralde renewal, and I got the upgrade offer on 10th Jan 2025. I accepted on 11th Jan 2025 and canceled the PVC before it got charged with the annual fees. I received the card within 3 days.

Congrats, was Emeralde plastic your primary spending card, to trigger he upgrade?

Regards,

GG

Yes GG.

In fact, all of my transactions (100%) were made using ICICI cards. 75% of my spending was through Emeralde PVC, 20% through AmazonPay ICICI, and another 5% for UPI transactions, which I also did through Coral ICICI Rupay. After Emeralde Metal, I canceled PVC, and my spending percentage remains the same. It may have triggered my upgrade in almost 11 months altogether (from Emeralde PVC to Metal); I am not sure, just a guess.

Just 2 days back, I got another upgrade for my Coral Rupay card, directly to Sapphiro by passing the Rubyx. It is barely a month from the Emeralde Metal upgrade. But I will pass it since the Sapphiro Rupay has come with 3.5K AMC, and my Coral Rupay is LTF. Since my UPI transactions are not so high, I am not going to upgrade it to Sapphiro unless they give it LTF.

No, Iyer, it is ₹12,499+GST per year.

Leave apart LTF, they didn’t even agreed for FYF.

Was your emaralde pvc card LTF?

No Rakesh,

I requested them to make it LTF, but they disagreed.

Ok. Thanks. I have PVC LTF. So was wondering whether i should contact my RM for metal LTF. I rarely use this as I end up using Infinia.

Does anyone know if this card gives points on govt soends ?

It doesnt

When will the joining benefits trigger?

Also, do we have any cases where EPM was offered LTF or even FYF.

Shail, as soon as you pay off your first generated bill, maybe within a week to 10 days, you will receive everything over the email.

I haven’t heard of anyone getting EPM with either LTF or FYF, but seen many people getting Emeralde PVC with LTF and FYF.

How about the add-on cards? While applying for add-on, the screen displays 199+Taxes but as per MITC all add-ons with Emeralde cards are complimentary. Customer care is confused.

Not that 200 Rs matter much but just want to clear if they have added fee of late.

No Shail,

I had applied for the add-on along with the upgrade offer. They haven’t charged me for that till today.

So ICICI also started to charge processing fees / convenience fees of 2.5% + GST i.e. 2.95% on Amazon Pay Vouchers purchase through iShop

I applied thru RM and got it. Now i have HNI trifecta – Infinia, M4B and EPM 😊😊

Rags to riches!

What is M4B ?

Magnus for burgundy

That a great trio..

In which range your annual expenses will be on these three ? Or your plan ?

Also how you utilise your reward points..

I have Infinia and EPM, but I’m unable to makeup my mind for Magnus for Burgundy.

Not even sure I can get and utilise M4B.

Hi,

Received my ICICI emeralde metal card about 2 weeks ago. Also received the easy diner membership and taj epicure card today.

How long they take to give new joining benefits. Almost 2 months ,still not received.