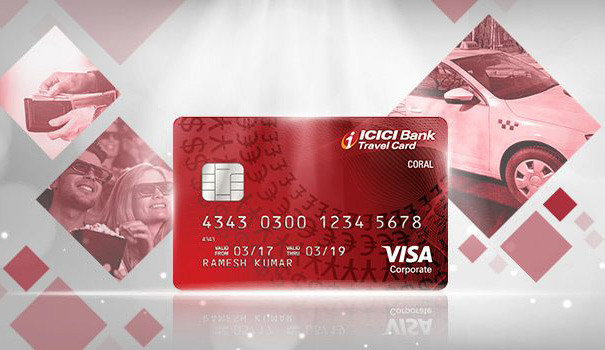

ICICI bank silently launches new gemstone collection of travel cards that are intended for international travellers spending in foreign currencies. The travel cards comes in two variants – Sapphiro & Coral just like their credit/debit card collection.

The benefits are surprisingly better with less fine prints in availing the offers linked to it. Let’s look into the cards in detail,

Table of Contents

1. Sapphiro Travel Card

Joining Fee

- Joining fee – Rs 2,999 + GST

- Annual fee – Rs 999 + GST from the second year.

Benefits

- 0% mark-up charges on any cross-currency transactions (AMAZING!)

- 5% cashback on all Airlines and hotel spends done through online channels, capped to Rs 3,000 per month

- International lounge access: 2 complimentary lounge visits via DragonPass (digital access)

- Uber vouchers: Rs 1,000

- Avail of SRL Executive heath check-up worth Rs 2,750

- Protect your cards and wallet with OneAssist Complete Cards protection

- Lost Card/Counter card liability coverage of Rs 5,00,000

Its good to see Uber vouchers, maybe the right people read Cardexpert Super Premium Card Concept ?!

The only question here is the conversion rates on loading forex. As this info is not available for now, its pretty tough to conclude if we actually get 0% markup fee.

Rest of the features are amazingly crafted and as you can clearly see, the benefits are definitely greater than the fees charged. And hey, how can I miss about that stunning card design – its beautifully done!

2. Coral Travel Card

Joining Fee

- Joining fee – Rs 499 + GST

- Annual fee – Rs 299 + GST from the second year.

Benefits

- Uber vouchers: Rs 1,000 (min. loading: USD 1000)

- Bookmyshow Vouchers: Rs.500

- Protect your cards and wallet with OneAssist Complete Cards protection

- Lost Card/Counter card liability coverage of Rs 5,00,000

This is a very basic card and there is no discount on markup fee mentioned. Meaning, you’ll be charged 3.5%+GST or so. Hence, its safe to ignore this card and rather stick to premium credits cards like Regalia or other credits cards for international travel.

Bottomline

It looks like ICICI Bank is leaving no stones unturned when it comes to cards business. I’m super excited to see the kind of changes happening to the ICICI cards recently.

In a very short span of ~6 months, ICICI has made huge improvements on most things related to plastic cards. Good for them, good for us. 🙂

But…. you may still ask “Why Forex Cards?”

Well, as not everyone is credit card savvy, there still exists a huge demand for Forex cards in the country. So for them I believe ICICI Bank’s new Sapphiro travel card meets that premium traveller’s expectations. Hope there are no hidden terms!

But remember, as long as 5X/10X forex loading offers exists with HDFC, the HDFC Regalia Forex Card is always the best one.

What’s your take in ICICI bank’s move with gemstone collection of travel cards? Feel free to share your thoughts in the comments below.

Now I am thinking to card change my Jet Sapphiro to Sapphiro Travel just for 0% mark-up charge.

I mean for international spends.

Jet Sapphiro is still great for forex spends, as long as you’ve trust in JPMiles at this time!

But yes, it makes sense anyway: low fee, more perks.

how to apply for this card?what is required as a minimum salary for this???????

To buy your ICICI Bank Coral Travel Card, you may visit the nearest ICICI Bank Forex Branch or contact your Relationship Manager. Usually there are no income expectations for forex cards.

so what will be the limit then ,,its how much u recharge?????and i dont have a coount with icici

I hold three cards from ICICI. The Rubyx, Sapphiro & Amazon Pay cards. I would like to close the Rubyx Card and request for an alternate option from the ICICI Card portofolio. Any recommendations? While lounge access would be an advantage, I would prefer a card with a good reward return rate. Does it still make sense to get a Jet co-branded Card given the present state of the airline ?

Is Credit card better or Forex cards? Thinking of availing a Regalia Forex card, and loading it with my moneyback credit card, as there is 10x offer on it. Your thoughts on this please?

Remember these are travel cards, which are prepaid. Also you don’t earn any reward points on these cards. Even HDFC Regalia forex card has 0% cross currency charges

Hi Sid,

Could this be used for PayPal?

I like the Sapphiro Travel Card, however had it been a credit card, it would probably have been the best. Something like 28 Degrees in Australia which is a credit card and charges 0% towards FCY

Hoping they launch a credit card also with zero mark up fee soon. That sure would be lapped up :)…Await for more inputs of people who have used the Sapphiro Travel card.

The question though, is, “What’s the currency loading fee ?”

How long is the Dragon Pass Membership valid?

Is it just for the first year or is it also valid for subsequent years?

Hi Sir, I am travelling to Europe for a student exchange program for three months. Can u suggest me a forex card?

Got pre-approved offer for intermiles icici sapphiro credit card. No joining fees. Lifetime free. Went for it. Since now I am just a collector of free credit cards.

9th credit card.

Hi Sid,

Is Sapphiro providing a mix of amex and mastercard privileges to a single card (in Visa variant) ? I got a call from RM. But details are not available in internet. its is said to be LTF.

I spend a lot in AED and USD, so signed up for a Sapphiro card and paid the joining fee of nearly 4000. Only to find that there is no significant gain in charges at reload, the rate was the same as the figure I got for Transfer overseas from my ICICI account. Unless you load up only USD and spend in other currencies, this card does not make sense is what I feel. I’m considering the Debit card offering from RBL now.

Hey Sid

Thanks for sharing information on travel forex cards. However, it has been 3 years since you’ve written an article on travel cards.

It would be good to write an article on comparison of best travel cards, along with a summary of travel vs. credit cards for a short vacation.

Thanks