We’ve seen multiple credit limit enhancement offers on HDFC Bank credit cards during 2020 & 2021 as seen here and it looks like the bank has decided to continue to same for 2022 as well.

If you’re new to HDFC limit enhancement system, do check out below link (during day time) to check if you’re eligible for the offer.

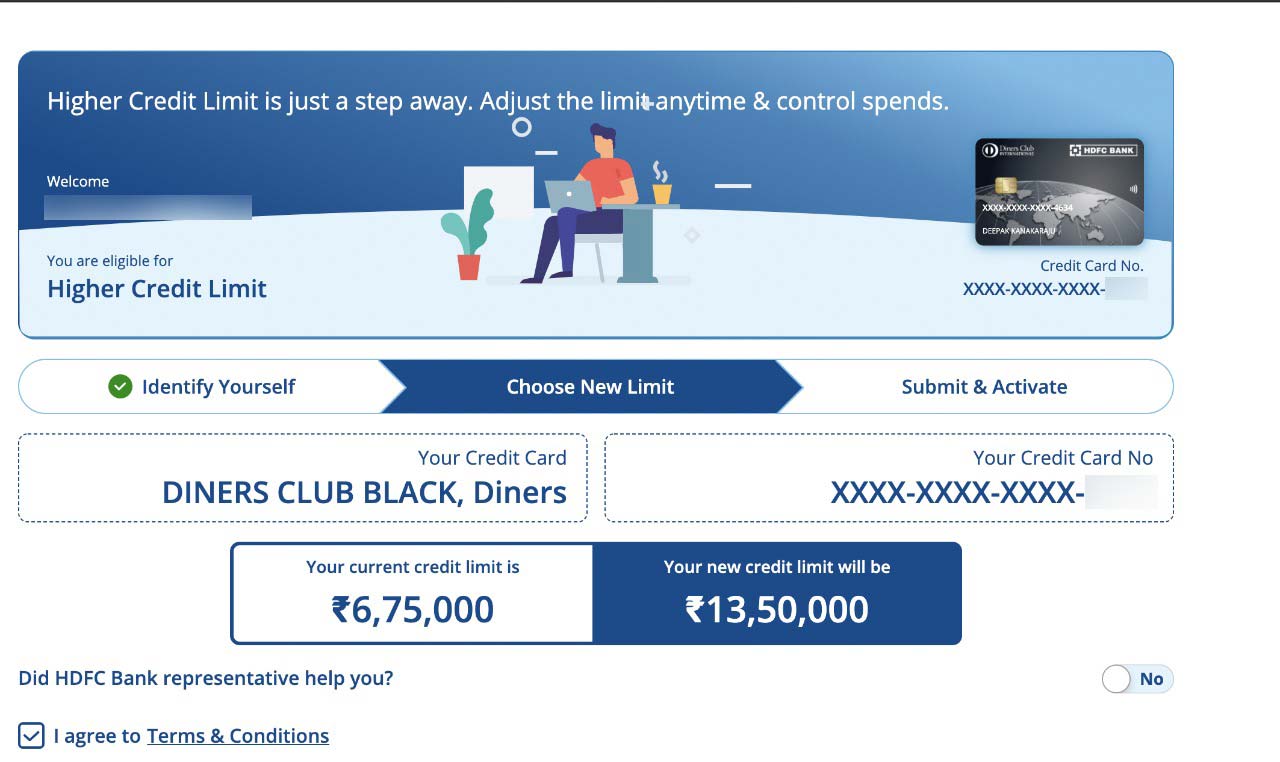

Login to NetBanking > Cards > Request > Limit Enhancement

This article will reflect all the Auto LE offers rolled out on HDFC Credit cards in 2022.

January 2022

Major Auto Credit Limit Enhancement offer has been rolled out during 1st week of Jan 2022.

- The % of LE is different for different people. Most have got about 30-50% lift in the limit.

However, neither I nor most others I know have received the LE offer this time, probably because the limit is already high and also because it was recently revised, some 6 months or so back.

Ideally, those who didn’t receive the LE in 2021 or those who got it during early 2021 would have received the offer now.

Bottomline

It’s indeed interesting to see HDFC being so generous with the credit limit enhancement for 3rd year in the row. As a result of which, almost everyone I know is now holding HDFC credit cards with credit limit >5 Lakhs.

Did you receive a limit enhancement offer on HDFC Credit Cards in 2022 and if so how much % was that? Feel free to share your thoughts in the comments below.

My Infinia limit is standstill for the last 20-22 months.

Nothing this time again for me as well to my newly on-board family members having paltry limits of 75K & 100K.

One off-topic question: Is there any RP redemption to Amazon pay egv charges for mid or low segment cards?

Stucked with 14l since two years not getting any offers to increase card limit

I received LE but by paltry 20% for my DCB to take it to 6 lakhs. Strange algorithm of HDFC they increased my LE to 5 Lakh and a LTF DCB when I used to spend around 50-60k annually on Regalia. After one year of DCB I spent around 5 lakh annually (max being 20% of limit in month) still got paltry 20% LE.

Wow. Good for you. I spend over 12L on my regalia annually but I didn’t get LTf either for dcp or dcb.

Hi Siddharth,

I received the credit limit enhancement offer on my infinia card and I took it :).

It was 19.5%, the limit was enhanced from 1022K to 1222K.

Thanks,

Santosh!

I received 15% limit increase in Dec -2020. Currently it isn’t showing any offer.

I did not receive the offer in 2021 or now in 2022. I was hoping to get it this time but looks like I am in bank’s bad book inspite of having a 800+ credit score and an Imperia account holder. LOL !!!

Hi Sid,

My limit has been enhanced from 9,70,000/- to 11,20,000/-. My spends are meagre.

I too did not get any limit enhancement offer. I was offered limit enhancement offer in June,2021.

Curious how high does HDFC go with credit limits. Would anyone know?

i have infinia limit at 25L and ICICI Sapphiro at 46L

Hi Iyer,

I hold Infinia Metal with 9L limit since March22, do u know when next limit enhancement and how much it increase?

Few here had 25-30 Lakhs. That was a few years ago. Would have increased now.

Hi, I’m using HDFC credit card since Aug 2018 & my limit is enhanced only once from 1.16 to 1.86 in 2019 & after that I didn’t received any offer.. Hope to get it soon

While its nice it’s also frustrating that they don’t report credit limits to the Credit Report Bureaus.

Yes, that is the major negative point with Hdfc Credit Cards… What is the use of having even a 1 Crore Credit Limit if it does not show up on the total credit available mapped to a particular pan/aadhar?

They report your highest used credit to the bureaus and your subsequent usage would be marked against that.

I have a limit of 3L for more than a year. Hold an LTF DCB. I have requested for enhancement before which was denied on the basis on income requirements. This time also, there is not limit enhancement offer for me.

How you got LTF DCB at 3L limit?

I have an HDFc LTF card since 2008. I kept getting upgrades and LEs over the time.

Yeah like a week back I was on hdfc netbanking and try to see if there is limit enhancement and once again they did increase my limit with 2lakh it already high enough so I can understand they didn’t give me more

I’ve received a LE fro 5Lakhs to 6Lakhs.

Yeah received for 20% LE

In Jan 2020 & Jan 2021 I got two credit card upgrade from HDFC. I was expecting same this year. But looks like it will not happen this year. 3-4 months back they increased my limit. So I believe that’s why I did not get LE.

I received LE @ 30%.

As you said, I did not received LE in 2021 but now got 100% increase.

Yes 462000 to 552k on Regalia, still hoping for infinia

Thanks Siddharth

I checked for potential credit limit offer across 5 cards – Was hopeful for getting atleast a good credit limit jump but alas none have any offer 🙁

Last year around same time, was able to upgrade one Regalia to Infinia and that too LTF!

Hi

How did you get the Infinia card LTF? I checked with HDFC Chennai customer care& with Bank branch multiple times, they all told me without any doubt that Infinia can never be given LTF (I had regalia LTF)

Got an LE offer of 2L on 1st Jan for ‘outstanding credit history’. Bringing my CL to 10.11L on regalia. Got LTF regalia upgrade in Sep 2021.

I just have the corporate card from hdfc, which is not getting limit increase ever since I got it 3 years back.

Does anyone know how can I get limit enhancement on HDFC corporate card?

I had 421000 limit. I was offered new limit of 715000 on my freedom card

I am stuck on the same 6.75 lacs for the past two and a half years. Just checked and still not eligible. My total spends in the last year should be around 5-7 lacs. I wonder if they enhance the limit only for those who spend more.

Hi Siddharth,

My infinia card limit was Rs. 14.29 lacs which has been increased to Rs. 15 lacs now. This is around 5% increase.

Hi Siddarth,

It’s been 1.5 years but I’m still stuck on the same credit limit which I got my card issued for. How do I get this offer as the net banking site doesn’t show any such offer under credit limit section.

The card is Milennia Credit card with 75k limit. My other cards have limit as high as 3.07 lacs and cibil score is 780.

How can I get my limit increased as talking to customer care is useless. They ask for salary slips which I can’t produce because I’m in my final year of post grad.

Got a LE of 67% effectively taking my Regalia First limit above 5L

When can we expect the next wave of HDFC card upgrades? Hoping to get a Regalia or better.

LE received by 20%. My already existing limit was well above 10L.

Hi Siddarth,

I have not received the offer.

My regalia limit is 5L over last three years without any LE.

My paycheck gives me eligibility for Diners black but due to low LE, couldn’t get the card upgrade.

Is it a wise idea to cancel existing Regalia and apply afresh from DCB?

My RM is of no use, she is only interested in selling me products.

Kindly advise. TiA

Yes, I too received the enhancement offer of 25% on my Infinia. What do you mean by LE offer ? Is that LTF ?

Limit enhancement

I got upgraded to DCB in Jan 2021 with 9.7L limit. Clocked close to 9L on this card through 2021. No upgrade 🙁

I did do receive the limit enhancement offer this time as well. However, it is ~10%.

Is there any tangible benefit to increase the limit if a person is already holding

2-3 premium card awith decent limits..say 5-6 lakhs ?

I received LE offer from 1.62 lakh to 1.94 lakh ie 19.75% only on 31 December 2021 for my HDFC MILLENIA CREDIT CARD.

Regalia limit upgraded to 9.09 lacs from 7.09

You are eligible to upgrade to Infinia

I got 20% limit enhancement last was in sept 2020

I was having a credit limit of 6.21L for along time and I had requested for a LE last Nov through post. They just increased it to 6.61 (just 40K+) and that’s it.

Same happened with me just 6ok increase when requested with supporting documents. Its wise to wait for a pre approved LE in case of hdfc.

I got LE of about 30% for my diners black on 30/12/21. It is after the one year of my upgrade to diners black. Normally i got LE after 5-6 months but this time after 14 months.

I have received 30% LE on nye and also a pre-approved dcp. Although I didn’t recieve any LE between June 2020 and September 2021.

Got enhanced from 15l to 25l – HDFC infinia

Does large credit limits (not utilization) of 10 plus cards impact Credit Score.

This is a big jump at such high levels.

What is your yearly spend Ricky

When was your last LE on Infinia card?

Thats crazy I am still stuck at 13Lac. I was told my spends “8-10Lac per month” will trigger a limit upgrade but nothing so far.

How much do you spend on the card and how old is it?

Do you really need 25L on your credit card? Do you worry about risks with loss of card, etc. I’m sure you could chargeback and get the money back but mentally it would be extra stressful.

For peace of mind we always have options to restrict the limit, based on spend type.

Do they go this high?

I received 50% LE during 1st week of this year

I have not got any LE on either my HDFC Infinia (15 lacs) or DCB (7.25 lacs) since last 2 years.

Received LE of 2L on DCB. Increased from 15.65L to 17.65L

What’s benefit to us consumers of getting Credit limit increased beyond a certain decent value (like Rs.6-8 lakhs) ?

I am stuck with 8.8L Limit in Infinia with last 2+ years after upgrading to LTF Infinia from Regalia. In Regalia itself I was having 8.8L limit. In fact I did not get limit increase in last 3/4+ years.

I got an upgrade offer from Regalia to the below cards without limit enhancement after having spends of around 8 lac

1. Regalia First

2. Millenia

Don’t know why HDFC call it an upgrade.

Haven’t received LE, few of my friends received card upgrades today.

I just received the Upgrade offer from Millennia to Diners Black card. So it’s look like they rolled out Limit Enhancement as well as Card Upgrade too. So check yours now guys.

They increased my DCB limit from 7.09 to 7.13. They seem hell bent on not giving me infinia.

They are offering me Regalia to millenia or Regalia first.

They are giving card upgrades as well. For card upgrades, we do get MasterCard variant if the older card was too although the ban is not completely lifted.

Sid,

Can you please write an article on how to utilize annual membership benefits offers by DCB cards?

Hi There,

I have got only 2k limit enhancement. My current limit is 160,000 and the upgraded offer is to 162,000. I didn’t take it because 2k means nothing in terms of limit enhancement.

Any thoughts!!!

Looks like HDFC has set up some auto tool for me . Every year exactly at march I get limit enhancement by 2 lakhs. Only in 2021 it got delayed by some 3 months might be due to lockdown. So i got no limit enhancement now.

Surprisingly i got limit enhancement for ICICI Rubyx by 1 lakh which I dont use at all and also by another 1.3 lakh to Amazon pay card.

Got 300% LE on my Regalia.

From 242k to 10L!

Sid, how long till i get invited to Infinia?

Just ask and you shall be invited.

Btw, thanks for reminding me about Diablo, my 15 yr old memories playing that game. 🙂

How/Whom do I ask? (RM said she cant help me)

Also, if I ask, what are the chances of me getting LTF??

PS – Never stop being a gamer 😉

I have dcb since five years, but don’t have a bank account with hdfc. Just got an email stating that convert my dcb to life time free by opening back account and also get reward points worth 5000. Have replied them positively but no reply from their side further. How to proceed? Will this offer be considered if i directly go to bank and open an account?

my DCB is life time free due to some savings account opening offer. opened it almost 3-4 years ago, keep 10k parked in there though.

last month got limit enhanced from 7.75 to 9.75. not much.

I did not receive any LE offer on my card since last two years. Can anyone tell me probable reason. I have never defaulted in payment of credit card dues and my credit score is also good.

I’m on the same boat! Last LE on my Infinia was 2+ years ago (2nd Jan’20).

My Earlier limit was 19L but got LE of 24L

Bit off topic query. I booked an Indigo flight via smartbuy (cleartrip). They charged about 3700 + convenience fee. The invoice given by smartybuy/cleartrip mentions the same value. However, the invoice sent by Indigo was for about 3200 only. Even the base fare is different in the 2 invoices. Now because, of this, when doing a reschedule at Indigo website, i am being asked to pay fare difference of 700 for a later flight, which ideally shouldn’t have happened. Anyone got any clue what’s happening here. For my earlier bookings, whenever i bothered to check the airline invoice, it was always the same amount (barring convenience fee) as the one shared by smartbuy.

That happens due to ‘Dyanamic Price’ (I think).

During Travel sale in Nov, when I booked first ticket (Indigo), it costed me 7694 (after 500 discount).

Immediately when I booked second ticket, it costed 8115 (after 500 discount).

In Indigo site, it was showing 8615 for both the bookings (higher value in my case).

I understand dynamic pricing. In my case, there is difference in values for the invoices generated for the same booking by indigo and cleartrip, which seems wrong to me.

That happened to me as well.

Cleartrip/SB Invoice: 7694 (8194, if 500 discount is considered).

Indigo Invoice: 8615

I too faced the same.. for group booking Cleartrip get reduced fare from indigo but Cleartrip never pass the reduction to customer..

Hence the difference.

I have emailed to Cleartrip/smartbuy but their reply was pathetic

This is happening mainly with domestic flight ticket. Raise issue with SmartBuy and their partner Cleartrip/Yatra providing both the invoice and you will get back the difference in amount.

You can claim refund for the difference. Airline invoice is the final price plus convenience fee is what clear trip should have charged you. If excess, you can claim refund. It happened to me once and i got the refund after numerous follow ups.

Have anyone received credit limit enhancement when the international transactions disabled on their cards? I heard from bank employee that credit LE will not be available if international transactions is disabled.

False info.

False. Have disabled the international transactions on my card and still received LE enhancement offer. Infact it’s a good practice to disable the card for international use when that’s not required to avoid any fradulant transactions which don’t require OTP authorisation.

@Ramesh

that’s absolutely wrong information

Because it is RBI circulation to banks that they have to mandatoryly disable International transactions if customer did not travel in particular time duration. I always keep it disabled and I got limit enhancemt even for Amazon pay card along with hdfc.. I would advice everyone to disable it first as soon as you get your new credit card and for others by default it would get disabled (not sure all banks follow this)

I have not seen any limit enhancement since last more than 1 year….may be because it is already 15 lakh…..what is the highest limit we can see?

They are offering me so called upgrade from Regalia to Millenia. Is it upgrade or downgrade?🤔

Even my wife is offered millennia to regalia but looking over the fact that regalia rewards when converting to cash credit comes to 20 paisa and millennia it’s 1 for 1. So millennia is gud.

Even HDFC thinks regalia is premium .

Only positive is lounge access, for which we have 3-4 other cards so millennia is gud and we have given a pass to regalia.

Just one confusion remains, I was upgraded to infnia from regalia, would same happen from millennia to infnia or it would be millennia then regalia and then infnia 😒🧐

@Robin

Absoulte downgrade.. Regalia comes with priority pass which itself is worth several 100s of dollars. Once upon a time even my RM tried to talk as if millenia card was infinia 😂😂

Most of Hdfc regalia card customers got DOWNGRADE option to Millenia card, Ridiculous! some customers having fee Millenia card upgrade from LTF Regalia

I have 25Lakh limit of infinia since last 2 years. Spends are about 2 lakh/ Month. Is anyone with 25L CL getting limit enhancements? If yes what are your spending range.

Dont need LE but just curious to know.

Got my first credit card in September 2020 as a pre-approved LTF Hdfc IOCL CC but with a paltry limit. Then in September, i got limit increased by 100%. Now, i have recieved an offer to upgrade to Moneyback+. However the card only comes as FYF and have to use smart pay to convert it to LTF as informed to me by customer care executive.

I am using HDFC money back card from last 1.5 years with 48K limit. Right now, I have upgrade offer for money-back plus card. Should, I go for it?

Difficult to trust hdfc bank these days…RMs are cheaters..I got one offer in hdfc NetBanking page in oct to upgrade to millenia card there charges mentioned as ₹1000 but when I asked my RM he said this charge not applicable for you, you can easily upgrade

Post this when RM got changed, new RM said it’s not LTF🤬.. on a side note new customers getting LTF offer…so decided to close my hdfc credit card…also there is no transparency in reward points credit..rewards points are credit after 90 days and I bet you will remember 😂I love axis bank card system especially axis bank ace card cashback per transaction is very transparent..also they send sms after each transaction

My Diners Clubmiles/Privilege limit has been on a standstill since last June (2021) when it was actually reduced by 1L. Stuck at 460K with my spending hovering around 20-30K per month.

Thinking of reducing the spending to <10K given that my other cards (IDFC/Amex) is offering better RR for money spent.

Got this one on HDFC Millenia card!

They over-communicated for this one, accepted it.

Does it really help to have a higher limit ?

Are limit enhancement and card upgrades still being given by hdfc in feb as well?

Hi Siddharth,

I’m having an old HDFC money back credit card from 6+ years, however didn’t get any upgrade till now. Also, I’m using it very very less these days as i have Amex MRCC and FK Axis. What’s your suggestion whether to continue that hdfc card or close it and also any tips to get it upgraded would be helpful.

Thanks

ppl here are confused if they think high spends equals credit limit increase. keep your spends to maximum 20 % of present limit. Spending too high equals credit hungry in bank systems. A potential default risk. Its counterintuitive but that’s how the systems are set up.

I was using regalia till last month & my CL was stuck at 10.98 L for more than 2 years now. Now i am upgraded to Infinia metal, but still no option to increase my CL!

I got limit enhancement on my millennia card today. Limit has been increased from 120K to 168K.

Finally my credit limit increased in money-back card. I got the pre-approved card in 2020 with 40k limit. In 2021 limit was increased to 48k. Yesterday got a new limit of 96k. Hope it doubles like that.

My DCB limit was enhanced by 25% this month.

today I Got 30% increase and so called upgrade to millennia (fees) from MY Regalia(LTF), I think cross sell team also having monthly target in order to complete their target offering like this SO Called UPGRADE.

HDFC is being cheeky with limit enhansements.

Got a 10K limit enhancement offer this morning.

If I pass it, will they provide a higher CLE in the coming months or shall I take it?

Is there a minimum time gap between the two CLE offers that we receive?

i got a limit increase of 40% in April for my Diners Black.

8.88L to 12.43L

I was upgraded to Diners black from Clubmiles in Jan22.

Wondering how to upgrade to infina.

I got an email from HDFC that my privilege diners card (LTF) will be blocked due to inactivity.

It is also mentioned that they are offering an upgrade to diners black card (on paid basis after 1 year).

I have used my credit card recently only so I was surprised for this email.

I called the customer care and they told me that HDFC is closing some varient of card including privilege card for all customers and only option for me to upgrade to diners black at paid bases.

Any one else got similar message from HDFC Or having any update on it?

Got limit increase offer on Regalia First after 2 years from 125k to 162k

For 18 months i have been using the limit fully and go no offer to increase it, So i stopped using this card for past 6 months and got the offer, Have seen this trend that when you use it you don’t get limit increase option. Waiting for upgrade to regalia.

Dont use 100% of your limit. dont use more than 30% of your limit. Doing that will reduce your cibil score.

I received 30% limit increase in August -2022 on my LTF Regalia.Its First time LE offer from Jan,2021.

Another LE offer kicked in last week in the guise of ‘Ganpati Special for you’. Got offered a 6L CL increase on Regalia, new limit now 12L. A little surprised since I’ve been an HDFC customer only since December ’21 and received my CC in January ’22.

with 12l cl, shouldn’t you be a infinia card holder ?

Is it showing in netbanking offers tab ?

Hello

I have a diners black FD backed credit card stuck with a limit of 4.5Lakhs. Any option to increase limit as RM is like you need to increase your FD / fresh apply.

Suggestions?

I got a call from HDFC to upgrade(?) my LTF Infinia to FYF Metal Infinia. I declined and within 24 hours my credit limit was decreased from 13.8 to 10.8. Is HDFC revising CL?

Have heard about few cases in the last 2 weeks.

Yes seems they are revising limits. I got emails, sms, calls from RM, and lot of congratulatory messages that my limit was eligible for a 6000 increase!! I have a diners with 7 figure limit, and 6K increase can sound massive by recent hdfc standards.

Just got a 50% CLI from 10L to 15L. Didn’t get any notification, I just check once a week.

I upgraded my LTF Infinia to FYF Metal Infinia last week. Caller Executive said, those who are achieving spends of Rs. 10 Lakhs are being upgraded. I initially denied. Then he hinted on Limit decrease & positive probability of future CL & future upgrades (if available). I upgraded.

Happened same for me Last year. Declining FYF Infinia reduced my credit limit almost 55%

I got 2 limit enhancements this year. In March got LE from 352000 to 422000. A month ago, it got enhanced to 500000. All throughout, I have been receiving continuous prompts for a FYF upgrade to Regalia from my LTF Millania that I haven’t taken, since Millania is more suited to my use pattern with the card. HDFC has in general, been generous in terms of LE. My worst experience has been with SBI so far. Never gave me an automatic offer, had to approach the PNO with salary slips for the only enhancement. Even Amex hasn’t been great, gave me an enhancement 4 months into my MRCC, and for almost 2 years, nothing from them.