As you might know Personal Loan is one of the costliest loan of all with the highest Rate of interest which is as high as 17% in some cases. If you have a credit card, its better to take loan on credit card or even to take EMI’s instead of going for PL as interest rates are comparatively less on the other.

After playing smart with Credit card loans & EMI’s, HDFC recently started issuing Pre-approved Personal loans easily to most customers. They have been doing it for a while but i see its more popular now, maybe a demonetisation effect. While i never wanted to get into any kind of Personal Loan or EMI in my life, my Dad is a perfect victim.

Hdfc Personal Loan Eligibility:

My dad recently got eligible for 10 secs Pre-Approved personal loan and the same was reflecting in his net banking, he also received calls regarding the same but interestingly not from HDFC landline support numbers, but from a typical 10 digit mobile number. Is HDFC outsourcing it to third party agencies or leaking the data of PL approved customers?! I don’t know.

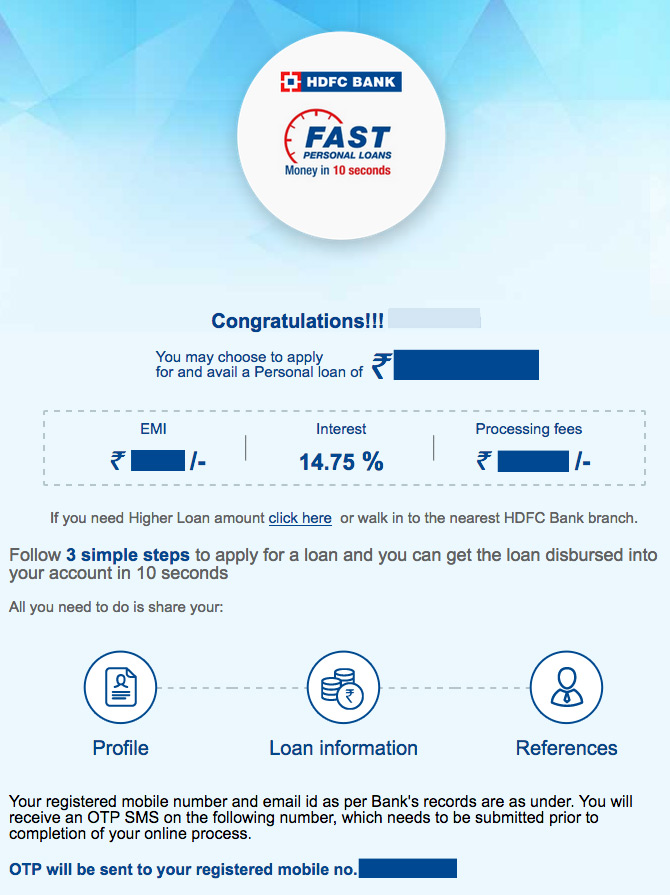

It was a nice 6 Digit loan approved @ 14.75% and my Dad decided to go with it. You might ask why PL while HDFC credit card loans are available at 11.88%. Well, he had availed EMI, insta Loan & Jumbo loan already and the credit limit is kind of maxed out, a really valued customer of HDFC as you can see, that should help in upgrading his card at-least 😉

- Secret is out: How to Enable HDFC Credit Card Loan offers

Meanwhile, i still wonder what’s the internal eligibility criteria that triggered this Pre-approved personal loan, because its neither a salary account nor an account with huge transactions or balance.

The only correlation i can make is, his Jumbo Loan on HDFC credit card is being debited from this account and also i see this formula is fitting in.

- Credit Limit + Jumbo Loan Amount = Pre-Approved Personal Loan Amount (Almost)

Applying for HDFC Pre-approved Personal Loan Online:

Its a super simple 3 step process which involves basic form Filling and OTP authentication which doesn’t take longer than 2-3 minutes and you get your funds on your linked savings account instantly, not even 10 seconds. No CIBIL hard pull, nothing.

While other banks are using traditional ways to issue personal loan, HDFC is killing it with its Digital Banking initiatives by giving its customers the ability to take loans in matter of few seconds with no BS paper filling.

It appears to be not so secured without CIBIL check, no, you’re wrong. Banks have your CIBIL report already as long as you’ve ongoing Loan/card with the bank. I wrote more about this in one of my recent articles on how My Amex Credit Card Limit was Increased by Rs.1000.

Have you ever taken a Personal Loan from any bank (or) 10 secs Pre-Approved PL with HDFC? Share your experiences below.

It is indeed great to find such loan offers as the money comes in handy in case of any personal purpose. Good to see such offers being run by HDFC. There is a reason why I love HDFC. 🙂

Now car loan is enabled for instant disbursal too. Its kind of addiction they’re putting us on using “instant” services 😀

Absolutely, but you know, people like you and me will always be happy as we value time so much. I know I have that instant access to extra cash whenever I want. This way, I don’t have to plan for getting the money months ahead and thus can narrow down all my time and research for the car/bike actually!

Well said Abhishek 🙂

Hi sid using regalia with 2.6l limit and classic status and I also have insta loan of 1.95l for 12 months and a jumbo loan of 3l for same duration and both insta loan and jumbo loans are booked by me at same date and last night I received an email from bank ready to give me a personal loan for 5.8 l at 13 percent interest rate and my question is that why they are providing me this loan offer and why they are not increasing credit limit on my card instead of giving loan my last limit increase is in Jan 16

Simple,

Personal loan comes with high interest rate and that makes more money for them 😀

Sid,

The thing I don’t get is – when PL is applied the banks would do a hard pull of CIBIL and then process. But HDFC says pre – approved PL which gets credited instantly that means there is no particular hard pull enquiry on CIBIL when customer opts for it? If that is the case, then PL applied in this way is secured loan, I mean the CIBIL score will NOT get effected for applying PL.

That’s just one difference. “secured” means bank can recover from the security of Fd or whatsoever, that’s a whole different thing.

Though, yes we can relate it something like this 🙂

Thanks Sid, so to know the eligibility for this, the “offers” tab on net banking is only place to check?

Absolutely.

it’s good to get a personal loan in this easy way.

How they recover the loan if someone will not able able to repay due to any unforeseen reasons like lost job, medical emergency, any kind of situation can come across?

Actually, this whole “pre-approved” thing is coming from the relationship value. It also comes from the credit card usage. Spending and paying back pattern. The more trustworthy and high net worth customer you are, the more of these lucrative offers you’ll see in your internet banking!!! 🙂

Ah same here. They have a instant jumbo loan approved for 5l, they just want to sell you as much as possible.

They haven’t increased the limit or upgraded my regalia card from Dec 15 🙁 .

I have availed jumbo loan, insta loan 3 times before. Note that taking Jumbo Loans will have a new credit account created in your CIBIL and reported every month though they do not pull a hard inquiry when you apply for the jumbo loan. I would suggest people to go for Jumbo Loan instead of Insta Loan as Insta Loan will block your credit limit on your credit card.

HDFC offers 0% processing fee few times for Jumbo Loans so keep a track on the Jumbo Loan page in your HDFC netbanking.

Try to submit the IT docs for Limit Enhancement 🙂

Thanks Sid. On a lighter note I wish I could have done that but if i submit my income documents they might decrease my current limit.

Ah, i get it then.

Hi Jay it looks like we have same story. My last annual income was Rs 3.2 lakhs. My credit card came with a limit of 1.5 lakhs on September 2015. They have not increased the limit even once. What to do ?

Could you please share your story of HDFC credit cards like when, how much limit, which cards HDFC gave to you and when and how much limit was increased ?

Hi Captain,

My HDFC Card limit was increased first time for 6 months and then it was on the yearly basis. They upgraded my card every time however they have stopped upgrading my card once i reached the regalia tier. I started from their Platinum Plus Card.

Before it was customer care who used to inform you about the limit enhancement and upgrade however now they have it on their netbanking portal itself.

Why do you require the increased limit? If it is something very important and that you want to make a big purchase then try writing about it to them. Also, don’t be afraid to send your ITR/Salary slip. They don’t decrease your already increased limit seeing your salary slip. Had that been the case then 99% people who have high credit limits would have their limits downgraded. They downgrade your limit only when you appear as a “risky” customer to them. Till the time you manage your spends nicely and pay on time, they value your business.

Hi sid my question is that why hdfc bank is not giving me online limit increase offer on my regalia card since Jan 16 my payment history is very good with bank and my current limit is 2.6 l

It depends on lots of factors like CIBIL, other loans etc. But you can request for enhancement with your latest ITR/Salary slip

hi jay. my story is similar to yours. platinum=> regalia. so for how long are you stuck at regalia.

also what is limit they offered you at that level (if you could give idea of what to expect).

@ all,

also did hdfc increase status of your hdfc saving a/c (if you had) basis your cr. card relationship?

@ siddharth,

do you think hdfc will come out with another layer between regalia and infinia?

many thanks

Am expecting it, lets see 🙂

No. HDFC never increases your savings bank account relationship based on your credit card relationship. Infact, the opposite may be true at times. If you are a high net worth individual and have poured in lots of cash into the savings account and have multiple investments with them, they might upgrade your credit cards accordingly.

I too think there is a high probability that there will be another Super Premium Card that will be introduced between Regalia and Infinia and in all probabilities, Regalia will become just a “Premium” Card.

I am stuck with regalia card from last 3 years and it will expire this year in April. I hope they will upgrade my card before that if not they will send another regalia card with 3 more years validity. I have a limit of 6l currently. They doubled the limit every time but now stuck at the same limit from a year. They used to increase every december for me.

Hi jay can you share your credit card journey from begaining for my help

Sure Amit, what do you want exactly ?

Jay thanks I want to know how you reach to 6l limit level and in how much time

@Amit,

It took 8 years 🙂 Started from 75k limit with Platinum Plus Card.

Just keep spending, every year HDFC will double your limit upto some point.

@Amit

Finally today got the limit enhanced to 7.8l from 6l. Even for my friend he got the limit increase option today. Please check in your netbanking once.

Hi jay my limit also increase by 30%

Congrats Jay.

1. Why don’t you try for Infinia or at least Diners Black.

2. Your limit was increased automatically or you use to send your IT documents to Chennai.

3. What other relationship you have with HDFC ( Imperia, Preferred, loans. etc. ) ?

Thanks Captain.

1. I got my card upgraded to Diners Black last week.

2. Yes, I got a mailer about the offer and it was also displayed on my netbanking.

3. Mine is Rural Savings Bank Account, QAB is just Rs. 2500. I do hold a Car Loan from last 4 years.

I guess saving account gets upgraded to preferred because of credit card relationship (dont know if there could be any other reason). Also i guess if we take, and repay on time, (and of course usage of card and repayments both matter), loan/s on cr. card, then the limit/card type/availability of loans on cr. card get enhanced. my friend has more than a couple of closed and couple of running loans on cr. card, still having limit of 7.5l, jumbo loan of 5l more available, total exposure available upwords of 15l, 2 yrs since getting upgraded to regalia…and got saving a/c upgraded to preferred too with dedicated 24*7 RM…..Any views will be greatly helpful here….

Am a regular user of credit card.initially cash back card was given with 75k limit in oct 2k15.now same card with limit 1.25l

Tried to upgrade my card but failed.

Wanna upgrade to Regalia.any suggestion?

First upgrade to Regalia first or allmiles and then go from there.

I got offer of loan 10 sec loan from hdfc as I have jetprivilage workd word Cc ..but was asking of document submit in near branch but I didn’t take then after 1-2 month late I get again same offer without any document submition..now already 12+ month over. Now I m doing business that time I was preferred cust n it was salary acc already instance jumbo I took on last diwali

If I close my pl (10sec ) loan which approved online only then I get same offer in future as that time my Cc limit was 1.60( got 2.10 lac 10 sec loan) only now 2.70 so I get better option in future like near to diwali planning for my business …hope of 3+ I could get .. So should I close this loan plz suggest

Hey Sid today I got one of these offers too. A mind boggling 7 digit number with an equally humongous emi of above 41k plus at 15.1% rate. I will admit I was tempted but rationality came back to me. Wonder what triggered all this. Why could they not increase my CC limit instead is beyond me. I went to the home branch and tried all that you told me to do but the only way it was going to happen was if I shared my salary and IT returns and alas I am at a disadvantage there because I am now self employed.

I’ve a similar case with one of the a/c i manage – 7 digit loan in 10 secs.

It seems they’ll give you loan as much as possible so your EMI is almost equal to your monthly salary credit on HDFC a/c.

CC limit works quite differently.

Hey Sid, Hows you doin? Just wanted to tell you that they have finally increased my credit limit on the card to 5lakh odd. The Insta Loan bit was the clincher I guess. Your inputs have helped a lot. Thanks a million :-). Hope I get a good deal on the card upgrade itself as it expires in August this year.

How old A/C holders are eligible for pre-approved loan offers and credit card offers, coz I have a hdfc regular saving account since last 3 months and I am maintaining 1 lac plus balance regularly, even then I didn’t received any pre-approved offer.

can anyone suggest best or lowest cost balance transfer card option ?

thanks in advance.

Kotak is a good option, HSBC is also offering good BT option.

You can explore these 2 cards for BT.

Hope this helps

Cheers,

Kiran

Hi Sid,

I too got the pre approved loan offer but I don’t need it now. Any idea is it a limited time offer and will it be available after a few months too?.

Hi

I’m reading this for the first time and it was so useful!

If i maintained 2 lacs and kept transfering 50k-1 lac twice a month apart from the balance of 2 lacs for 3-6 months, will this increase my chances of getting instant personal loan? The only problem is that this account was opened as salary acc for a company i worked for and my pay was 11k per month, Will this affect my chances of getting a instant personal loan?

hey i want help . as i availed insta jumbo loan in july but it disappears in very next month but know iam inable to see any insta jumbo loa offer . after how much time the loan offer will get repeated . i need it and how to avail the jumbonloan once again please anyone can explain .

Hi,

Jumbo Loans are pre qualified offer based on certain analytics. You have to wait till you get the offer again.

Once the order pops up you can avail it online itself without submitting any documents.

Hope this info helps.

Cheers,

Kiran

Hi Amandeep,

I availed the jumbo loan of Rs.75,000/- in july,2017( Duration of 3 years, ROI.10.5%). After that I got one more offer of Rs.9,25,000/- in Oct,2017. (Duration of 3 years, ROI.13%, processing fee Rs.500/-). Now I see one more offer of Rs.5,10,000/- ROI.15% for 48/69 months with the processing fee of Rs.799/-) . I think the offer triggers based on the usage of the credit card, limit and the transactions of your account. I’m a classic Account holder.

I got this loan in 10 second no document submitted may be because I hold account in HDFC. Got it 3lack for 3 years at 15% interest rate. So getting in urgent is good but with such high interest dont do it until you are desperate.

Advice : borrow only id need most and specially if you are capable of pay back.

I am a hdfc customer for last four months. I had a lot of transaction. I didnot received any pre approved offer.