RBI allowed use of Credit Cards via UPI platform on 09th June 2022 starting with Rupay Credit Cards. Razorpay became the first payment gateway to support Credit Cards on UPI.

Until 14th February 2023 afternoon, only 3 banks officially allowed this via UPI viz. Punjab National Bank, Indian Bank & Union Bank of India. From 14th February TATA Neu range of Rupay Credit Cards from HDFC Bank also went LIVE on BHIM UPI.

Later on it went LIVE on TATA Neu, Freecharge & Payzapp as well within few hours. With this HDFC Bank became the first private sector bank to do so.

Here are my thoughts & experience with UPI on my HDFC TATA Neu Infinity Credit Card which I got hands-on recently.

PRO’S for Merchants

- Average order value tend to be higher when buyers use credit cards

- Cost of maintaining a Card swipe machine may be a thing of the past soon

- Easier credit card payments & happier customers

PRO’S for Customers

- No additional charges for using Credit Cards on UPI (as of now)

- Ease of UPI with flexibility of using Credit Cards

- Customers won’t have to use their Cash or money on A/c for day to day UPI transactions

- No need to carry Credit Cards in wallet for payments in future, for those category of vendors who don’t accept Credit Cards

- Earn RPs on UPI transactions as well. That too for vendors where CC acceptance is NIL e.g. Veggies/ Fruits/ Small shops etc.

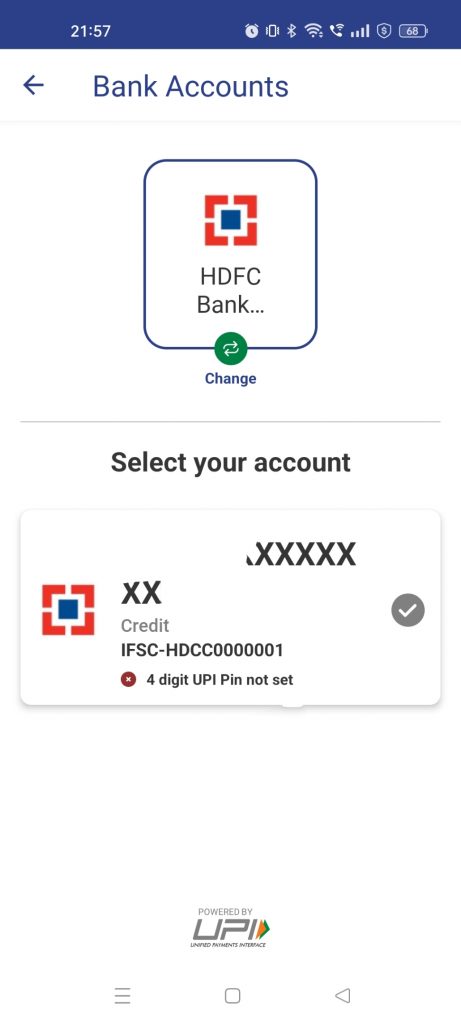

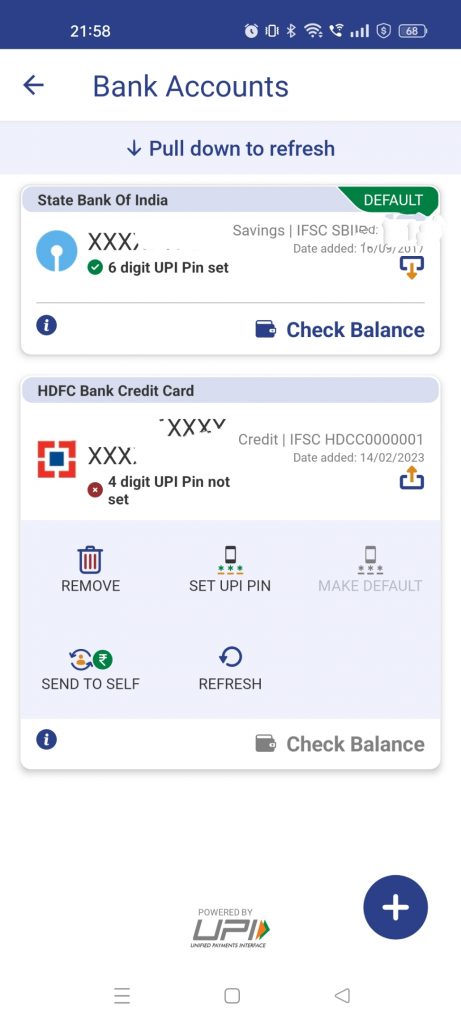

Adding Credit Cards on UPI apps

Now that you have a Rupay credit card LIVE on UPI (be it TATA Neu Infinity CC or any other Rupay CC from PNB, Indian Bank, Union Bank of India & even HDFC Regalia/ TATA Neu Plus etc), here’s how you can add it to UPI apps, so you can use for UPI transactions.

- This is the simple process on BHIM app–

- Login into BHIM app & register if not already done.

- Press the Retweet type looking tab on apps top center

- On next page bottom right corner use Plus symbol as shown below in 2nd image.

- Add the Rupay credit card by completing the verification & you are good to go

Notes on Other UPI Apps:

- Paytm (while Android app v10.23.0 Beta version shows an option to add Rupay CC on UPI, other versions not), Phonepe, Gpay should be Live soon.

- Mobikwik now allows to add Credit Card on UPI with its latest update dated 18th February (Beta version might have allowed this earlier too)

- As there is no restriction to the number of Rupay CCs that can be added, if you have multiple Rupay Credit Cards from above Banks, all can be added to UPI

- Visit Rupay website for the detailed tncs of the BHIM cashback offer seen above in image (i.e. 10% upto 100 every month till 31.03.2023 on minimum transaction of 50).

Note that Rupay Credit Card on UPI will work only for P2M transactions. P2P, P2PM won’t work. Also funds can’t be received to linked credit card on UPI.

Rewards on UPI Spends

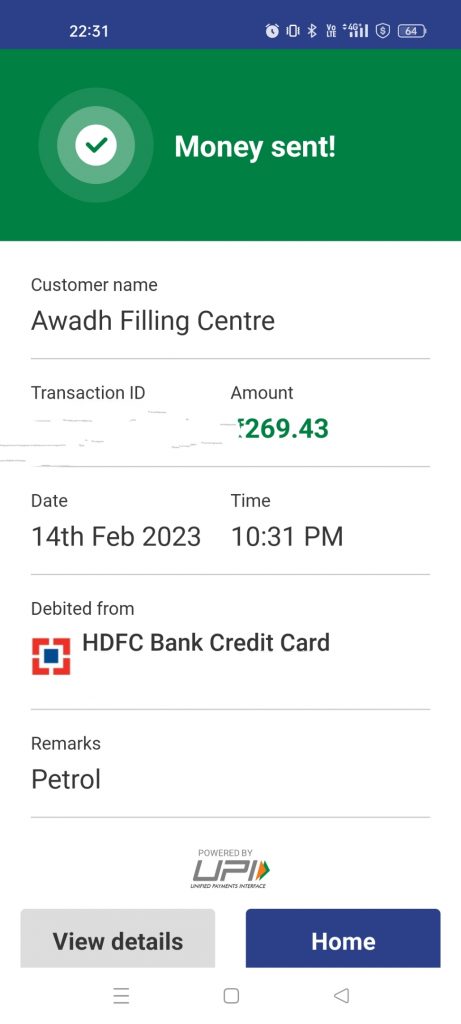

Tata Neu Infinity CC is currently crediting base RPs i.e. 1.5% Neucoins on payment via UPI payment mode, which is good.

HDFC Bank days back came out with a notification that it will limit RPs to 500 per month on all HDFC Rupay CCs on UPI transactions. This means max. spends can be ~ 33334/- per month in order to get 500 RPs.

As we get NeuCoins here and not RPs, this seems little ambiguous. In practice though I have been getting 1.5% on all transactions so far. Keep in mind this may change in future as per above 500 per month rule.

Make hay while the sun shines!

Transaction Limits on UPI

- 5000 INR for first 24 hrs

- 1L per day per card

- 2L per day per card (for some special MCC codes)

Apart from that, there is no limit to the number of transactions carried out via linked credit card on UPI.

My fairly large transaction via Rupay CC on UPI went successfully. 1 more transaction which would have taken the cumulative spends to more than 1L, got failed vindicating the above transaction limit rule.

QR Payment Experience

Though I have been able to add Infinity CC to BHIM first on inaugural day itself i.e. 14th Feb 23 and then to TATA Neu, Freecharge, Payzapp as well within 24 hours followed by on Paytm (Beta version), transaction experience on these have varied quite a bit. Here are my experiences–

- BHIM App- Flawless everytime on Paytm/Amazon QR mostly & Gpay once

- Payzapp- Tried twice on Paytm QR & successful

- TATA Neu/ Freecharge- Tried on Paytm & Gpay QR, failed everytime

- Paytm- Successful everytime

Bottomline

Currently there is no MDR charged to customers using their Rupay Credit Card on UPI. NPCI is likely working to make it win-win to banks, customers & merchants.

Hope the Rupay/UPI experience gets better over time across all apps and payment gateways without compromising on rewards.

I am yet to see any neu coins added to my account even after so many transactions, both UPI and swipe

See in HDFC netbanking post 2-3 days of transaction. In Neu app it will be transferred within 7 days of statement generation

On Phonepe Visa credit by UPI is already working in filling stations

I and my friend are already making payments by UPI with Visa credit cards

I am using my Visa cards on Gpay since last two years. Only part is that these cards are visible only if the merchant has HDFC smart vyapar hub QR code.

Statement shows name of merchant with Visa Direct. Rewards point with normal reward rates

@Deepak and @RAJESH ALLABOYINA

GPay and Phonepe link Visa credit card is different thing and work only on Bharat QR (limited merchant acceptance).

But here RuPay credit card link UPI supported on any Merchants UPI QR payment or online UPI payment.

Well, way back even Amex used to accept UPI payments on their CC using their App.

That was (is) BharatQR. A great concept complete gone down the drain. BharatQR had a very very limited acceptance… Amex on BharatQR virtually non- existent

I got an LTF offer for both Infinity and Plus card. but there has been a problem. My registered mobile number with bank is different to tata neu app. After talking with bank and customer care for 2 to 3 days i gave a try but unfortunately the app thinks that i am a new customer and offered me plus variant with 79k limit. I am an existing card holder with HDFC and my limit is more than 7 digits. I would have got infinity for sure but since mobile number is different it only showed plus card.

Now i have no option but to loggout after i use all my BB wallet amount and neu coins and then login with bank registered number and use for 1 year to get LTF infinity.

Its sort of scam they show one thing and offer another thing. Please advice what i can do on this ?

If you hold an HDFC bank credit card, your credit limit will be shared between the two cards. I too got an initial credit limit of 30k or something while applying for Neu card, this was updated to 5l after 24 hours of card activation

I cannot transact for any amount greater than 2000, anyone facing similar issue?

Hi

I have received hdfc neu infinity rupay card..I am unable to make bill payments using bhim app….pl enlighten what all transactions allowed?

Update your BHIM app will solves the problem.

Will it work on addon card if primary and addon cardholder have different number.

Alright, I am not sure if this card is till very appealing in terms of UPI transactions as UPI transactions above Rs 2000 are going to be charged at 1.1% from April 1st. NPCI has issued a circular and with just 1 few days for this to begin.

They say that the user will not be charged and the receiving bank is entitled to pay this fees to the sending bank. I am not sure how this will work. Does it mean that if I transfer 4k to someone then the entire money will be transferred and the sending bank won’t take it’s cut? Or will it and the receiving bank will replace that amount and credit the full 4k to the receiver’s account? Or will the fees be accumulated and paid separately?

I am not sure what impact this will have on Cred payments and other card payments through UPI. Also since this card claims to be free of charge on UPI platform, now that these charges are coming into practice, will this card still remain free of charges for transactions above 2k? Only time will tell.

This has already been debunked. It’s only for PPI instruments like wallets.

Any clarity on this?

What are PPI payments?

I made a significantly large payment, and the receiver received the payment after 1.5% + GST being reduced from that amount.

This is not what I had expected, as if I had paid through another credit card my charges would be much less that what was charged. It defies the purpose of using this UPI based card.

What could be the solution or reasoning?

The unfortunate reality is that I too loose about 1.6% + GST on most transactions. And in some cases the receiver has demanded that I pay the deficit and I’ve had to because deductions weren’t allowed on those payments. UPI scan & pay using RuPay card is not free of cost.

I don’t wanna jump into any conclusions but bottom line is that there are charges involved.

Has there been any update on the Neu card. I have added the card on goay and bhim and it work fine till last month. It has suddenly stopped working and I am not sure what to do to make it work. Anybody faced this and has a solution?

Can you please elaborate on what you mean by the card stopped working? I mean do you get some error? If so what’s the error that you get? Or does it not even show the card as an option for payment?

Does this not work on iOS? I am on latest Paytm app but there is no option to add Rupay card to upi

Enroll for beta program and see if you can.

Can you please show the steps for linking HDFC Tata Neu Infinity CC (Rupay variant) to UPI on the Tata Neu app? I’m not able to figure out how to do it.

Points are not all getting credited correctly. Purchased from Tataneu app for Rs 298(tatacliq) and instead of getting 5% got just 4 points credited. got no points for mobile recharge from tata neu app. Got no points for POS swipe (1.5%)

Definitely not worth card if its paid. Anything I am missing ?

I have DCB and neu infinity. There is spend based offer on DCB. Certain spends on neu infinity card qualify for DCB spend based reward ? Coz my current amount spent in monthly milestone > total outstanding on DCB.

@nsk

Both cards only share limit but rest I think it’s different. Even i am not sure whether 5 lakhs annual spend if we use Tata card it would be considered under 5 lakh spend.

Even I got 1500 gift card for Jan month spends on DCB. I don’t remember how much I spent.

HDFC has been sitting on my application for the Infinit card that has got an in-principle approval. So I decided to go for a back-up in PNB Rupay Select, as I happen to have a salary account with PNB for a very long time. But in typical PNB style, they went through rounds and rounds, but eventually issued me the card. Took almost a day to get the card activated, the process is from the previous century. Finally have been able to set up the card for UPI pay on Paytm. Going to check in the coming days. Have not been able to find the option to link the card on TataNeu, can someone explain please?

TATA Neu has the most buggy app seen by me so far.

Neu card doesn’t work on its own app network for UPI.

Phonepe, BHIM, Payzapp works best on Android.

I did enable UPI for tata neu infinity credit card. But how to use this CC for UPI in tata neu ?

I am not sure about what success rate others are enjoying. I’ve tried 3 times so far from GPay and the first time it went fine and I was so happy. The second 2 times it did not. The errors were “Payment failed” and “Payment was declined.”. Are there any cases where UPI payment using RuPay Credit Cards won’t work? I know I can’t transfer to phone numbers. I used scan and pay at retails only. Or is this just a random error?

Google Pay has just started Rupay on UPI, there could be some glitches. Paytm works better in my experience. Some people have suggested that the Bhim app also works reliably when it comes to Rupay CC on UPI. I have installed and connected my card but haven’t used it yet.

The other reason could be that some small retailers might just be using an individual account rather than a merchant account…

Yes, this has been my experience too. Rupay scan success with GPay on the card is 50% at best. GPay and RuPay do not seem to be the best of friends despite their shared nomenclature.

Better add the card on BHIM and use that to scan and pay. It is slower and a bit more cumbersome than GPay but not even one transaction failed.

My thoughts exactly.

I have been using Neu Infinity for 2 months now, but haven’t faced errors. Linked the card on Paytm, Phonepe & Payzapp; works smoothly on all of these. Haven’t tried on Gpay yet.

PayZapp supports UPI payment using RuPay cards too? Alright, I’ll try that then.

Tata Neu app itself has a scan and pay option. Does that allow paying from RuPay cards too? If so I can use that itself, besides PayZapp, and I wouldn’t have to install BHIM.

Tata Neu app is a mess. It seems to be full of bugs. The most irritating thing is that it takes a lot of time to open up and most of the times heats the phone up as well. If you don’t want to install BHIM I would suggest PayZapp only.

Yes, Tata Neu often freezes and crashes for me too. Also they don’t seem to give any clarity regarding Neu Pass. A doc on their site says it’s an upcoming membership program.

Today I attempted my 4th ever transaction on UPI with this card on GPay and it again said declined. I immediately tried on PayZapp and it succeeded. Looks like GPay has some issue. Luckily it worked the first ever time I tried. Hmm. In general I think RuPay itself has a lot of issues. It wasn’t easy to add the card on GPay and PayZapp. Made multiple attempts till I was able to finally get it done.

I have another doubt. Does this work on Gpay on iPhone? I know the Axis Ace can’t be used on the iOS version of the Gpay app. What about this card? The only reason I am sticking with Android is the Ace card. But it has been devalued now slightly. So I am thinking of using it only for Swiggy and Zomato and not use it on GPay and use this card for bill payments on Tata Neu instead to earn the same 5% value back.

With the latest updates I seem to be having 100% success rate on GPay with this card. Attempted 3 so far and all have been successful. It’s 100% successful on PayZapp too.

Alright. As always there are blind spots to this whole RuPay on UPI thingy. The claim is that there’s 0% MDR and so no extra charges should be deducted, at least as of now. But the reality seems to be far from that. I would like to highlight my personal experience in this regard.

Our Apartments’ association uses MyGate app and we make payments towards maintenance charges through this App. It uses RazorPay as the gateway. While there’s a separate option to pay through RuPay debit cards at 0% extra charges, compared to 1% charges on Visa/MasterCard debit cards and 1.85% extra for Visa/Mastercard/Amex credit cards. But there was no separate option for RuPay Credit Cards and so I tried going into the RuPay debit cards. It didn’t accept the credit card there saying card type not supported.

So I tried using the credit card option and it was trying to charge me an extra 1.85% which was not supposed to be for RuPay as there’s no MDR. Bottomline is that most payment gateways have not yet supported RyPay Credit cards properly. Where there’s no extra charges involved you’d be fine but where there is, you’re not gonna be paying extra, unnecessarily.

I reported this to MyGate and told them it was against the norms to charge extra on RuPay cards and they should bring in a separate option for RyPay credit cards or club it with RuPay debit cards. That’s being looked into but I don’t know how long it will be before a solution is reached.

Considering this I took the alternative of paying via UPI on RuPay using GPay. And this is where I got a shock again. There was a discrepancy in the amount I transferred and what got credited. I transferred Rs 3430 but there was a deduction of Rs 56 and then some GST for that of Rs 10.19. As the association can’t accept this deduction I must now pay them this deducted amount now. This means that there are charges being deducted when paying on UPI using RuPay while the claim is that it shouldn’t be. I am not sure where the disconnect is.

Looks like the whole UPI network has not yet been properly calibrated or tuned to allow payments through RuPay without any deductions being applied. Please bear that in mind.

Add your cars on BHIM UPI app and while making a payment on MyGate, select UPI as the option. Then select BHIM app from the list and pay via the Rupay Credit card. There won’t be any additional charges. Worked for me and thought might be helpful to you and others.

That’s the idea for the next time, to use UPI and then select PayZapp probably. Because the account to which I am transferring is with HDFC. So instead of scan and pay I am gonna try to do via UPI on the app itself. Thank you for the suggestion.

I plan to make an INR 2 lakh payment for an educational fees payment, please suggest which card will give max points, the options i have are:

1. HDFC Neu Infinity card

2. IDFC Select card

3. Amex MR card

Currently there is an offer going on for IDFC cards on education payments directly on institute website or POS (but not through third party payment sites/ apps).

The Infinity card has the best reward rate of the 3… So long as you have enough use on Tata Neu, that should be the option to go with.

Am using Axis Indianoil Rupay card on all purchases via phonepay , GPay and paytm and i did not find any charges. Maybe for rent and maintainence it may do as even banks charge 1% of the amt paid apart from the gateways. Even i will try paying through rupay card and see if there is any charge for rent and maintainence . Looks like the gateway provides need to calibrate for rupay cards not to charge.

Can we make payments higher than 2000 via UPI using the nue cards? I am unable to.

I regularly pay society maintenance charges amounting to approx Rs 5k every month . In Adda, I select Paytm UPI , then pay using Neu card.

If I shop using my infinity card on my family member’s tataneu account, will it give 5% neucoins as per card feature on my card (eventually transfers to my tataneu account) plus 5% standard neucoins in my relative’s account, as per tataneu feature? In other words, my card is not restricted to shopping done solely in my account for getting the 10% cashback?

The problem with this whole fiasco of RuPay on UPI is that the user is left guessing all the time. With Visa, it’s not even in the list of payment options if a particular payment doesn’t allow card payment. But with RuPay it even shows up when paying other card bills.

When I tried to apply for an appointment to renew passport, I used scan and pay so that I can avoid the extra charges on credit cards. First tried on PayZapp and it failed with a message that said something like my bank denied the payment. Then tried immediately on GPay and it failed again.

I can only guess as to why it didn’t go through. Maybe if someone else knows you can fill me in.

Fortunately purchased epicure when it was running 20% discount on tataneu app last month. Privilege was costing 20K+gst = 23600. Now it’s been raised to 50K+gst = 59000. Few added benefits such as 3 spa sessions instead of 1, and few more Club Taj lounge access, more complimentary lunches. But nothing that justifies such a steep hike.

Took the card for electricity bill payment but its not accepting JVVNL Bills payment with cc. If i do it with using upi feature on neu app does it give 5 percent cashback.

UPI only 1.5% with a earn limit of 500 nue coins

UPI scan and pay using RuPay is not free of charges. I have done multiple transactions from GPay and PayZapp too to confirm this. The deduction is about 1.65% with another 18% GST on this amount being deducted. With one such transactions I was able to get the details and this deduction is under the head “MSF Amount”. When I google that it says it’s Marginal Standing Facility and has nothing to do with card transactions. So I am not sure why it’s being deducted. Is it just MDR in a different name?

Bottom line is that UPI scan and pay using RuPay cards does not transfer the entire amount to the recipient. This is unfortunate because now we can scan and pay at many outlets where they don’t usually accept any card. When we make UPI payments they would assume that they’re gonna receive the whole amount but at the end of the day they’re gonna see deductions. For merchants that accept cards this shouldn’t be a shocker because when they accept cards they are prepared for MDRs. But this UPI thing is unfair. I mean they should at least be open about it and say that there are gonna be deductions instead of hiding it.

Yes, experienced the same. Sad that it is misleading, and will eventually drive down the popularity of UPI.

You made a great point. Eventually the sellers will bump the prices (for ex groceries, which don’t have MRP) and will be put on the end consumers.

MDR is high when the amount is more than 2K, so your day-to-day transactions such as buying groceries, fruits, and vegetables won’t get affected.

For a transaction of Rs 130 I saw a deduction of almost Rs 2.7. So the deductions are not just for transactions above Rs 2000.

MDR is low for transactions below 2000 limited only to debit card swipes. all credit card transactions are linked directly to the MDR set by the bank.

Can someone confirm what is the reward rate if I pay insurance from the insurance’s webpage ?

I am observing that there are some limitation while doing transaction while UPI to another merchant.(Review date 18th July 2023)

1) Unable to do transaction more than INR2000 in one go .

2) UPI Transaction limit get over before paying anything else(daily UPI limit is 10 transaction/day).

3) If you are paying big amount like 32K to someone in part payment of 2K . Then after 5th transaction they will declare this transaction as bot transaction resulting in card block. This happened to me yesterday(17th July 2023).

4) Due to above fiasco I was even not able to use my account UPI for transaction.

After using the Tata Neu Infinity card for UPI payments now for over four months I feel that the entire “UPI for credit cards” has been not what it is hyped up to be.

The reason and the one no one talks about being that many merchants especially nearly all small ones have put up their private accounts to be scanned and not business accounts. So you end up doing a P2P money transfer which is not possible using credit card. You will still have to pay using your bank account.

Over the past 4 months my return on UPI scans can be counted as only around 0.7%. Half of the time I wasn’t able to do a payment using credit card.

As a rule of course I do a UPI scan only when CC payment option is not there.

On online apps if I choose UPI and then try to scan and pay using this card from GPay or PayZapp, I get some error or other. Have not had this kinda transaction succeed, ever. Is it not supported. These are merchant transactions only. One such attempt was an attempt to pay the fee for passport renewal. After multiple attempts with both apps mentioned above, I had to pay using my Infinia instead.

Also from what I know card machines are not calibrated for 0 MDR even with RuPay cards. Merchants who charge extra for credit cards, charge extra for RuPay cards. What’s even more strange is that no one seems to have any idea where this money goes. Merchant isn’t getting the full amount and there’s a deduction which many of you already know. With Visa or Master or the others cards, the significant cut goes to the card issuing bank, a lesser percent goes to the POS issuing bank. A minor fraction goes to the card network which is Visa/MasterCard or whatever.

With RuPay it’s certain that the card issuing bank and the POS issuing bank get nothing. I was able to confirm them on some occasions. Does it mean that the entire cut goes to RuPay? Or is it just stuck somewhere? This is very strange. Not sure if I am missing something here. Someone please enlighten me.

Many eateries and provision stores have already started charging extra 2% for Visa and Mastercard and 3% for Amex. The timing coinciding with the massive push for RuPay can’t be dismissed as a mere coincidence. I believe that there’s pressure from somewhere to eliminate competitors for RuPay. I don’t think this is healthy.

So far I’ve been selecting UPI in MyGate and then GPay as the app to make the payment for the maintenance fees for my apartment. This month it says “Payment declined” and that any money deducted would be refunded within so and so days. Checked with the bank and the request has not even gone to them apparently. The scam that is RuPay on UPI is turning out to be bigger and bigger every day.

The scam is that more and more merchants are now disabling UPI on Credit Card. This means that the biggest use case of Rupay Credit Cards, that is to pay through UPI, is rapidly being made obsolete.

You can’t be more right. It’s all gone now. Within 6 months of my usage, now not a single merchant I know, around my area, accepts RuPay on UPI. Even places that accept cards otherwise seem not to accept RuPay on UPI. For some reason they don’t want any deductions on their UPI receptions.

3rd Class Reward program. . 1st they will send to mails and messages that buy for minimum this this much and u wil get 5% coins. Once the month is over they will say we wont give u aby coins as our system has detected some activity and no coins wil be credited. . You are for justification and they wont respond. . Try if u want to experience the same

It’s been about 7 months since I got this card. And by now every place where I used to accept RuPay on UPI has stopped doing so. I can’t blame them. A shop owner nearby me said that he noticed some charges getting deducted on some days. It was not against a particular transaction but at the end of the day he was losing some money on some days only. He carefully studied and figured out that only on days I was doing UPI payments to him with my RuPay card, this was happening to him.

It’s very cunning on the part of RuPay to not mark it against a transaction but to deduct it still. Needless to say he’s not accepting RuPay on UPI anymore.

Even places that accept cards, still don’t accept RuPay on UPI because they don’t seem to want deductions on the UPI payments they receive. Given all this, it would be fair to say that RuPay on UPI is no longer what they claimed. Such a shame and a sham too.

It has been reverse atleast for my place in bangalore, almost all paytm qr codes accept rupay cards. Now I am able to pay vegetable vendor even pani puri using my credit card

I am happy that at least in some parts of India we don’t have that issue. Here I used to pay at a xerox shop, a supermarket, my apartment maintenance through MyGate and all 3 are no longer accepting it. Also in many other random shops, even ones that accept cards, RuPay on UPI was declined saying transaction not supported or merchant doesn’t accept card payment.

Using Rupay Credit cards on UPI attracts MDR for any transaction above Rs. 2000. This MDR is more than MDR for visa and mastercard credit cards ,around 2% plus GST. Merchants can opt to accept Rupay cards on UPI only for transactions below 2000

While that’s what many say, that above Rs 2000 there will be a charge, I have on many occasions made smaller payments, some even below Rs 100, and have had merchants come back to me about the deductions. One such even showed me the details of the deductions. For an amount of Rs 130, the deduction was about Rs3 to Rs 4.

The shopkeeper right next to me, most payments I’ve made to him are less then even Rs 1000. Many even under Rs 100. Yet he lost some money every time I made a transaction. This whole thing leaves everyone guessing.

Here in Bangalore CC over UPI has been fairly great. Except for couple of shops, I never faced any issue. Tata Neu Infinity is a great rewarding card with 1.5% nue coins and it works as quasi cash in Tata eco system like bigbasket etc. No need to track or act.. earn and burn.

The acceptability of CC over UPI is still less. I think the merchants who know about the charges have disabled receiving payments over UPI via cc and in some case i was able to do payments less than 2K but not above that to same merchant. But yes the card is really good for bill payments and purchasing over nue app.

Hi @Sid,

Is fair usage policy applicable for calendar year or card anniversary year?