As you might know, American Express is the only credit card provider in the country to issue charge cards without a limit. While that’s good, the downside is, you can’t carry forward the balance to next month as you’re supposed to clear 100% of the due by due date.

As some card holders expected an EMI option, Amex issued the gold credit card / MRCC as a free companion card, which is similar to Gold Charge card except that its a credit card, so you can carry forward the balance or convert to EMI. But again with companion card, you need to manage multiple cards and once you’re with MRCC, you’re less likely to use the Gold charge card.

What is Amex PayFlexi

So finally Amex has come up with a new option called PayFlexi that alows you to transfer the outstanding from your Amex Gold charge card to any other Amex credit cards that you hold.

Remember this allows to transfer only the outstanding on Gold charge card only and not on Plat Charge card. I tried with one of the plat charge and it didn’t go through. They may have different offer/option in future though.

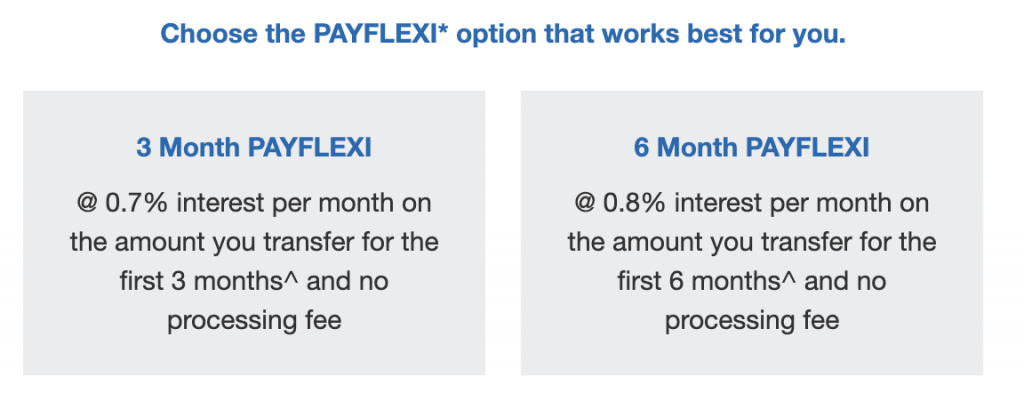

Payflexi EMI Options

The rate of interest above is highly competitive in the credit card industry and is infact as low as an Auto Loan. Not to forget, even the regular EMI option on Amex cards are very attractive.

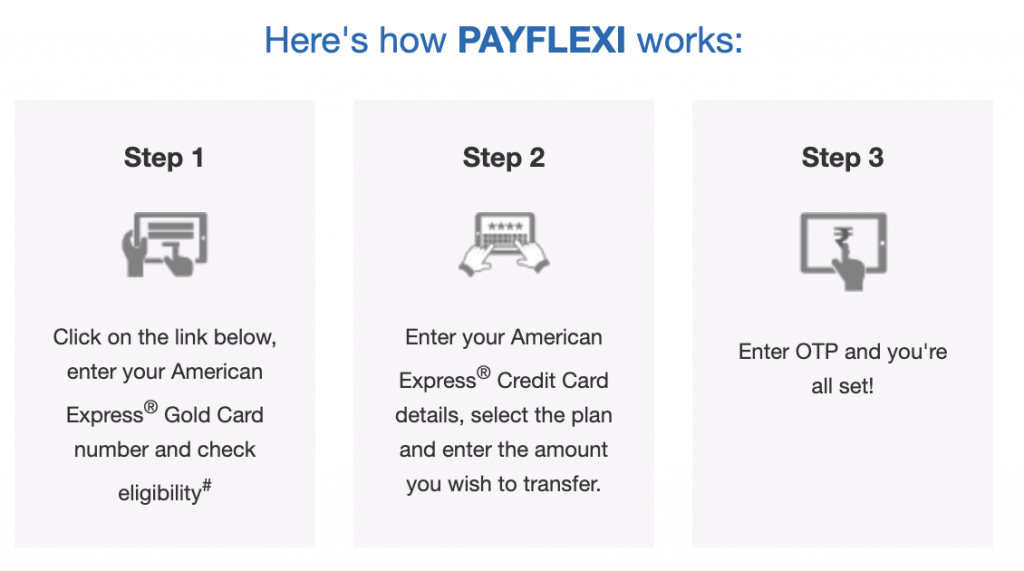

How to Payflexi Works?

- Check your eligibility: Click here

Bottomline

While going for EMI or balance transfer is not something I would recommend in the world of credit card rewards, its still good to have options so that you may use it when there is a need.

Hello Sid,

First of all thank you for providing this valuable and outstanding service. I hold Amex MRCC card. Can i apply for Gold Card and use both the cards? I mean does Amex allows a person to hold two multiple cards? And if so will i b able to transfer card outstanding from gold to MRCC?

Thumbs up to this website.

– Amex Limit: 1 Charge Card + 2 credit cards

– Yes, you should be able to transfer

How does the eligibility work? I have a gold card and MRCC credit card , and it says I’m not eligible.

It seems they made only select Gold cards to be eligible for it, for now.

Thanks for the info

Well apparently I call’d up Customer Care to confirm if I have this option. Apparently they said I am eligible… On this conversation I swiped 1 lakh on Gold Charge card and tried to move it to Payflexi option of 6 months. And Bang.. it didnt work so I had to again connect with Customer Care and escalate this issue where they said they had disabled this option after i made a transaction of 1 lakh in Gold Charge card (Since they have the right to disable Payflexi without informing). After couple of argument calls over closing this card and 15 days of wait they agreed to get it transferred manually. So the option is great but use with caution.

It doesnt show up in CIBIL score as its not an EMI transaction but just a low intrest transaction for 3 or 6 months as per AMEX statements. Technically you can pay minimum due for 3 months and clear full payment on 3rd / 6 month to avoid higher intrest unlike EMI where we need to pay fixed amount in parts.

So an awesome exclusive feature I have not seen in other cards like HDFC, CITI, HSBC, SBI.

Am holding gold charge card is it eligible for flexi pay option

Any suggestions on what the path should be for someone moving from US back to India? I still hold AMEX platinum, Citi Prestige and Chase Sapphire reserve card but I know Chase Bank isn’t here in India.

What are some of the premium cards I should go for?

Global transfer your Plat. Dump US Prestige (You should have already tbh). Do NOT close CSR unless fee is about to hit soon. Your next two cards should be Citi Prestige (Indian) and DCB.

Oh, and keep your US Plat until when you’ve paid fee. Having two country’s Plat is helpful during moving as you get discounts both ways through IAP. Then downgrade it to Everyday or something.

I had Citi Gold hence the fee on Prestige is essentially $100. Although with new devaluations coming in Sep, it doesn’t make sense to keep it. CSR I will keep it, too valuable due it’s awesome partners.

I’ll look into Global Transfer for Plat.

Thanks! I figured DCB would be good based on my little bit of research. But Citi Prestige I’ll think about it.

I should have jumped at the opportunity when Citi offered me to upgrade from premiermiles. But when I saw the devaluation from 1:1 to 2:1, I transferred everything and also ended up moving to States and didn’t think prestige (Indian) would have helped.

hello,

can i able to apply to get gold card and mrcc or plat travl in one application.

I am holding a gold card and a rewards card. Still, i am not eligible

I would like to know if using payflexi option affect my cibil score.

Now they have stopped payflexi as they have run into monthly issues with incorrect finance charges on the card. I personally experienced three months in a row and was almost going to close down the card until Amex realized its mistake and has put a stop to Payflexi temporarily

How to get payflexi triggered for my gold charge Card?