Rupay has been giving a lot of false promises lately on launching its new credit card. It was supposed to get launched by 2016 year end and then delayed by few months and again delayed and now finally its up in the shelves. Here are few things that you need to know about the newly launched Rupay credit cards.

Rupay Credit Card Launch

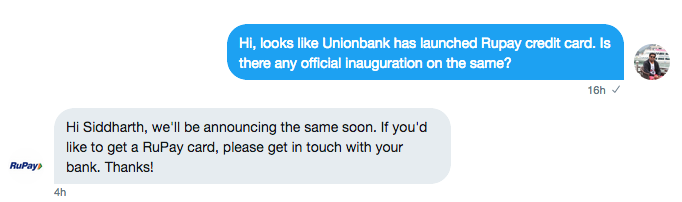

Some banks have published their Rupay credit cards on their websites, however it doesn’t seem to be officially launched yet by Rupay/NPCI. When i asked, here’s what Ruapy said on Twitter. Maybe when the actual press release goes live, they might want all banks pages to be live as well.

#1 Union Bank Launches the first Rupay credit card

Union Bank is the first ever bank to launch Rupay Credit cards to the masses (as they say). Looks like they have 2 variants for now and the Features are very simple and of course not really transparent in most aspects.

The major benefit: International airport lounge access across 300+ cities across the globe.

Now i’m not sure how they actually go with this. They might use Diners machines to authenticate you as Diners-Rupay is in reciprocal partnership for international usage. However, i’ve never heard even a single reader here who had successfully utilized international Lounge benefit on HDFC Rupay Debit Card. Do let me know if you have?!

- Here’s the updated lounge list of Rupay Network: Download here

The other nice benefit you can see is, the top 25 spenders in a month will be given travel vouchers worth 10k each. Nice touch, but it always feels like a lot*ery system as this is not a guaranteed one. I hate such promos, recently ICICI ferrari cards were playing with the same “top spender” game and no one knows who really wins. Wish the bank comes up with a number, be it 5L or 10L, so customers can be sure of what they will get.

#2 There are 2 Major Variants of Rupay Credit Cards

There seems to be two popular variants with Rupay, namely,

- Platinum (Premium – Like Visa Signature)

- Select (Super Premium – Like Visa Infinite)

As the name says, Select variant is the top end that seems to come with 4 International Lounge access per year and also 2 domestic lounge access per quarter.

As top official said, irrespective of what bank issues a Rupay Credit Card, the major benefits remain same across the banks based on the variant. This is pretty interesting, its more like Visa controlling the entire benefits of Platinum/Signature/Infinite issued by any bank.

It means, Rupay has the full control to change its features at will anytime. However, i noticed that the reward points program linked to these Rupay credit cards are different. Maybe features like lounge access/insurance coverage are controled by Rupay/NPCI

#3 Rupay favours Public Sectors Banks

It looks like only Public Sector banks have tied up with Rupay for now to issue credit cards. Sadly public sector banks are not something we card connoisseurs would like to deal with. SBI/HDFC may tie up with them sooner or later and then it maybe a game changer. I already see that HDFC Rupay Credit Card wire-frame design, so i hope it’ll be live soon. Here are some cards, the Andhra/IDBI cards looks good.

Whatsoever, finally we have the new entrant in Credit Card game. So good news is competition is again heating up and now we can expect MasterCard/Visa to come up with Jaw dropping offers to retain its place in Indian Market. Oh yes, this should be over and above the features given by Banks 🙂

Regarding the acceptance, you can expect 80% offline and online acceptance will increase gradually over a period of time. Might take couple of months to an Year to hit 50% online acceptance as payment gateway integration’s takes some time, lets see. While Rupay Credit cards might not shake the premium segment users much (at least for now) it will enable Public Sector banking customers to opt for Rupay Credit card which has better features than the bank’s proprietary cards.

Aftermath of Rupay Credit Card Launch:

If Rupay deals with Credit cards the same way they do with Debit cards, then this means a LOT of Indians, almost everyone will be holding a credit card in near future, thus shooting the numbers crazy. This is what they did with debit cards as they now have 375 Million Rupay Cards live with 43% market share in the Indian card networks as of June 2017.

Most of this came from Jan Dhan Yojana accounts, ofocurse of low profiles but the numbers and the growth % are staggering. If Rupay upgrades their standards/systems bit more, no wonder that Rupay will rule Indian market like never before.

Tip: Its good to hold one Rupay Select credit card as it might serve as backup for lounge access or to avail some timely offers. Hence don’t ignore 😀

What do you think about the Rupay Credit card and its benefits? Feel free to share your thoughts in comments below.

According to you which Psu bank card is best (easily approved, less bureaucracy)

Never explored the space, but yes reviews coming soon for sure 🙂

The first bank for issuing Rupay card was Pmc Bank in July 2017 as i am the holder of the card as well as i am the employee for the same..The second bank to launch after a month was Saraswat Bank..so union Bank of india isn’t the first bank to serve the rupay credit card services..

Regards

Hemil Gaitonde

If ease of approval and requirements is a concern — Canara and BOB are easiest. IDBI and PNB are better but approvals are no different than private players we are used to.

Also note that hardly any PSU will give a card to a non-account holder. So really, the easiest PSU to get a card from is the one you have the strongest banking relationship with.

I am having SBI VISA credit card I have asked SBI to change my card from VISA to RUPAY but thy say they only issue VISA & MASTERCARD can action be taken on this bank

Is Rupay Indian ?

Yes, by NPCI / National Payments Corporation of India

Rupay can’t count same success as debit since credit card customer are more informed than debit card until it provides nice benefits.

One more important point most rupay cards issued are without customer concern, BTW I have been issued HDFC rupay card and if I have to swap for other card I have to pay replacement charges.

Cheers,

Anand.

IDBI rupay credit is best till now for sure, as the features are good and have applied for one.

Do we need to be an IDBI Bank existing customer to apply for the credit card..??

Yes.I applied and got rejected as I am not an IDBI account holder

But psu bank issues credit card to their customers not to others.

Yes, that’s true, most of them quite literally

Axis bank kochi metro card is under rupay platform

Hi Siddharth, could you please review what you think is the best credit card from Kotak?

Thanks!

Sadly none of them. Will anyways review to let ppl know that 😉

My wife holds HDFC Rupay Platinum Debit Card.

Tried to access Plaza Premium Lounge at Changi Airport with this rupay card, it didn’t work. Their machine said, Access Denied 610. Bank card is not a valid membership card. It was a bitter disappoinment.

Tried complaining to Rupay via facebook, no response to my complaint.

In your wonderful article you mentioned that Diners have are acceptable on Rupay machines. Now that IDBI has launhed Rupay, does that mean IDBI machines will also accept Diners Card ?

Yes, it should be technically. Though they may take sometime to get this into action.

Hi siddharth

Rupay Indian bank platinum debit card allows lounge access?

Any idea

All rupay platinum debit cards will work. Not platinum credit card

I am very satisfied with the IDBI rupay winnings credit card after five months of usage. Had used over rs ninety thousand to wave of the annual charges of rs 900/-+gst.plus every month receiving cashback of rs.200/-, 100 on wallet transfer, 50 on utility bills payments and 50 on dining. Also accessed lounge on the add on credit card as well, full paisa vasool.

Cool, thanks for the first review on Rupay Credit card 🙂

Explored more benefits-

Getting BOGO on BookMyShow differently with both primary and add on card.

Wallet transfer cashback also received both for primary and add on card as well.

Also receiving 500 bonus points every month for any 5 transaction of rs1000/- each(somewhat like amex)

Also unlike SBI, I did not get charged for reward points redemption.

In totality, after one year of usage will get benefits of more than rs10000/- after paying fees of 899+gst.

Have been using the PMC bank Rupay select credit card for the past 4 months . Its free of charge and PMC is the first co-op bank in INDIA to issue a Rupay credit card . Even tough the card is free , the branch asked me to take shares worth 0.5% of the credit limit as some bank internal policy .

The card is having only 1% interest rate and I use it only to avail cashback of 50 INR + 50 INR on Utility bill payments and Restaurant usage . It has national and international lounge access VIA Diners but my swipe was declined at KLIA Malaysia whereas my Diners Premium allowed me access to the lounge .

Sid,. All well? R u fine? My comments r in moderation from last 3 days??? Have my comments unrelated, unrealistic to the topic or is their anything nuisance?

It hasn’t been before like this, really disappointing, ridiculous, what’s happening?????

Comments written after me have been approved so I just can’t get the reason or the logic behind this.

Have u become too sensitive, r u censoring 2 much, u r too busy to be answerable or I should stop commenting, what’s the reason????

Really appreciate if you would a little more professional as before.

Guys!

I was out of town for past 1 week. I approve some latest ones on the go usually. Just approved about ~100 comments live today, including yours 🙂

P.S. Appreciate your patience in future, sometimes it takes a week when im not at desk.

Can someone please update about rewards program on various Rupay credit cards?

I have become proud user of Rupay Credit card , being Indian trying to use Indian card and be a responsible citizen. I urge one and all to forsake Visa, Master card etc and use the India established systems for the benefits of our Country.

Is it possible to apply Rupay credit card on basis of another card have HDFC credit card

I requested icici to provide a rupaye card last year but I was handed over a MasterCard and an American Express Card. This year they charged @ 3500/- per annum, which I had to decline and raised my request again for a Rupay Credit Card. Why are more Indian Banks not adopting Rupay Credit Cards? I fail to understand.

I really doubt whether ICICI really got a partnership with Rupay/NPCI for a credit card. never seen any Rupay credit card mentioned on their website.

Why more Indian banks are not adopting Rupay card? That is an interesting question.

I understand that the agreement with Visa/ Master is such that Indian Banks cannot easily go back, There are heavy penal clauses. Again the acceptance of Rupay card abroad (although they got tie-up with Diners) might be another thing which is stopping Indian Banks from migrating to Rupay card portfolio. On the technical side, it may involve foregoing the huge investments already made in systems and procedures for Visa/master, Plus the new investment to be made for migrating to Rupay cards

Banks make no cut in the interchange fee on a Rupay card. That’s a significant blow to revenues of banks. Banks that are offering them are either baks that plan to make no money from their card products at all, or are using them to onboard the next wave of new banking customers to eventually paddle them on to either other cards or their own wallets like Payzapp.

It’s also a colossal waste of money for the taxpayer. If you were to use NPCI based payment, with taxpayer taking the burden of payment instead of the merchant, and there is no transaction charges to neither payer not payee, I would rather stick to UPI as it is cheapest for a taxpayer. But wasting it mimicking a regular credit card is absolutely stupid. Why would a person who does not use card take the burden supporting the infrastructure to support it? Unless NPCI starts charging merchants the regular way and stop burning people’s money in creating their “free” alternative, I’d be against it. It is an inverted distribution of interests.

It is also a consortium of big banks trying to mimic themselves as India’s national platform. It is not. It is owned by 10 largest banks and promoted by RBI. Imagine how hard will that make for new banks to exist, and new payment tools like Paytm to happen. That’s another problem, as RBI is promoting it, it is a conflict of interest. They will make biased laws which will benefit their own organisation. We have seen this before when they were forced to give up ownership in SBI for the very same reason. RBI’s vested interest should be country’s health, not profit differential with Visa and MC.

In the long run, it will do more harm than good to both country and banks. I think banks realise this.

that is really an eye opener…

good perspective. never knew this

I dont see it that way. It is first a way to challenge the duopoly. Had china thought the same today CUP would not be existential {China Union Pay}. And When CUP came in, within few years CUP was the chosen card in whole of China, Hongkong, Macau and Taiwan automatically because of freeness of clauses from VISA and Mastercard. CUP went on to be recognized in Israel and eventually, i was able to see it in Woodbury Common Outlet, in upstate new york, last year….Its a beginning. When a banking card swipe is done with VISA or Mastercard, the txn is charged at 3rs for a batch run, every night. And that too out of the country. The reconciliation of the TXN happens in the servers of US. Compare that to the security and privacy of the same Txn batched on the same night in India in Delhi or Bombay. Secondly, NPCI charges the merchant only 0.40 INR thats less than a rupee against the 3rs that VISA/Mastercard charges. And the revenue is also back to indian economy. So i dont understand why we can artifically promote it…security and economy and cheaper alternatives….

Agree. I have the same views.

Hi, there was an ad of Ru Pay in the paper today (4th March – TOI) which mentioned saying “Get 5% cashback at ATMs & 10% cashback at merchant outlets when travelling abroad” (and then it also had Discover and Diner’s club international card pic there). Just wanted to know if anyone has actually benefited from this offer. And if yes, what are the T&C. I could find much on this in their site.

Currently, Rupay is offering 20 percent discount on loading minimum INR129 in Amazon Pay upto a max discount of INR 100 i.e. INR 100 discount for loading INR 500. The offer can be availed once a month only on any Friday of the month on RuPay Platinum debit Card only. Offer is per card and user can load using multiple cards as well.

I have a long banking relationship with Federal Bank and among the credit cards they are offering, they have a Rupay variant as well. The bank is offering me a card against FD free, both the Visa and Rupay options. Is it worth to go for the Rupay credit card option?

Hi Siddharth,

I read in couple of places RuPay credit card can be added to Gpay and make QR code scan payments as usual. Is this working already? If yes, are there any limitations or charges?

I was excited to get one rupay credit card from any of the three bank idbi, pnb or union as only these bank were allowed for UPI linkage of rupay credit card.. i went for pnb select as reward rate was good and easiest annual fee waiver condition. And in October 2022 only pnb was allowing online application. Applied online on 21st of October.. application was approved on 15th of November… Till that i didn’t have any pnb account (had applied for that too and took longer than a month). After approval i was able to generate virtual card and did some online transaction. But physical card was dispatched very late on 6th of December and that’s the way pnb is sending credit or debit card. No reward point credited yet. Customer care executive said that after first transaction using physical card reward points will be credited. Nothing mentioned on information brochure about rewards or any benefits except accidental insurance and charges. Ok one last thing about rupay credit card UPI linkage… UPI payment through card will work only on such merchant qr codes where current or cc account is linked.. so if any one is thinking like me that it will enable to buy groceries and sabji bhaji from local shops it will not work in 99% cases 🤣🤣