American Express offers are always lucrative because they could get better deals from merchants given the fact that the Amex cardholders are considered to be premium. So here are some of the offers that i feel is worth exploring.

Table of Contents

1. Amex Insurance Offer

- Offer: Get 10 MR Points on every Rs.100 Spend. That’s 5% value in my books.

- Max Points: 5000 MR Points (2.5k INR value)

- Expires: 31st March 2019

This is definitely a nice offer if you’re having upcoming Insurance payments. Note that this is a targeted offer. So if you haven’t received the communication, you may not be able to avail the offer.

Amex has been sending this offer in batches to various cardmembers since past 2 weeks, so you may need to wait for sometime if you haven’t got the communication yet.

2. Amex Hyatt Offer

- Offer: Rs.4000 Cashback on Rs.20,000 Spend (20% Value)

- Condition: Applicable only for first 10,000 Cardmembers. Hope they takedown the link after that

- Source

This offer is there for about a month and it totally makes sense to avail if you’re staying at Hyatt properties.

Moreover, as Hyatt also is running other promos, you may double dip. If you plan to stay longer, you may even use multiple cards to save more.

3. Amex Travel Offer

- Offer 1: 10X points on hotels (Domestic/International) and 3X points on Flights for all bookings made on Amex Travel website. Applicable on select Cards. Not applicable on Plat Travel & Jet Cards.

- Offer 2: 15X points on hotels & 5X Points on Flights on Plat Charge Card & Centurion.

This translates to be 20 MR Points per Rs.100 spent on most cards for hotel booking, which gives nice 10% value. Makes sense for premium hotels as you generally don’t get OTA discounts there.

4. Amex Taj Offer

- Offer: 25% off on Best Available rate (roomy only offer).

- Valid on: Centurion, Platinum Charge, Platinum Corporate Card, & Platinum Reserve

- Source

While this appears to be an amazing offer, i wonder why Amex isn’t aggressive promoting the same. If you’re availing this and paying with Amex voucher received from Amex Plat travel card, you’ll save quite a lot.

5. Amex Paytm Flights Offer

- Offer: Rs.1500 Cashback on spending Rs.7500 & above on flights.

- Source

That’s amazing 20% savings, which is massive discount when it comes to flights category.

6. Amex Zomato 50% Off

- Offer: 50% Off on Zomato online ordering, upto Rs.250 per order, upto 3 times per card

- Expires: 31st Jan 2019

- Detailed Offer info

This is one of the hottest offer i know of at the moment. I’m making good use of it pretty well.

7. Amex Platinum Travel Card Offer

- Offer: Get Platinum Travel Card Free for 1st Year

- Validity: Limited Period offer.

- Get it FREE – Apply Now

- Detailed Offer info

Bottomline

While these are some of the offers that gives good value on spend in my perspective, there are also many other offers like accelerated points on Educational spends, Upto 20% off on select Future group brands, Marriott 25% off on F&B etc. that maybe attractive to few.

Which Amex Offer are you actually availing? Feel free to share your thoughts in the comments below.

10x points on travel is only for plat charge and centurion?

Its 15X & 5X for plat charge & centurion. More details updated in article content. Pls refresh 🙂

Offers are just mouth-watering.

@siddharth Eligiblity for amex cards? Self employed with Net income 4.2 lacs. Am i eligible?

6L on most cards.

You can try the American Express Everyday Spend Gold Credit Card. I used last year’s form 16 which shows 4.6L per annum and it got approved, just a week back. Earns the same tier of Membership Rewards Points as the MRCC. The official eligibility criterion is 4L per annum and the fee is 495 + GST.

You should get it if you have a good credit score, though initial limit maybe rather low. Also, for some reason, the card is not featured on the website and you only get a banner at the top advertising it.

Thanks Ananth,

I’ll try to apply for that card. My cibil score is 792 with no payment defaults.

Regards

Hi Ananth – Interesting that Everyday spend earns same amount of rewards rate. Do you know what are the other differences then given that MRCC is at 2.5K/annum ? There are no special lounge benefit with MRCC. Only thing I can think of it 4 tx/month of more than 1K can earn you 250Rs. as cashback. I am anyhow not using that option. In that case unless there is any other big difference I should switch to everyday spend one. Do you have any suggestions ?

BTW, you are right about everyday spend not listed on website. I saw it in zomato app where if you apply through app, you get 50 zomato points. Thanks.

Well, the part about it earning proper FTO poimts is not even mentioned in the MITC docs, actually the card itself isn’t even properly mentioned in the MITC docs that come with the card. But I saw the Amex Guy mentione it somewhere in the comments and the other marketing materials you get with the card mention that the points never expire. As for a comparison with the MRCC, it’s not too difficult to hit those 4 transaction every month, but that’s not the really benefit I suppose. It’s the 18k and 24k category. If you don’t find use or find it unable to reach that target considering acceptance of Amex is still pretty bad, I’d say the Everyday Gold card is fine.

But even though the everyday spend card offers 10x and 5x partners, earnings per month are capped at 500 MR Points and 250 MR Points respectively. I personally got the card cause I wanted an amex card and hitting the annual spend of 40k for fee waiver is very easy. But when my 18-19 ITR is finished, I’ll be getting a MRCC card as I can milk out more points from that than this one. So if you can hit the fee waiver target on the MRCC, I’d suggest you keep it. But if the fee is eating into the returns you are getting from it, they you may consider getting the Everyday Spend card.

Load paytm every month 4 times and use paytm for fuel/grocery/medicine, etc payments. 4k will get spent easily as paytm has 100 times more acceptance than amex.

You are eligible for one of the cards. I forgot its name where eligiblity is 4lac and above…

Hey Sid, would like to know how the value of 10 MR points per INR 100 spent is coming to 5%?

I value 1 MR point (from MRCC card) to be worth INR 0.44 so that make a 4.4% value for me. This is from the 18k redemption for Amazon vouchers worth INR 8k.

Is there any other good redemption option which increases value of MR points?

Marriott transfer can give you better value, as good as 50ps most times or even as grand as 1Rs at times.

Cool. Thanks for the info.

You should do a piece on how much you value Indian reward points and what are the best redemption for the particular reward points ecosystem!

Thanks for the feedback!

Hi Sid,

When I spoke to Customer Care of Amex, I was told that Marriot transfer is not applicable for MRCC and you have to choose between 18K and 24K

Missed that part!

Yes, some cards donot have that feature.

Marriott transfer is definitely possible for MRCC from the Amex Rewards portal(choose SPG transfer option), I tried it and the points were transferred to my Marriott account the next day.

Are you sure its MRCC and not Gold Credit Card?

The Taj offer is open to American Express® Centurion Card, American Express® Platinum Card, American Express® Platinum Corporate Card, and American Express® Platinum ReserveSM Credit Card members only.

Thanks, Updated!

The link for ‘source’ of Taj offer mentions only American Express® Platinum ReserveSM Credit Card. Where is it mentioned that Platinum Charge cards eligible?

Hi , does this also include complimentary international lounge access ?

Hi Sid,

Is there any cap of number of Amex cards an individual can hold ? I applied from referal link for Plat Travel but they are telling me as I already hold 2 credit cards, I can only apply for Charge card now ?

Your inputs ?

May i know what are the 2 other credit cards you hold? If one of that is not Co-branded, its tough! Usual Limit: 1 Charge Card + 2 Credit Cards

Is there a cap on number of Amex credit cards can individual can hold ? I am told that cap is 2 & I cannot apply for Plat Travel card but choose from a charge card now ?

Here’s my experience with one of the offers:

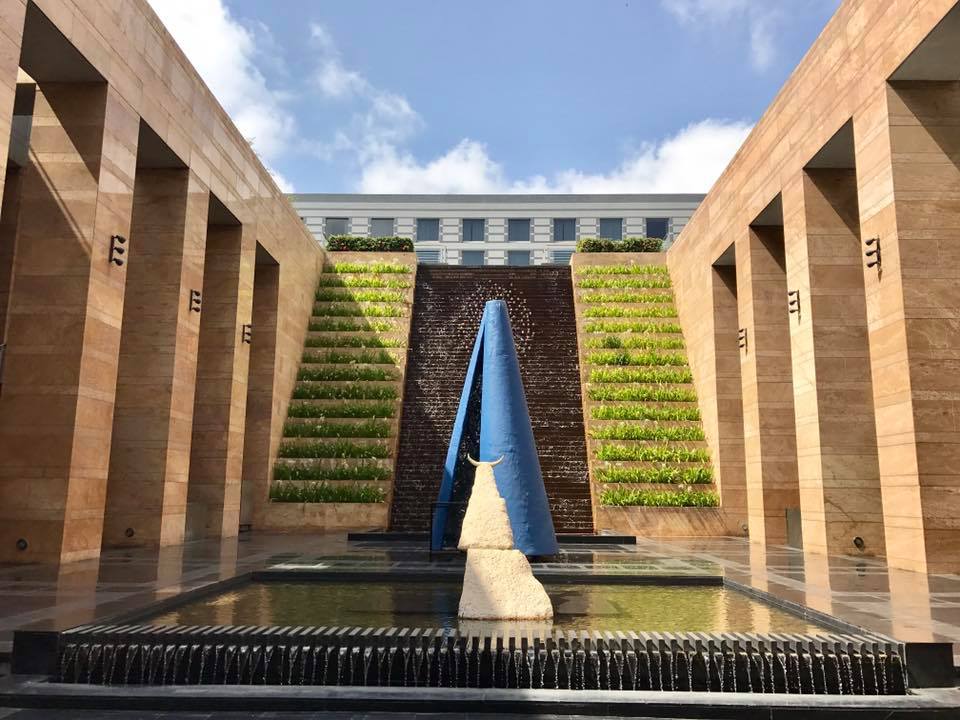

I recently availed the Amex 25% discount at Vivanta Panaji, and got one night for Rs 6500 after taxes. I then used one of the two Taj Epicure silver room upgrade vouchers that come with the Plat Reserve, to get upgraded to a suite which normally costs Rs 20k plus taxes! The suite had a large private balcony and a good view too. Plus I got very early check in, thanks to TIC Silver (and room was thankfully available).

I must say, the Amex plat reserve has definitely been worth it.

Hi Sid,

You could have included Marriott 25% off on F&B and 20% off on spa that is also still valid on Amex.

Cheers,

Kiran

Mentioned it now. Yet, i see Eazydiner works better in most cases when it comes to F&B.

Dear Siddartha,

Im quite a fan of ur work and enthusiast for credit cards.

Recently took MRCC and Axis Privilege after regularly following your blog.

Thanks for fabulous work in bringing all AMEX offers in a single article.

One offer on Amex card these days, is on discount of Rs 500 on MMT Black membership of Rs. 1499.

May be included for zero cancellation MMT Black offers.

Holding Amex Plat Travel Card. Recently got emails for 2 offers:

1. 10% off on PayTm Mall (OFFER VALID FROM JANUARY 22 – JANUARY 27, 2019)

2. A complimentary membership of the Membership Rewards Credit Card (otherwise available at an annual fee of Rs.4,500 plus applicable taxes) as a companion to my existing Platinum Travel Credit Card.

What do you guys advise? Shall I opt for complimentary MRCC?

me too. Got both the offers, if someone here can suggest MRCC as a good compliment to the Gold Charge Card, I would really love to opt for it too.

no accelerated reward points for hotel/flight bookings in Platinum Travel card ?

Guys, update your Amex App to the latest version. It’s sleek and beautiful.

– Fingerprint login

– Notifications for Spend tracking, payment due reminder, weekly balance alerts etc.

– Rewards balance and summary of reward milestones (No longer need to call their CC support)

I hope other companies take a note or two from Amex (especially Citi bank; their app is the worst according to me).

BTW – Amex just offered me a lifetime free MRCC. I already have a Plat Travel, so this one was based on that existing card. I’d maxed out the rewards (taj voucher etc.,) one month into the new calendar year and moved my spends to other non-Amex cards. Got hit with this offer because of this, I think 🙂

This card id LTF only if I maintain the Plat Travel. If I give up the Plat Travel, I lose LTF on the MRCC.

hi.. insurance offer not received.. is this specific to cards and selected customers only?

pl clarify

I also didnt receive. Asked customer care to share the link again for registration and they were happy to help.

Got link in 1 hour after phone call with CC.

I had a very strange experience with AMEX customer service yesterday. The Customer service guy even asked my card’s CVV. Is it safe to give CVV to AMEX customer care? Should I get my card replaced?

Please give your valuable input guys!

@Amex Guy @Sid

Its normal, they usually ask for additional validation, during MR points redemptions.

There is a slight misunderstanding. AMEX guys never CVV number. For Amex, the CVV number is the 4 digit number written on the front of the card. That is the number that you use for all your onkin transactions and credit card authentication for merchants. The 3 digit number at the back of the Amex cards is the number that you may have been asked. That is there as a second factor authentication. So it’s fine to ask that number on the back. It’ll only be asked for the CC guys on some special authentication purposes. Hope this clears things

They do ask for both CVV (Card Verification Value – front – 4 Digits) and CID (Card Identification Data – back – 3 Digits) at times.

Actually, 4 digit number is called CID, and 3 digit number is CSC. The CSC is usually asked for points redemptions and things like FHR bookings. There is no such thing as CVV in Amex world.

I have been asked sometimes just for 4-digit CID sometimes, most recently when I upgraded my SPG number to new Marriott number. Also, when I made a change in billing address.

Thank you guys for clarification,

But still I feel this may compromise the security of the Card; Don’t know about Amex but other bank’s Customer care representative generally have our Credit Card number and Expiry Date on their screens, the only thing which they don’t have is CVV/CID/CSC. Telling them CVV means they now have a virtual hold of our card, and there are many International merchants which don’t require OTP/PIN.

I already have jet -Amex Credit card. Wishing to apply for indusind Odyssey Jet Amex version card . Both are co-branded cards , is it acceptable or they will deny that ?

Thanks.

Can someone share the registration link for Amex insurance offer..

Here is the link

I have got the text after I have paid my car insurance and Health Insurance just a couple of days ago.

bad luck to me. Giving out the link to help others.

What is the maximum points once can earn hotel/flight offer ?

Also, no travel offers for Platinum travel card, thats sad !

Get Rs.4,000 cashback on spending Rs.20,000 on stay at select Hyatt Properties

Save to Card to get a INR 4,000 statement credit on eligible spend of INR 20,000+ in participating hotels by 15 April 2019. Valid once per card for the first 10,000 Cardmembers to save.

I didn’t receive any of above offer mails from them. Holding MRCC. received a future group offer in December’18 saying valid till March’19 but, tried in 4-5 brand factory and big bazaar stores(Hyderabad) every month and they say we don’t have edc machines supporting amex. The amex representative said they are having technical problems at few branches and trying to resolve soon.

I Fear most of this offers are not applicable for PAYBACK Amex card holders.

Satya Paul Vouchers up for grabs in Hot Rewards. Rs.1000 fro 1600 points. Its a steal increases the point value from .33-4 to .625 on Plat Reserve. Redeemed 21K points. It can be perfect gift for your wife,gf or parents.

in online shopping with Satya Paul, how can I redeem multiple 1000 Rs e gift cards ?

Redeemed more total Rs20k for 32k points. Savings of 32k points. Incredible value. Satya paul anyways have very leas sale on its clothes.

Wife happy 😀.

in online shopping with Satya Paul, how can I redeem multiple 1000 Rs e gift cards ?

I redeemed in store but they can be redeemed online and any number of vouchers can be used. I think at the time of payment it will ask for entering voucher code.

Hi Siddarth,

Have you seen the golden harvest scheme of tanishq which is being offered to amex members. 5x points on auto debit payment for the scheme. Offer is from 15th April to 14th July. Its also applicable on the supplementary cards. So one can earn quite a bit of reward points through this and end up with gold jewellery for your spouse or other relative.

Whats your thought on this

Got the 5000 MR Points in my account for my Insurance spend. Great value for me.

Now awaiting the Flipkart voucher worth 2500 on completing spends of 50000.