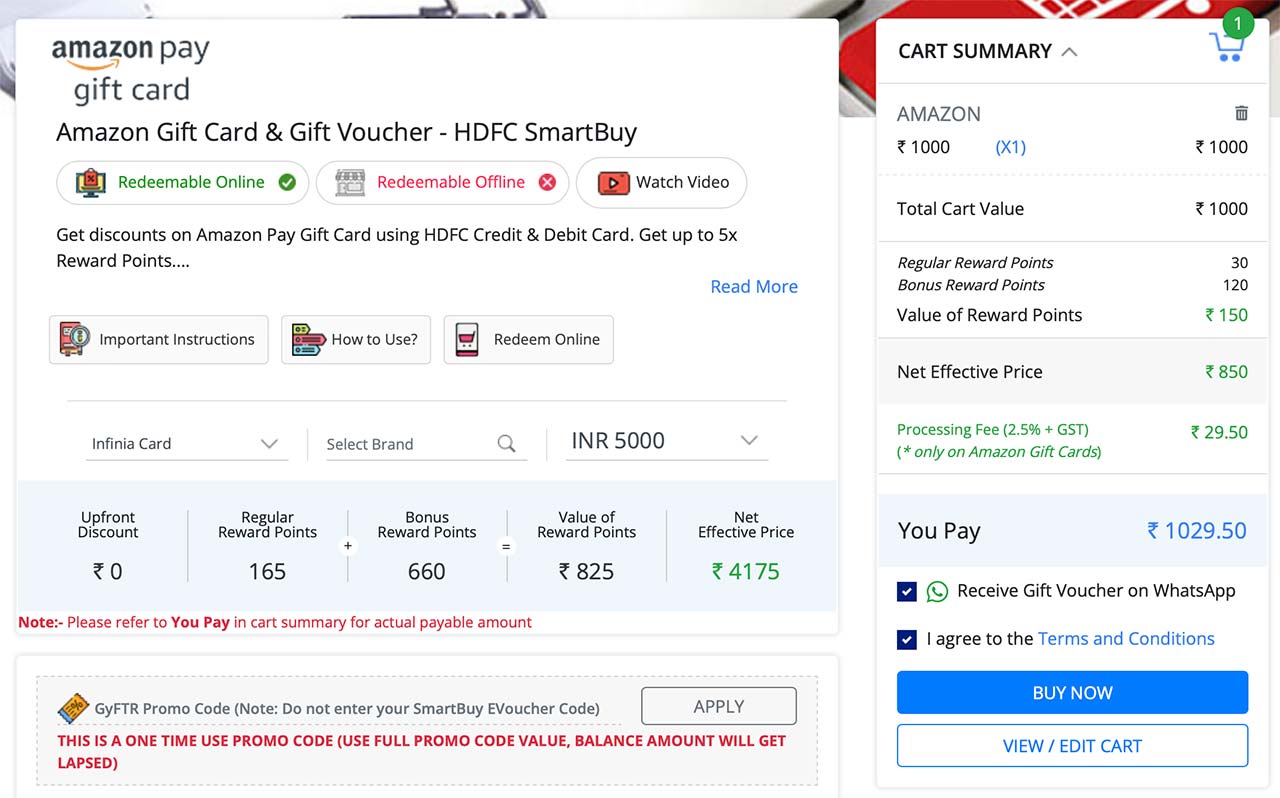

As you might know, from 1st May 2022 HDFC Bank has added a “processing fee” of 2.5%+GST to amazon gift cards that are sold under instant vouchers section of HDFC Smartbuy (GYFTR platform).

By doing a quick math, you can see that its not 2.5% but ~3% (taxes included) loss. So if you’re enjoying 16.5% savings (5X rewards) with HDFC Infinia, now the number becomes ~13.5% which is still decent in my opinion.

Not to forget, Axis Bank has removed the Amazon vouchers from Gift Edge portal since last month, so something is better than nothing.

Just like before when HDFC made 10X to 5X, there is nothing to be surprised.

Basically the 10X/5X program is going through a slow death and we may even see 3X instead of 5X anytime (Oops, I see that its already 3X for Diners Black). That’s how it is and we’ll have to accept it, unfortunately.

Though, what I rather wish with HDFC is a better product with new features and perhaps a redemption system without 70/30 rule.

Indeed a sad move, but reality.

Hi Sid, in your experience what is the best card/option to pay utility & insurance payments with the limit for Amazon Pay vovuhers reduced to 5K as well as reduced rewards ? In my opinion a 5% direct cashback is pretty good for utilities and insurance payments

Also, monthly cap on Amazon vouchers has been reduced from Rs 10k to Rs 5k for last 1-2 months silently.

Is there any card better than DB (including Infinia). Please substantiate with some examples or calculations.

SC ultimate if you’re concerned about 3.3% rewards.

No, I was talking about overall returns for DB (including monthly mileatone benefits) and assuming say 1:0.7 conversion of reward points (being realistic).

It will be good to see some alternatives given the monthly spend at different levels say at Rs 75k or Rs 1l or Rs 1.25l.

Thanks in advance.

> So if you’re enjoying 16.5% savings (5X rewards) with HDFC super premium credit cards, now the number becomes ~13.5% which is still decent in my opinion

This holds true only if we assume that value of the points is still 1:1. Given HDFC’s recent track record in changes related to awards accrual, it’s not a stretch to consider that they might devalue the value of the points too, in the near future.

I’ve already experienced that point value is definitely not 1:1, more like 0.8:1, given that most things for which we can redeem points are at least 15-20% more expensive in Smartbuy than direct channels.

I’ve already moved many of my expenses to fixed-reward cards like Axis Ace, where I can be sure I can get 2% back next month, instead of collecting points and praying that they don’t lose value when I need them the most. Infinia is now kept mainly for the priority pass and Visa Infinite benefits. Will buy vouchers if there is a discount on them which offsets the convenience fee; I can’t bear paying extra for something which has nebulous value.

HDFC, ever since they returned to card issuing after the RBI ban, seems to be losing the plot a bit. Too many devaluations across too many cards, and Smartbuy too. This is when Axis is coming up with some solid products, and even ICICI moving on from Payback into their own rewards system and also introducing some decent products. Not sure this is the right way for HDFC to recapture the market share they kind of lost and attract new customers.

Yes, until we redeem, we always have to worry about reward points. Bank may reduce value, increase required number of points for redemption, increase/add redemption fee, terms and conditions for redemption etc. It’s not a quick process, we may thought accumulate bulk points to redeem on our favorite products but when time comes that product value increased or RP value reduced or expired.

I agree that one way or another even with less value, cashback looks good but again here also this will not work for bulk saving and will spend within next few months, so finally we feel that nothing much benefit with cashback too.

Usually reward points for me like achievements for my credit card game, now these achievements not good that much to achieve.

We have seen so many banks do this.. Sad that HDFC continues like this with so many customers.

P.S. Amazon removed from payback, YesCart, Axis Grab Deals.

DCB gives 10% value on smartbuy instant vouchers if redemption is on travel, it’s only 5% if redeemed for vouchers like amazon. And if you take 3% out in fees, then benefit is mere 2%. Hence I would rather use Amex rewards multiplier to buy Amazon vouchers.

Gift vouchers have been taken off Amex Reward Multiplier as well. There’s no option to buy gift vouchers through Amex Reward Multiplier. Even Amex folks are not aware whether this is temporary or not. So this is a hit for the CC ecosystem as a whole.

Amex indicated that they are working with vendor to resolve this technical issue and they do not know the timeline to resolve it.

In my opinion, HDFC is trying to gain market share by spreading the benefits across credit cards. Earlier, rewards were unattractive on entry-level or mid-level HDFC CCs and mostly concentrated on their super-premium CCs (DCB and Infinia). Recently, HDFC has come up with rewards at the entry-level. If new customer takes their CC they are providing INR 1,500 to INR 4,000 amazon gift vouchers. Looks like they have a defined budget. Someone’s loss is someone’s gain. It is my opinion.

Looks like they don’t want people to use their cards. This is showing that the system is stressed, which will further go down hill as global economic factors cause the indian economy to suffer.

If one is holding DCB then their returns are ~7% (assuming 1:1).

I have also noticed that earlier processing fees for flight tickets was flat Rs. 236 using Smartbuy no matter you book 1 or 5 tickets in a transaction, irrespective of number of passengers in the ticket.

But now they are charging processing fees of Rs. 236 EACH per passenger for last couple of months.

This is also a downgrade of the smartbuy portal.

I hear that the newly launched Tata Neu is also coming up with a credit card. Any idea when is it being offered and eligibility criteria?

Tata already has tie up with SBI so its likely to revamp or issue a new card.

Tata is working with HDFC for a new Co branded card planned for go-live in June.

Is there any Card which gives better Rewards Points than HDFC Infinia to redeem for Travel / Flight Tickets?

Well the devaluation is too fast. From 33% to 13.5% now in a span of just couple of months.

Link to subscribe for specific post is missing

Alerts system temporarily disabled due to unavoidable reasons.

Now Amex Reward Multiplier has also removed gyftr section. Too Bad !

It’s not removed.

Only technical glitch, amex confirmed that the portal will be back soon. Hence Amex is still better option.

AMEX had sent an email in this regard. It will be up and running after 6th May. They are upgrading their membership rewards portal too.

Processing fee added in smartbuy mmt section also. I had checked price of a hotel on April 30 and now price has increased, I found a service charge extra added, which came to roughly 2.5 percent.

In HDFC Smartbuy Flight booking, earlier there was only Rs236 taken as convenience fee per booking irrespective of number of persons travelling.

Now I find that convenience fee is charged as per the 3rd party travel partner (cleartrip/easemytrip/yatra) and so it depends if the booking is return/one-way and number of persons travelling.

In general, the discount we used to get on booking flights at the partner site used to be absorbed by the convenience fee charged. So booking flights at HDFC Smartbuy used to be at around similar rate as minimal convenience fee of 236 was charged.

But now, booking at the 3rd party sites seems to be lucrative as we atleast get to apply discount coupon codes and use appropriate credit card to avail those discounts.

Am I missing something here ? How to best utilize flight booking through smartbuy now?

In case flight booking is no longer attractive through smartbuy, then how do you consume the points accumulated in HDFC credit cards for best conversion and value ?

You can try citi premier miles portal. They don’t charge any convenience fee as well as give points worth 4.5% of transaction value.

I am using IDFC wealth credit card, which give me 2.5% rewards in form of cash adjusted to my statement. No other card give such great reward with freedom of redemption as cash adjusted to statement. Even Infinia/DB give 70% ratio that too in form of vouchers. (3.3%*.7=2.31% only).

But IDFC has changed their system as well now from october onwards but not that much. so if you are online spender then IDFC wealth credit is best card.

Beg to differ.

Wouldn’t BoB Eterna be the better option for online spends with its 3.75% RR?

Agreed. Only issue is BOB service and limit they provide

IDFC is also changing their reward point program. Maybe you can do an article on that as well? They are adding charges for redemption (earlier it was free), i think rent payment will now not give points etc.

Agreed Bhaskar. IDFC also devaluing their reward program. which is not a good sign as well.

It’s better to keep LTF cards for any offer on online shopping. Amazon ICICI and Flipkart Axis are always good options to buy online.

I am happy with 70/30 rule, but depressed to see devaluation of 5x and reduction in AZ vouchers.

I have diverted my sends to Magnus and Amex.

I have a concern about kotak card actually I’m holding kotak royal signature card and I got the upgrade from bank to white card should I upgrade or go with the same coz it’s gives me cashback in reward which is not available in white card

What I also found out is not all transactions through smartbuy / amazon link is eligible for 5x (Infinia). When we use the search button within Amazon site after going in through smartbuy, you get search results stating no results in HDFC smartbuy offer. However, the product that you search may still be listed. When you buy that product, it would not earn 5x. Similarly nuts / dry fruits etc. don’t earn 5X points using smartbuy / amazon link. Slowly but steadily they make this infinia card useless.

I would first go in normal amazon app and add the item in buy later. Then I login via smartbuy to add it to cart.

Buy Later items will not be counted as Smartbuy purchase. You can save them in wishlist.

If that product is not listed in smartbuy offers in Amazon website then it won’t be eligible for that 5x reward.

Dineout HDFC discount now applies only if after discount net payable is Rs 1500.

HDFC wants to kill all offers!

Seems after Aditya Puri’s exit , things are slowly but surely moving down hill. While they may get some transient benefits, I feel in the medium term it would be their loss and getting back those high spenders , who would have moved to other platforms would be very difficult.

HDFC has also reduced max limit of discount in Dineout from INR 1000 to INR 500 per month . So here too they have cut down on benefits from their credit cards.

You are missing a big point here. This is applicable only for infinia and DCB its only 2X. Also one should remember that Hotels at smartbuy is highly inflated when compared to directly booking through makemytrip. I have given a complaint on this and they said they will send it to management. I request every one to complaint only then they would change things. As of now with DCB vouchers would become useless as already hotels are sold at inflated rates in smartbuy.

I also complained on flight extra tax of 260 odd. the said its charged by airlines. Infact i said them that in 2017 or 2018 too HDFC for short brief charged convenience fee but after complaints they immediately removed it.

Hi Rohit

There’s still some value in Smartbuy hotels. Just last week, I had occasion to do a last-minute booking at Chennai. Zeroed in on a property and found all aggregators had pricing in the 7k-10k range, and the hotel was offering the room at 6750+taxes directly (over call – no inventory was showing on their site)

Smartbuy showed availability at 6.5k; and i paid it immediately

So my personal observation is that Flight & Hotels are getting expensive, and this checking option doesn’t hurt one bit

Other points re. Degradation of benefits are spot on!

As per my understanding, profits for CCs comes mainly from people converting to EMI/loan products (especially for high end cards where default RP > MDR) But it looks like banks may have realized that high end premium card holders avail loans/EMIs to a lesser extent (I am making assumption that most high end premium card holders have good enough financials so they can use cash in hand to save their interest.)

So it is better to give more RP related benefits to lower end cards and make them spend more. Also, lots of people who may have started earning recently will be spending much higher on loan products than someone whos home is saturated (again assuming that someone in early years is likely to buy more home appliances on EMI once. After that probably replacement will come start many years and would probably be on cash.)

Correct and infact there are many new banks, neo banks and other apps which comes with cheaper personal loans. So no one use credit cards for EMI option until unless its zero EMI option or it have some reward point offer.

As I know people pay their credit card bills through some personal loan @8-12% nowadays.

MDR has reduced due to UPI and Rupay and other wallet options as well. Most cards even premium ones, we get LTF so basically, there is not much profits with card companies. That’s why they reduced all such attractive offers to lure clients.

There is devaluation or addition of charges all around the credit card world. Probably the whole eco system of cards changing. As the UPI usages surges in all the areas, they might be getting less amount from Merchant commissions as most of them now prefer UPI or insist on UPI payments.

This FY, even Amex has cut down on offers. No signs of Amex Small Shop or Similar cashback offers.

i have been using diners black for more than 5 years…am confused whether to upgrade it to infinia or stay with black..plz advise ?

@aka

whats your limit ? if your spend is more than 5 lakhs then might be u can stick to DCB or ask for infinia but u will end up paying 14500 fees every year. So if you travel a lot then might be infinia is correct or else stay with DCB.

my spends are north of 20 lac every year so fee is waived off. was persisting with DCB as every month get additional 1k voucher on spend of Rs. 80K and was thinking that maybe good partners may come back so point earning becomes easy. I don’t spend to much on 5x and10x categories to take full advantage of accelerated 15k RPs

Lately, I have been facing issues with Amazon transactions. They are not going through SmartBuy even though I adhered to all of SmartBuy’s T&C.

Have you or someone encountered anything similar?

Yes. I cancel my order and then try reorder by opening a new chrome incognito window and logging into my amazon account from there. But now a days too many such occurrences for me.

I have stopped using HDFC Infinia credit card at all. just spending on my IDFC wealth credit card till the time they change their rules. Will be looking for better card which gives better rewards in form of cash as IDFC gives 2.5%.

SC ultimate may be good option bcoz firstly, its chargeable and no good option to voucher redemption such as AMAZON/Flipkart. Just spending to get vouchers only and then overspend on these vouchers is never a great idea.

So Sid, please suggest some great credit card for future use with great reward points.

I have got one spend based offer on my HDFC debit card. Get 250 Amazon voucher with a transaction of 2000. Just wanted to understand whether NPS transaction will be eligible for such kind of spend based offers? Any Idea?

Now they’ve added this 2.5%+GST processing fees on EVERYTHING!!!

Any new devaluation for June? I called them but customer representative declined my request by stating that we can let you know about any change on or after 1st June, not before that.

No Change : offers.smartbuy.hdfcbank.com/offer_details/smartbuy/15282/Zmilm2U%3D

I did not buy any voucher in the month of May and funny part was I got 2000 gift voucher 😂😂 anyone else got this voucher?

Nope. Where did you get it – email or SMS?

@lav

Mail.. Due to some reason I never get offers through SMS..

I got it last month spend based offer for my infinia ltf

HDFC is downgrading every thing… offers on PayZapp are also downgraded…. Cashback amount for Utility payment has been cut down by 50%.

Amazon now out of SmartBuy reward framework. Infinia is rendered almost useless after taking away the biggest USP. @Sid pls do an article.

@ Jay

And dcb users are forced to get infinia because of this dcb is useless. Atleast with infinia you get 12500 points

Sid seems super busy these days 🙂 . Very few updates coming up on this site. Similar story on his twitter handle.

HDFC SMARTBUY July 2022 Update : Amazon is removed partner now? Do not see it in portal as well as T&Cs.

Yes, Amazon has been removed from smartbuy portal. Confirmed with consumer care also.

What ?

Infinia reward redemption for Amazon voucher is very much there. No changes.

Infinia vouchers buying through Smartbuy for Amazon voucher with bonus rewards is very much there. No changes.

Only Accelerated rewards for Amazon seems removed.

I haven’t received bonus points for transactions done in june on smart buy.

Anyone facing same issues.

Not recd except the points on amazon GC

Gyftr is back on Amex reward multiplier.

They have completely removed the SmartBuy Amazon option. There is only Flipkart available now in Ecommerce websites. This is idiotic decision by HDFC.

Its not HDFC. Amazon has decided to remove itself from multiple CCs multiplier sites.

Amex also affected by this.

Amazon was removed long time before but Amazon instant vouchers still available.

I just bought Amazon vouchers on smartbuy. Of course 2.95% fee is there.

Starting 1st Sep 2022, i do not see incremental 4X or 9X Smartbuy points (Instant voucher etc) coming on T+2 day, is it same for all? HDFC changed it back to 90 days?

Correction : Received the points after few days delay.

Only Amazon and Flipkart gift voucher points are delayed.

I am not able to purchase Amazon instant voucher from past 3 months and gyftr are not able to fix the issue. I am using DCB.. What can be done? Any one else with the same issue?

If you are getting payment gateway error then it could be the case of using same CARD in 2 diff GYFTR account to purchase amazon voucher, in some cases they block the card for future purchases of amazon vouchers. Check with GYFTR helpline.

@mukhul

I have never done that and gyftr also confirmed that by cross checking my cc . From past 20 days they are only saying they are trying to fix issue.. I really don’t know what fix.. Amazon has been pulling out of many banks, partners etc so not sure whether I that’s the issue.

Wanted to know from people who had this issue and how it got resolved.

monthly cap on Amazon vouchers has been increased from Rs 5k to Rs 10k

HDFC Bank Smartbuy 70p Offer (Product/Voucher Redemption) for Infinia & Diners black customers

1. Redeem your reward points on SmartBuy Rewards Catalogue for vouchers/products at 70 paise per Reward Point

2. This offer is applicable on all vouchers & products listed in the SmartBuy Rewards Catalogue except Tanishq & Apple for Infinia customers

3. This offer is applicable only for Infinia & Diners Black Credit Card customers

4. Offer valid from 23rd Sep’22 to 25th Sep’22.

Monthly cap on Amazon vouchers increased to Rs 10k also charges for Amazon voucher has also been reduced to 1.25% +GST.

“A customer (a combination of registered mobile number and card number) can buy a maximum of INR 10000 worth of Amazon Pay Gift Cards in a calendar month.”

“There is a Processing Fee of 1.25% + GST on Amazon Pay Gift Cards”

On diners black- The bonus points have been reduced to 3x from 5x earlier on instant vouchers

HDFC Smartbuy limit for Amazon Pay (or Shopping) Vouchers increased to 20,000 per month, per card effective June 28, 2023.

Wow, HDFC increased any benefit… Thats a rarety 😀

GYFTR increased Processing Fee to 3.25%+GST for Amazon Pay GC from August 1, 2023.

(3.25% + GST on Amazon Pay) ~3.84% (incl. GST)

(2.5% + GST on Amazon Shopping) ~2.95% (incl. GST)

With 3.85% Amazon pay basically we get only around 5% returns for diners black which is absolutely waste. The only thing I am enjoying is unlimited airport lounge for family . But just yesterday I noticed a scam at Chennai airport travel club lounge. Even though lounge had enough space they were not allowing people inside stating it’s full and we’re asking people to take away food. Since I was running out of time to board flight I did not make an issue. But its time to report to DGCA. Nearly 20 people were on queue and that’s absolutely not good. They are just wasting people’s time. Anyone else noticed this at other city?

Anyone able to buy any vouchers from smartbuy gyftr? all transactions seems to be failing from last 2 days. (24th and 25th Feb 2024) m and it seems they changed payment gateway interface also.

Now, Amazon Pay & gift voucher, Flipkart gift card all are charged either 2.5 or 3 plus GST !

3%+GST on which voucher?

3% + GST on Amazon pay voucher.

Flipkart & Amazon gift voucher costs 2.5% + GST

From April 2025, it’s now 3.5%+GST on Amazon and 2.5%+GST on Flipkart. So Infinia is reduced to 12.5% and DCB to 6% which is almost close to Millenia or Swiggy card’s or SBI Cashback’s direct 5% cashback. I think the instant discount cards which give 10% in sales and are lifetime free are starting to look better.