All of us are searching hard to find the best credit card with higher reward rate through points or as direct cash back. But we’re missing out some unbelievable offers that are available even on debit cards. Once such card is axis bank’s priority debit card that can easily save you 10% of your spends made online. Let’s dive into the details.

Cashback Offer details on Axis Bank Priority Debit Card:

Priority Customers spending Rs. 20,000 or more, online, in a quarter on their Priority Debit Card (only online spends) will get to choose from one of the below mentioned rewards, every quarter:

- 10% Cash back capped at Rs 2500 / quarter (or)

- Option to convert above cash back to equivalent eDGE loyalty points

“Quarter” is defined as below:

- “1st January to 31st March”

- “1st April to 30th June”

- “1st July to 30th September”

- “1st October to 31st December”

So basically you need to spend Rs.25,000 online in a span of 3 months to avail a maximum cashback of Rs. 2500, considering 4 quarters in a year, that’s about Rs.10,000 in savings just for using a DEBIT card.

It’s a perfect fit for most of the families who spend about 1Lakh on the card, on quick research I just realized most of my friends are fitting in to this category and they can save 10k very easily. But the downside is the minimum balance that you need to maintain to avail this card.

Redemption:

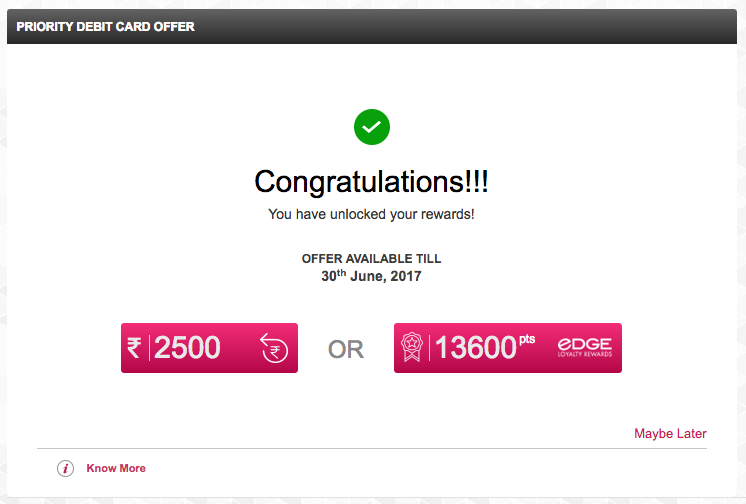

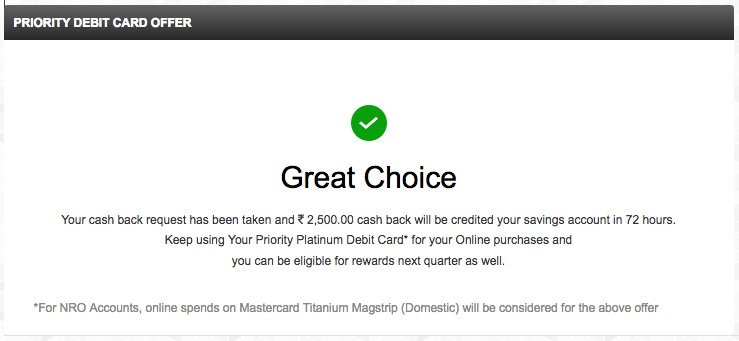

Once you’ve done the purchase, wait for a week or two and then you can claim the offer by clicking the offer page which pops up at the bottom of the screen once you login to the net banking a/c. Its a 2 click process and you get the funds on your linked savings a/c instantly as below.

How to get Axis Bank Priority debit card:

- Open priority savings ac with 2 Lakh balance

- You need to maintain AQB of 2 Lakh to keep this card free.

- If you’re upgrading your ac from regular savings ac to priority, ask them to issue priority debit card post account upgrade.

My account upgrade was a big headache and as it fell under the demonetization days, it went worse. It took them about 2 months to upgrade my ac, but if your planetary positions are good, you may get it done in a week or two. It’s relatively easy to open a new priority ac on other hand.

So from the array of debit cards, this is the BEST DEBIT CARD you can ever have in the cashback perspective and next comes the HDFC debit card that gives you 1% cash back on both online/offline spends upto Rs.750 a month.

- Cardexpert Rating: 5/5 [yasr_overall_rating]

Do you use this axis bank priority debit card? Share your views in comments below.

4 days ago I opened a priority account with Axis Bank. Thanks a lot for this amazing information. As always bank representative has not informed me about this offer.

I want Axis credit card so i have opened this account.

Should I apply for credit card immediately or should I wait for 6 months ?

My annual income is Rs. 3.27 lakhs any my CIBIL is 783.

Do some txns for them to enable the CC offer automatically. If its new a/c, yes you need to wait for 6 months to get the card based on txn.

You can also get based on ITR.

Well Sid, there is one more cashback debit card in your kitty. The IndusInd signature one. You earn Rs. 1500 on spending Rs. 62,500; which is equivalent to 2.4%. You can get this every month (18k benefit annually)

The condition is that 62,500 or more needs to be spent in one single transaction as they have tiered reward structure.

And now the best part – you don’t even need to do this spending to earn Rs. 1500 every month. Just pay your any credit card bill using Indus net banking, and choose to pay using your debit card instead of bank account on Indus banking page. Done!

IndusInd bank will treat payment as spends on its debit card and will offer you reward points.

Yes, i’m availing this every month for about an year.

But never know it can be used for credit card bill pay. Anyways i don’t have Indusind CC. Will look into this though.

Thanks for the info 🙂

You don’t need IndusInd cc necessarily. Any cc bill (hdfc / stanC/ kotak etc) paid using indusnet, will do good. BillDesk facilitates this. Once you are asked to login to Indus net banking, make sure you pay using the debit card instead of bank account.

That’s pretty much awesome trick then!

Will be useful for many. Will make a separate article on that sometime 🙂

I don’t know if it will work. IndusInd specifically mentions that such transactions by debit card under the netbanking section won’t qualify for IndusMoney Points. Can anyone confirm this?

This does not work on indusind debit card. Although the bill pay banner says it will be treated as a debit card spend, sadly it does not qualify to get reward points 🙁

The option of debit card isnt there. I tried doing that. Now the only thing they show is Netbanking.

This is Incredible!

I was thinking of adding money from this card to paytm and than from paytm to bank. I have to do this in multiples of Rs. 5 thousand. Hope it will be considered as online transaction. So I will get cashback in March right ?

I can also add my family members to my Priority account and they will also get priority debit card for free. I can get cashback from their accounts also.

Yes, technically you will get. Yes, you can add family members as well and get cards for them too.

If I buy a phone worth 15k with axis bank priority debit card,then can I get 10% cashback or I have to spend 20k Atleast?

Hi,

Have you got the cashback for using it in Paytm ?

Hi Captain,

When you are retrieving the money from paytm to bank, are you axis priority account to deposit the money, else I think paytm might charge of 2% of txn amount

You can load money into payzapp and than you can transfer it to any bank account instantly. This way an AXIS bank priority account holder can easily qualify for online spends and can get 10% cashback quaterly.

Can any one suggest Best Debit card or Credit card which offers maximum rewards and I should be able to convert that rewards into Cash directly and maintain less minimum balance in case of savings account like up to 50k average balance. Like similar to HDFC debit card (I am using it right now) which offers 1% cashback irrespective of type of transaction.

Thanks for your valuable information.

Hi Sid, I just came across to your website and I am loving it.

Just to analyse this offer further, Axis Bank wants you to maintain 2 lac rupees AQB which means that you will be only getting a 4% ROI on the 2 lac locked account. If I compare it to tax free ROI in the market, we are losing 3-4% as an opportunity cost. This equals anywhere between 1500 to 2000 INR per quarter. So, net net, I am only saving 500 to 1000 rupees from this deal per quarter.

Now the question is that is it worth maintaining a new account for 2000 to 4000 / year?

Its not for you if you have this perspective, yes you’re right, you can get better returns on other investments 🙂

You can go for Axis Priority Salary account, which dont have condition for MAB. But on other hand, regular Monthly Salary should be greater than 1L. I have received this card recently. I can post my experience after a quarter or so.

Terms & Conditions

please note that in terms and cond.. it says no rewards for debit under netbanking, please elaborate how if we pay cc bills using debit card we can get rewards

The below Terms & Conditions will need to be applicable for the rewards payout

Transactions made on merchant categories – Mutual Funds, insurance and payment to government will not earn these additional Indus Money points.

These points will be capped to a maximum per month limit of 2000 points for Platinum Cards and 3000 points for Signature Cards.

All other IndusMoney Terms and conditions of Platinum Card apply.

Transactions done via Debit Card under the NetBanking section will not be eligible for IndusMoney points.

Yes you are right Thomas. Debit card used for payment via net banking didn’t give me the points. It was actually a parallel transaction which did.

Sorry for the confusion.

Thanks for clarifying.

what were those parallel transations? If you can throw some light

@Anil – it was Muthoot gold loan repayment using debit card.

Just wondering most of the app based banks allow native account funding via debit cards of other banks. Is that funding treated as transaction, and gets reward points/cashbacks? Can someone testify a use case?

how soon we come to whether we earned points or not on particular transactons on Indusind debit card?

can we track points on netbanking?

Usually it takes 3-4 working days from the transaction date to credit the points. Once credited, you can immediately request redemption which takes another 2-3 days to reflect as money credit. So total lead time is typically a week.

This Priority debit card from Axis bank also allows you a free domestic airport Longue access every quarter.

Yes, kind of icing on cake 🙂

which hdfc card you mentioned gives 1%reward ?

Most HDFC debit cards has it, like Easyshop Platinum

I am thinking of shifting my salary account to Axis as ICICI is not providing any great benefits. Can priority banking or debit card be provided to salary account holders?

Also, can you send me the link for IndusInd debit card which gives INR 1500 cashback per month. I have IndusInd account, just need to request for the debit card.

Yes , you can get axis priority debit card for salary account. I have one.

Salary should be net above ₹1L/month, only then you can get priority salary account. Otherwise you’ll get prime savings account.

Is this Visa or MasterCard. Visa has drastically reduced lounges compared to MasterCard.

The one i have is Mastercard.

Is this offer still applicable?

Yes, it is.

Thank you. There are multiple priority holders in my family but I only learned of this from to your blog. Unfortunately the RMs seems to be only interested in selling MFs/Insurance and never seems to pass on any useful info.

Please continue the good work.

I logged into my NetBanking and despite using the card to top up my PayTM/Amazon for INR 20000, seemingly the offer has not been applied. I guess I will have to go through their useless customer care.

It takes 2 weeks approx to reflect.

Oh okay, thanks Siddharth. Last quarter when I used this trick the qualifying spends were recorded in a day. This quarter it’s been more than 1 week so was wondering what happened to my free money 🙂

Siddarth,

Thanks for the article

If I add money in any mobile wallet through the debit card, will that also be considered for the cashback ?

If I add money for Mutual fund purchase through the debit card, will that also be considered for the cashback ?

Thanks,

Mouli

Most likely.

mutual funds?? Are you sure??

And what about Indusind Debit card >> how soon we come to whether we earned points or not on particular transactons on Indusind debit card?

can we track points on netbanking?

Highly depends on which payment gateway/mode you use to pay.

yes, you can track the points.

Siddarth,

Is it in one transaction we need to do more than 20000 or multiple transaction adding to 20000

Multiple is fine 🙂

Siddharth,

I got the 2500 cashback.I am holding this card for 2 years but was not aware of this offer

Thanks for your information.your portal is really helpful .Keep up the good work

They mentioned this offer is valid till Sep 2017.From when this offer is active.

If I open Family account and use family members debit card , are they also eligible for this cashback ?

Thanks,

Mouli

Yes, should be on all cards. No idea from when its active.

I filled form for axis priority account & Executive told AQB non maintenance won’t attract any penal charges.

1. Will this impact 2500 Cashback accrual also?

2. Does mutual fund transactions qualify for axis cashback?

Ps: HDFC has put conditions for 1% Cashback, now only on specified transactions & merchants

aqb non maintainance will not attract any penal charge but they have written in small print that account may be shifted to simple savings and if shifted by them , card fees will be billed.

Thanks for response.

Is the offer still running?

It looks like the party is over. From 23rd July 2017 I cannot see this cashback offer in net banking. Has anyone noted it ? Anyways I have made more than Rs. 50,000 so far and all thanks to Siddharth. Thanks buddy.

50k? Wow! great Man. Its my pleasure.

Yes, it seems to be down now.

I made a mistake. It will not be July but June.

I have four Priority accounts and they gave cashback lots of time in a quarter. Infact I got cashback 4 times in the month of June alone. I think its a mistake from their end.

Has anyone got multiple cashback in the same month ?

Seems like the box is gone. I called Axis Bank and they said offer is still active.

But I cannot see the box anymore.

Can anyone of you confirm with your Relationship Manager about it?

P.S.: My relationship manager is on vacation.

Now they are taking it back. I got mail from Axis as I have claimed the 2500 cashback twice in last quarter because of bug in their software. Now they have found it and mailed me .Not sure how they are going to adjust the extra cashback that they gave

Hey. I am not seeing this offer anymore in my Priority Internet Banking. Can you see that still?

I don’t see it either anymore.. It’s a shame if they took it off without any notice and before the month ends.

Even I am not seeing the same from last Friday onwards. Maybe offer stopped.

Axis Bank is clearly can’t keep up their offers. Again, Rs. 500+Tax Card from ICICI Bank (talking about Coral Card) is more beneficial as compared to Axis Bank’s 2 Lac + Average Monthly Balance Account.

Clearly, Axis Bank is loosing the battle in providing better deals to customer for the value they provide.

2500 Was a good offer.

This offer is gone from last 5 days . I last used it on 22nd June. Very sad to see its over now.

Hi Siddharth, Can you confirm if the 2500 Rs cashback offer is still there or gone?/

Thanks

The offer is still on but there is some bug in the system hence it is down for maintainance . This is the official update given by the RM desk.

How can we claim the cashback? Please let me know.

Even if I use it, How do I know or where I shall claim the reward? As the option is not coming in the dashboard or anywhere.

Do u think we can continue spending and hope that it will be calculated and added when the offer comes back online

I’ve no idea as Axis Customer support too is clueless on this.

hope in sight. logged in to axis netbanking a message came priority offer estimated to be back on 15 august

I checked Axis internet banking and it says that 10% cashback offer redemption is temporarily out of service and is expected to be functional by 15th August.

NOW IT SAYS 10% BACK BY 15 AUG. THE LINK WILL BE BACK AFTER 15 AUG

everytime i use to redeem 1000 points for 200rs recharge.So its 1000:200 which means actually u have to get 2720 rupess but they have given only 2500.

i think its better to redeem as prepaid recharges time to time to get more value/.

If I am unable to maintain the balance of Rs 2 lakh in this account and thus if my account gets downgraded, will I still be able to retain the Priority debit card? Will I still continue to earn the cashback on the same? What are the charges levied for the Priority Debit Card for such downgraded savings account ( from Priority Account)?

June Statement emailer had mention :

Travel in comfort with Complimentary Access to over 28 Airport Lounges across India*

Make your movie going experience special, with a 25% discount on movies booked on BookMyShow*

Enjoy a 15% discount across our partner restaurants when you celebrate*

Your online spends is more rewarding with a 10% cashback,* and much more

July statement says :

Make sure to upgrade your Debit Card to the Priority Platinum Debit Card through Internet Banking or Mobile Banking, to enjoy

Complimentary Airport Lounge Access*

25% Discounts on movies*

Minimum 15% Discount across our partner restaurants* and more

So no mention of that offer though link shared in email is same & do mention about 10% in PDF but that’s dated

So looks this quarter onwards no points earning, only redemption for last quarter may open on 15th August

Hi,

Still the link is not enabled, though its mentioned that link will be up by August 15th

Anyone got the cashback ?

Ho Siddharth it has been a long time since you opened a priority ac. with AXIS Bank. Have you applied for a credit card yet ? Have you got automatic offer ?

My priority account is also in its sixth month and I have not got any automatic offer to apply for credit card. What to do ?

They’re issuing Privilege card for free to priority A/c Holders since past 2 months. You don’t need t wait, just apply with IT docs.

Checked with the customer care, they said the redemption link will be enabled by this month end only !

I opened my account on 24th Feb. 2017 and the branch credit card guy applied my credit card ( through ITR ) on March. Though he was 100% sure of my card approval but my card was denied.

Now it has been only 5 months when I last applied. So do you think I should apply again right now throgh ITR ( 4.01 lakhs annual income ) or should I wait for automatic offer to trigger just to be on the safe. My sole purpose of opening the priority account was to get a credit card. I am very nevous now but I trust your judgement 100 %. What do you suggest ?

6 Months cooling period is good. Rejected for privilege or some other card? They might expect high ITR.

10 percent offer is discontinued by bank now

I don’t recall the name but it was surely not Privilege card. Infact it was a basic card. I am still waiting for you answer . Should I wait for automatic offer or should I apply through ITR after 6 months of cooling period ?

Hard to answer in single line.

CIBIL

Active A/c’s

utilization %

Secured loan mix

Too many parameters there.

But 4L ITR on basic card afer 6 months cooling period is good to go.

Thanks a lot.

Hey Siddarth, How to apply for the Privilege Card?

I click on the Apply Now Button and it open contact form.

How did you apply?

Thanks

You mean Privilege credit card? Visit Branch.

Now they updated like 10% cashback redemption will be up only by September 30th. Pathetic Service by Axis Bank

I noticed too. looks like Axis backend team is not so good at solving a simple glitch.

Where you are this option???

Hey. Are you receiving transaction alerts in your email box (specifically email) for Axis Bank Savings Account?

Thanks

Is this offer back???

I am not seeing any update on this still the same error message . Temporarily out of service and Estimated to be back by September 3oth

Where you can see this option? I am not able see this on the app.

This is visible only in the webportal and not in mobile app

This offer is back. Now wallet transactions are excluded from transaction.

How does one claim redemption for the April-June quarter?

Redemptions are supposed to be claimed within the following quarter (i.e. July-September), but the redemption widget was not available for a single day during July-September!

Amazing!!

Its there in the bottom of the window with small fonts saying previous quarter or last quarter. Click that link and you can redeem for the previous quarter. It worked for me

Previous quarter is July-September 2017.

I am asking about the April-June quarter, which could not be claimed within the July-September quarter because the widget was not working at all for even one day from about 23rd June to 24th October.

Customer Service replied that a SMS was sent to all eligible users last week, but I did not get it. They haven’t responded after that. Anyone get the message?

Yes. Now wallet loads don’t count.

Try loading phonepe wallet, it still works 🙂

lets please post all included/excluded transactions. as of now I got bookmyshow and uber as eligible for cashback

Luckily amazon pay wallet loading is considered as online shopping and getting counted.

Hi i got an sms saying i am eligible for cashback april- june quarter. It mentioned 2 options sms back cashback or redeem points, will update if cashback falls in account. fingers crossed.

I too got the same message on nov 1. Till now the cashback is not credited. I have escalated it and today they say, I will get that in 5 working days.

I have got the Apr-Jun i.e.,Q1 cashback yesterday. They didn’t consider wallet fillings in this .

Finally got the cashback for April-June quarter!

Wallet transactions on Mobikwik were excluded, though amount was not large so it didn’t matter.

Had no Paytm transactions during the period.

So basically you need to spend Rs.25,000 online in a span of 4 months to avail a maximum cashback of Rs. 2500, considering 4 quarters in a year, that’s about Rs.10,000 in savings just for using a DEBIT card.

Sir it should be

So basically you need to spend Rs.25,000 online in a span of 3 months instead of 4 months

Thanks, updated.

Sir, where I can see deposited points earned through Axis priority card?

Login to your axis bank account.

Click snapshot and scroll down a bit to see “Get rewarded for spending! banner in the middle.

which all wallets are included and excluded ? Any idea on MF transactions

This is from my experience.

Included : Amazon, Ola money

Excluded : Paytm, Mobikwik

Good News

Offer is extended to this quarter also, I have redeemed and waiting for the cashback amount

Offer is extended till June 2018

Yes, Indeed it’s been extended.

I have a Salary priority A/C with Axis so exempt from maintaining AQB/AMB of 2L. 12.5 K INR of free money so far received from Axis bank just to put money into PhonePe wallet and download it a few seconds later 4 times a year.

Should I open one for my dependents as well 😉

What do you mean by downloading it few seconds later? Do you have an option of transferring the wallet money back to account or what?

yes, transferring the money to account on phonepe is as simple as swiping down 🙂 hence the phase downloaded

Any working wallet?

Tried pocket,phonepay,none count as online expenditure

looks like they have removed all the wallet transactions, even if they are bill payments. so as of now it is only ola money and amazon .

@harshit – I did a txn on 10-Jan on phonepe and although it took a week to recognize this, it did eventually clocked as an online spend.

@balaji – they only call out paytm as exclusion –

T&Cs specify – 3. Spends done on Wallets will be excluded from this offer. All transactions done on PayTm, PayTm wallet, PayTm mall, PayTm payment gateway will also be excluded from this offer

yesterday I tried phonepe and it is considered as valid online transaction. I used phonepe and paid airtel broadband bill via debitcard. I didn’t topup the wallet.

So final list from my side

Included : Amazon, Ola money,Phone Pe, Nikki.ai (I load amazon pay and use nikki.ai to pay bills)

Excluded : Paytm, Mobikwik

Now this is worse. Mobikwik,Paytm,FreeCharge aren’t considered as online payment, even if we pay bills via those gateways(I mean, without adding to the wallet).

How to avail the cashback. I spend the minimum amount in last quarter where i can get cashback on netbanking page?

Login to your axis bank account.

Click snapshot and scroll down a bit to see “Get rewarded for spending! banner in the middle.

But that is showing for the current quarter only. How can I unlock for the previous quarter ?

Is this offer includes credit card payment of other banks

is the cashback still available on shopping through site from Amazon, Flipkart

Are spends on Amazon still included in the offer (shopping or recharges)?

They are not wallet loadings but actual purchases, and are not showing up as recorded for 1 week.

Any idea about Flipkart?

Yes. Amazon spends are considered. Recently when Amazon had 250 cashback for Amazon Wallet load of 5000 INR, I loaded it using Axis Priority debit card and it is considered.

I think it would be the same with flipkart too.

Hi Balaji,

Is it better verus Burgundy ? I don’t see this card listed on Axis

Thinking about opening an Axis priority account. Is this offer still valid?

Also what is the current minimum salary credit requirement or AMB requirement to open a priority account?

Check Axis Bank website 🙂

Yes opened the account and realized that this cashback offer on online spends is a feature of this card and not an intermittent running offer 🙂

I got the cashback for last quarter. Somehow i couldnt figure out the maths and didnt use the card for 1 year 😯. Too much concentration on using credit cards, but now cred app is helping in geting the cashback.

Yes the offer is still valid till June 2019 and they may extend as the were doing for all these years

I have normal axis savings account. Should i upgrade to priority account and get priority debit card?

Is 10% cashback offer still running?

Yes, offer is active.

Offer is still running

I am getting Rs750 cashback every month apart from Rs2500 per quarter. The best debit card i must say and priority savings account.

how r u getting 750rs cashback?

Its corporate priority saving account cashback…..1% capped to Rs750 per month.

Thanks Mouli, Prashant.

I’ll soon visit branch to apply for the upgrade to priority account.

I am too having salary account that is priority but not getting this 750 cashback

When you received this card?

Any seperate activation for this ?

Would be interested in knowing how additional 750 cashback can be redeemed. Never received for myself, only the 10% cashback per quarter offer I have been able to redeem.

Mines is also priority savings salary account. I get the 10% quarterly cashback, but not this 750rs.

Can you please elaborate?

Firstly, the criteria to get this 1% cashback (Max up to 750/- in a month) is to have a Priority Salary account(not just savings account). Transact as usual with your Priority Debit card(online/offline). Cashback for a particular months transaction will be available for redemption by 15th-16th of next month. Also you need to transaction for a minimum of 15000/- every month to be eligible for this.

Follow this path for cashback redemption: Services -> Account Services -> Cashback for Premium Customers

My account type shows “Savings”.

When I followed the path shown by you, it shows “Sorry Cashback is not avilable for your account”. Will talk to my RM, as he says that mines is a salary account.

is amazon working ie i loaded 1000 to wallet and 1000 as gift card .

no ecom before transaction. so i guess it is not working?

Wait for 3 days and check your axis account. If it is valid, it will be reflected. If not then they might have removed it.

Please let us know .

Are cred transactions also valid for this ? 🙂

Yes. I am getting cashback for CRED transactions, worked even in this quarter.

Sanyam yes CRED transactions are counted as valid transactions and they give 10% cash back. I do this every quarter in my three AXIS priority savings account.

Yes they are…i am making a killing with this…Rs750 per month + Rs2500 per quarter…..the best debit card…

I am also getting 2500 but 250 ,I am not getting and I am having my salary account with Axis.Visited the branch and they also dont have much clue about this

You can make 2500/quarter to 5000, if you have Axis Privilege credit card and redeem for 12500 edge points instead of 2500 rs

I will get 5000 Yatra voucher for 12500 points

I received the 1 percent cashback for one month, but then on I am getting the message “Sorry cashback is not available for your account”. I am performing more than 15000 transactions per month, still getting the message. I have requested my RM to look into this. Will repost if I get any response from him.

Looks like Axis has stopped considering cred txns now. Can others also confirm on this?

That seems to be the case. I too haven’t received any reward points for using Axis Priority Debit Card in Oct.

Transactions done on 1st October is shown up today only and I have redeemed for 2.5K cashback.

Axis notification said cashback is discontinued from Oct, though the redemption screen still shows both cashback and edge rewards.

Did you receive the cashback for current quarter Oct-Dec 2019?

Or even on selection cashback you ended up getting edge rewards?

I opted for cashback on 20th Oct 2019 and still did not receive cashback or edge rewards of 12500.

How about others?

I have received the point edge rewards for cred payment with debit card.

I too received but there is delay in posting points for the transactions done from October 1st to 3rd.

For transactions that are done on October 6 th I received points on 9th but for transactions that are done on October 1st,I received points today only

Hi Moulieswaran,

Can you kindly elaborate how you are getting yatra 2*2500 voucher for 12500 edge points. When I check in rewards catalog site, I find 2000 yatra voucher for 10000 points. I have axis privilege cred as well. Does it have a separate rewards redemption site for this card? Thanks in advance

Harry,

Sorry didnt check your query.Both have the same redemption portal and page

BIs your Privilege card linked to the same cust id? in that case just search for Yatra vouchers in the redemption page and you will find this

Hi, the 1% cashback for salary accounts is going to be withdrawn from next month onwards. Alas another good avenue for earning cashbacks going away!

Incidentally the website still shows 1% cashback for salary account.

Hey Sid

Got a message saying

” W.e.f 1st Oct’19, 10% cashback on online spends of Axis Bank Priority Debit Card can be redeemed only for EDGE REWARD points. T&C apply https://bit.ly/2nMG1dV”

So the 2500 direct cashback to bank account is discontinued

So is this still as beneficial to justify 2 lacs average balance?

If you do regular shopping on Amazon, Flipkart etc. then you can convert the points to gift vouchers from the rewards store.

Even now you have the choice of Rs.2500 or 12500 points, for which you can get exactly Rs.2500 worth gift vouchers.

This assumes that the same reward ratio will continue, and that they will keep Amazon and Flipkart vouchers.

But the options are not as attractive and direct as cash in the back.

I have paid a credit card bill of 1.1Lakh thru Axis Priority debit card on Oct1st. I got the edge rewards credited to the account on Oct 14th. BUT, the 10% priority cashback is not yet available. Earlier I used to get both the edge rewards for debit card spends and 10% priority cashback offer.

Is anyone facing the same issue ? Their customer care is not helpful.

I too have this concern. Received edge reward points but not counted for 10% priority cashback for transaction made on 1st Oct. However transaction done on 8th was considered for the 10% cashback spends.

Today they have credited the 10% cashback for the transactions done on oct1st. I could redeem it for cash of 2500 INR.Looks like some technical issue from their side. Effectively I got edge rewards + online 10% cashback.

Balaji,

How did you pay the credit card bill througb debit card?

yes via cred app. it allows to use debit card for bills greater than 1lakh.

Seems some issue for the transaction from Oct 1st to 3rd,I received reward points for those transactions 2 days back only whereas for the transactions done on October 6th I received a week back

I have received the 10 percent online spend also for transaction done in cred on October 6th

I did transactions on Oct 1st, edge rewards posted on 12th or 13th and redeemed for 2.5K cashback on same day. Maybe wait for few more days and then escalate, but mostly you need to fight for long to get the cashback, because Axis support is terrible based on my experience.

Axis notification said cashback is discontinued from Oct, though the redemption screen still shows both cashback and edge rewards.

Did you receive the cashback for current quarter Oct-Dec 2019?

Or even on selection cashback you ended up getting edge rewards?

I opted for cashback on 20th Oct 2019 and still did not receive cashback or edge rewards of 12500.

How about others?

@ Siddharth

Still we are getting cashback for debit card which are most giving cashback debit card are currently available ?

I am looking for card with unlimited cashback or higher cashback provided for online transaction (Not for CERD)

Please suggest cashback debit card

Thanks

HY Mahendra,

Yes, Axis Priority Cars still offers the same cashback up to 2500 per quarter.

For unlimited cashback, I am using Axis Flipkart Credit card as they add cashback in next bill cycle and to make payment for that i use my Axis Priority Debit Card to pay the bill through CRED. Unfortunately now CRED allows only a single transaction up to 2000 per month through a debit card.

Hi I selected 2500 Cashback but have been given reward points 12500. So I guess Cashback is over

Yes, it’s changed since Oct 1st, but still worth it because can redeem for amazon or flipkart vouchers.

Thomas,

Yes cashback is over,the same was communicated by Axis in the last quarter itself but still they didn’t remove the cashback redemption option in the web interface

Thomas yes it’s over but you can easily convert reward points into Amazon EGV. Than you can use it to pay electricity bills and many other things. So for now it is equivalent to cash in my eyes.

Yes. Same happened with me too.

Hi I selected 2500 Cashback on 2 Dec 19 but still not received.

Anyone able to unlock the points for spends in the last qtr? Though I have met the threshold, it is not showing up in netbanking yet.

Got this message from axis today

“W.e.f 1/4/2020, free cash transaction limit, EDGE REWARD earn rules will change & 10% cashback on Priority Debit Card will discontinue. Details tiny.cc/AxP T&C”

So basically now its totally worthless to maintain 2l AQB

Received a message sometime back stating that 10% cashback program on Priority Debit Card is ending from 1st Apr 2020. Any point in maintaining a Priority Account with Axis bank after this?

Axis bank sent a message that 10% cashback will end on 1st April. So, the party is over now. I guess Siddharth, you can now change the rating from 5 to may be 2.. 🙂

For <= 25000 purchase, this was the best among Credit/Debit cards.. RIP

Is there anyone still using priority debit card for any credit card payments? as cred is now not allowing debit cards,want to know other way to use this debit card.

CRED allows to use debit card to pay credit card fee for amounts greater than 1Lakh INR. For amounts lesser than 1 Lakh you have to use netbanking or UPI.

10% cashback offer on online spends:

• The 10% cashback offer on online spends of the Priority Debit Card shall be discontinued w.e.f 01/04/2020.

• Customers will need to redeem the cashback earned in the form of equivalent EDGE REWARD points in Jan’20 to Mar’20 period by 31st Mar’20, post which the same shall expire.

Earlier one could choose from 2500 Rs cashback in bank account or 12500 reward points which could be redeemed to get Amazon Flipkart etc vouchers.

Then the discontinued Rs 2500 casback offer.

And from 1st April 2020 they have discontinued the 12500 reward points offer too.

Now I am using Amazon icici credit card which gives 5% unlimited Amazon Pay balance on purchasing from Amazon and 1% cashback from other ecommerce sites.

No yearly fees.

Almost similar offer is available on flipkart Axis bank credit card but the Annual fee is 500 Rs.

Please keep us informed if there comes any other good cashback debit or credit card.

Is offer still running?

No. Discontinued.

Now even for ecom transactions they are not providing edge reward points on this debit card. Not mentioned anywhere in the terms and conditions. For CRED and school fee payments I used to get reward points. But since May 2021 the transactions are marked with 0 reward points.