Many of us who love Credit Cards cannot deny the fact that IndusInd Exclusive Signature Debit Card which comes with IndusInd Exclusive Savings Account is one gem of a card when it comes to Foreign transactions. However, recently there have been some major changes in the Exclusive banking portfolio which has made it evident to review the same in the light of the changes and thus reconsider if it actually now suits the purpose of not.

Changes in Exclusive Banking Porfolio – Negative Changes

- Introducing IndusMoments: Another major blow for people using this Signature Card or other Debit cards from IndusInd Bank is that, earlier the points could be redeemed against cash credit to statement or Jet Miles. Now the entire option have been ditched for something know as IndusMoments. This is again a major devaluation as the points are to be redeemed against vouchers. Say for example a ClearTrip or Westside voucher worth ₹1000 will now cost 2082 points. This way the valuation of points is even less than 50 paise.

- AQB Increased: Initially the AMB/AQB was 1 Lakh for Single operated accounts, now a new option can be seen. They have now kept the criteria of AMB as 1Lakh/2Lakh based on the location of the branch. So kindly contact the branch or customer care to know if you now have to keep 2Lakh as AMB/AQB or not.

- Small Charges are not good: The IndusInd Exclusive Signature Debit Card can now accrue points only against ₹200 spent. Earlier it used to be spends against ₹100. This makes the reward points reduced to half. This is a major devaluation of Reward Points.

- Redemption Limits: One more blow is that there is a cap as to how many points can be redeemed in a single month. The maximum points that can be redeemed in a single calendar month is 5000 only. This is another bad news as you cannot even accrue points for a bigger purchase.

Exclusive Account Eligibility – Positive Changes

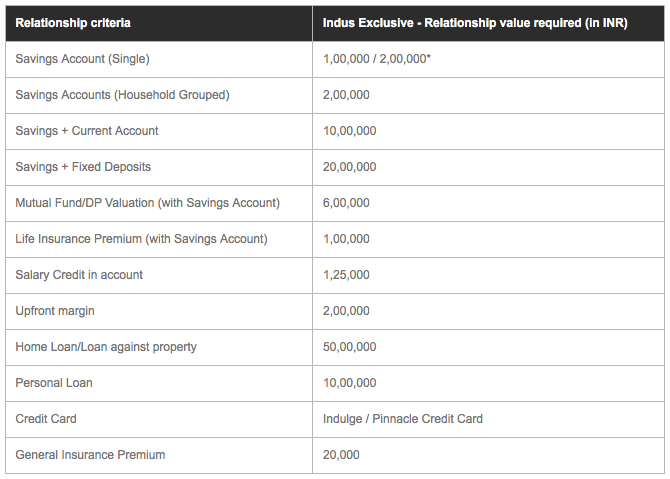

Recently, a new eligibility criteria for relationship value has been added for Exclusive and Select Accounts.

Now, if you hold Indulge/Pinnacle Credit Card, you can still keep an no-frills Exclusive account. In this case, you are exempted from maintaining any AMB/AQB. It actually becomes a zero balance account for all your family members too. There are also other eligibility criteria as below,

Similarly for Select Savings Bank Account too, Credit Cards like Signature/Legend/Odyssey JP Card can qualify you for a zero balance Select Account. This is really good for a HNW individual and for those people who already have these cards as you already qualify for a premium banking service. I’m sure many can make use of this facility.

I cannot think of any more positive developments apart from what I have already mentioned. The benefits might not be much now in comparison to what it used to be earlier. However, I’ll still advise against ditching the Exclusive Savings Account.

At least people who travel to lot of foreign destinations should still keep this Exclusive Account and Exclusive Signature Debit Card.

The simple reason is that the mark up fee is still zero (with some meagre tips surcharge, though I really don’t know what it is) on Indusind exclusive signature debit card. The second big benefit is that this card allows you unlimited free ATM withdrawal in any part of the world without incurring any extra costs. This can be a real savior for a lot of us.

UPDATE: IndusInd has reintroduce Cash credit. Now each point is valued at ₹0.35.

What do you think about the changes that IndusInd Bank has brought in? Do you intend to keep your account and debit card? Do you intend to upgrade your existing account to Exclusive/Select Savings Account based on your existing credit Cards? Do let us know in the comment section below.

I don’t know much about IndusInd, but I have an Iconia and they opened a current account (Indus Blue, I think) basically because nobody at the branch knew how to go about a card application for non-customer. Does Iconia qualify me for a Select thing too?

Well, you don’t need an account (Savings/Current) to get a credit card from IndusInd Bank. My brother too din;t have an account but still got the card. So don’t worry. Till you are okay with paying the joining fees for their cards, they don’t create much fuss about approving the card.

For your second question, NO Iconia does not allow you to hold the Select Account. As you can see only, Signature, Legend and JP Odyssey is eligible.

Please share the link where this is mentioned.

The customer care is unaware of this..

It’s all present on their website and terms and condition, charges documents.

You qualify for the Maxima Account if you have Iconia card. You can also choose your own account number.

That’s great.. But is zero balance account offered or a chargeable account.

They are offering zero balance accounts however only condition is that you will have to start a RD or have an ACH Mandate or any SIP along with opening the account.

Is it? Then that’s a good news.

The customer care denied having any such offer..

The Branch said, the offer is not for all but there is a selected list of people pre qualified for this offer.

Further, there is no offer For Indusind Iconia…

Hi

Are earning rewards point per 200 the same as was for 100 earlier???

Is the earning maximun rewards points per month the same???

Is there still zero makup on forex for the exclusive debit card???

Please update regarding the same.

Yes the basic reward structure is the same. The only difference is you earn points per ₹200 instead of per ₹100. Maximum reward points that you can accrue in a month through VISA Signature Card is 3000 points. Zero mark up fees is still there for Exclusive Signature Debit Card.

Hi Abhishek Roy,

now as per 6x structure, you have to spend 80k to get 2000 reward points. and each reward point is 0.35 paisa. Before it was 46k spend and get 2000 reward points, and each points is 0.50 paisa.

so now giving return as 0.88% as compared to before it was 2.6%.

Drastic devaluation in the history.

In my opinion close the account as soon as possible.

Yeah, Let’s see how it goes. As of now I’m keeping the account but don’t know for how long.

My bank statement also carried a news that the value per point is getting revised from 1 Oct onwards. Here are the wordings

“Effective 1st October 2017, the IndusRewards accrual structure & point to rupee conversion rates will change and the revised point to rupee conversion will be applicable for all IndusReward

points accrued on or before 30th September 2017.”

Seeing the trend, it can be guessed that the points will be devalued from Rs. 0.50

We will have to wait and see.

The prediction came true. All goods and gift cards of Rs. 1000 denomination are now available for 2974 points, which were available against 2032 points until 30 Sep.

And I was about to get Exclusive account with one of their credit cards being offered (Pinnacle). Now thinking if I should open relationship with Indusind with Exclusive & Pinnacle… Any views?

Hope they don’t mess with the Iconia credit cards.

They already did, with Fuel surcharge thing.

For Iconia visa only.. Amex one is left untouched.. I think..

Amex on HPCL maybe untouched, but with rest, i doubt.

ICONIA AMEX remains untouched as per website. But their VISA variant is affected.

Viewpoint:

If one wants best forex with zero markup one may opt for the Master Card World Exclusive debit card variant which gives better lounge options and better forex rate than the visa variant…

Deos indusind still issue this? Or only visa???

Mastercard is still being issued.

Newer options like VISA and MasterCard Contactless cards are also on offer I guess.

Last month in NCR, IndusInd Bank allow me open exclusive savings account with Master Word exclusive debit card (not free one) only after reaching credit limit of Rs 100K+ with Iconic AMEX credit card. Swap the great Iconia AMEX with Indusind Pinnacle Credit Card Review (Mastercard) @ 50K (offered)

Credit limit 100K+ is an eligibility criteria if u hold their premium CC.

I have share such program under ” Indusind Pinnacle Credit Card Review (Mastercard)” to Mr. Sid on 03 Sept17 hoping he do more inside story write up.

(Change of mind came after knowing that card is still not accepted at amazon.in & some fraud transactions of approx. USD 9 happen to me stating merchant named: COLORADO VALLEY CELLTELILA GRANGE789)

I’ll really like to know if this is even possible. 100K limit is not much. It’s just 1Lakh. This seems interesting to me. Do let me know any proof or resources if available.

Talk to IndusInd Sr. customer care executive.

We are working in PSU, most of colleague have CC limit 6lac + in other cards like HDFC CC, Citi CC however limit offers was 60K to 75K for aura, platinum, signature card (all LTF Card)

Ok. First let’s see if I get the card or not and if yes then how much limit am I offered.

But even after these devaluations, Indusind Visa signature debit card is still the best debit card in the market. No other bank has 5x program on debit cards

Well, there is no point in accumulating points if you can’t redeem them as per your convenience. However the card does hold value still.

i am an NRI . when i went to Indus Ind branch in trivandrum today to see if i could open an NRE account with the zero markup fee card , i was informed by the branch that this card is only for resident indians . 🙁

Joel, Which branch you approached ? There is a worst branch in Trivandrum which can make your life miserable.

Seems the cash redemption option is back. Though the site doesn’t mention how much is each point worth, like they used to earlier.

Yes, I’ll update the option accordingly. I too redeemed my points today. Will update once I know that value of each point.

Can I open ZERO AMB indus exclusive current account along with Indus exclusive savings account with zero AMB if I hold pinnacle relationship

It’s 35 paisa per point. It’s on their website under features of debit card.

With max 6 points per Rs. 200, this reduces the realisation to 1.05%, that too for transactions above Rs. 40000 on the amount which is Rs. 40001 onwards. Not worthy for any debit card transaction, except maybe foreign currency transaction.

Yeah came to know yesterday. Will update the article soon.

However, JPmiles conversion ratio is 1 JPMile = 2 Reward/Loyalty points. So, spending 40,000 rs. per month on your debit card will fetch 1200 reward points ie. 600 JPmiles. Applicable only on Platinum & above debit cards. Not applicable on Regular, Gold & Titanium debut cards. JPMiles conversion option not showing on netbanking. However, can be done via phonebanking.

Hi,

A query here… if one opens their Exclusive account with Initial Cheque payment, do they offer any good credit cards?

Anyone having experience of getting good credit card post opening the bank account?

Please find the correct branch or else your life will be miserable.

please go through this to aware about the worst part of customer service.

Hmm, Stupid people.

Address verification done on 2/3 days, check cleared. I also asked BM about account status, he redirects me to RM. RM was useless.

In my case, 15 days have been passed after the application of the account opening.

On the 15th day, I visited the branch to directly task BM. RM was in the BM office, he asks me to come with him, I ignored it.

My brother was with me and he was thinking something bad gonna happen! (He told me after he understands that!)

Me: What’s happening with my account?

BM: In progress, RM will update me.

Me: I am asking you, Why you redirecting to HIM!

BM: RM is responsible for this.

Me: You are responsible for him. I don’t have time to do this. Now tell me how long I have to wait for more? 2 weeks, not enough?

BM: Ah … mm. Give me the next 2 days(Till Saturday).

Me: I am giving you will Monday, do it whatever it takes or I will go farther.

BM didn’t tell a word after that and the full branch staff was like wow!

The next day account got activated and RM called.

Before that day RM called me by name & after that day he started calling Sir!

IndusInd is the bank that took that many days to activate an account for me. Others 5 days max even ICICI wealth activated my account on the same day.