SBICard has been sending spend based offers to selective number of people since long time but i haven’t received any for more than a ~1.5 years. Finally i started receiving spend based offer emails on my SBI Simply Click Credit Card lately.

I’ve received 2 offers, actually the second offer was sent once i completed the first. This article is to share my experiences with the same.

SBI Credit Card Spend Based Offers:

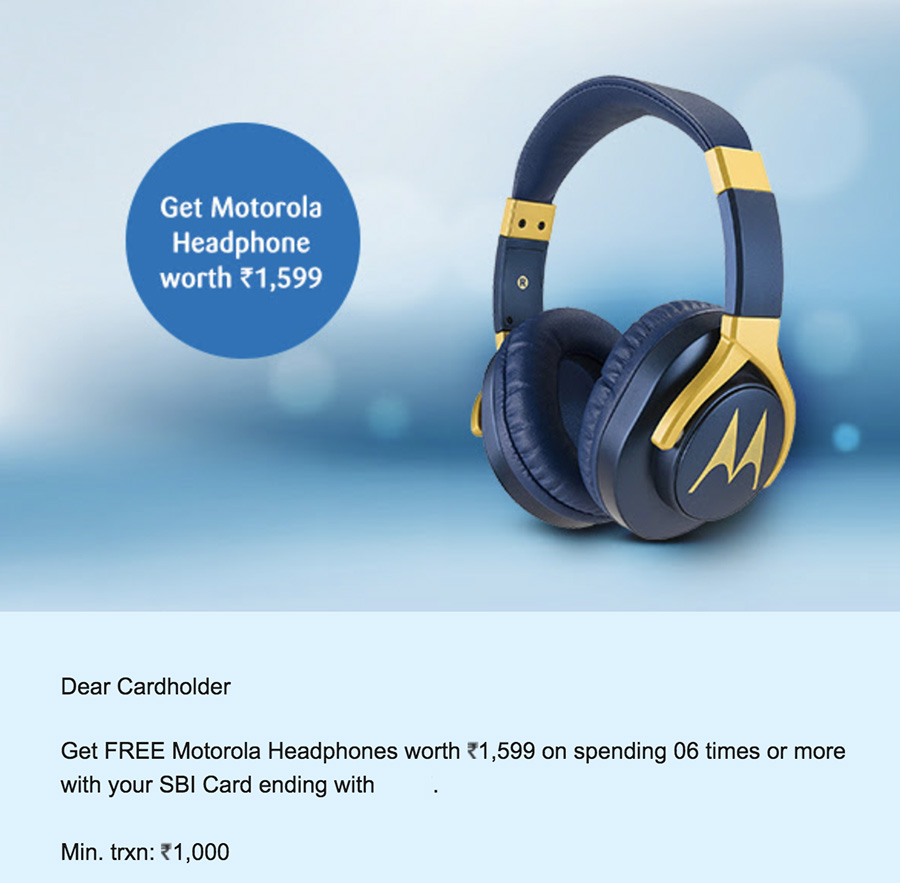

#1 Offer: Get FREE Motorola Pulse 3 Headphone worth Rs.1,599

Get FREE Motorola Headphones worth Rs.1,599 on spending 06 times or more with your SBI Card.

- To do: 6*1000 = 6,000 INR Spend

- What you get: Motorola Pulse 3 Headphone

- Fulfilment: 45 days from offer end date

- Retail Value: ~ INR 1400 (as on amazon)

- Reward Rate: 23% (WOW!)

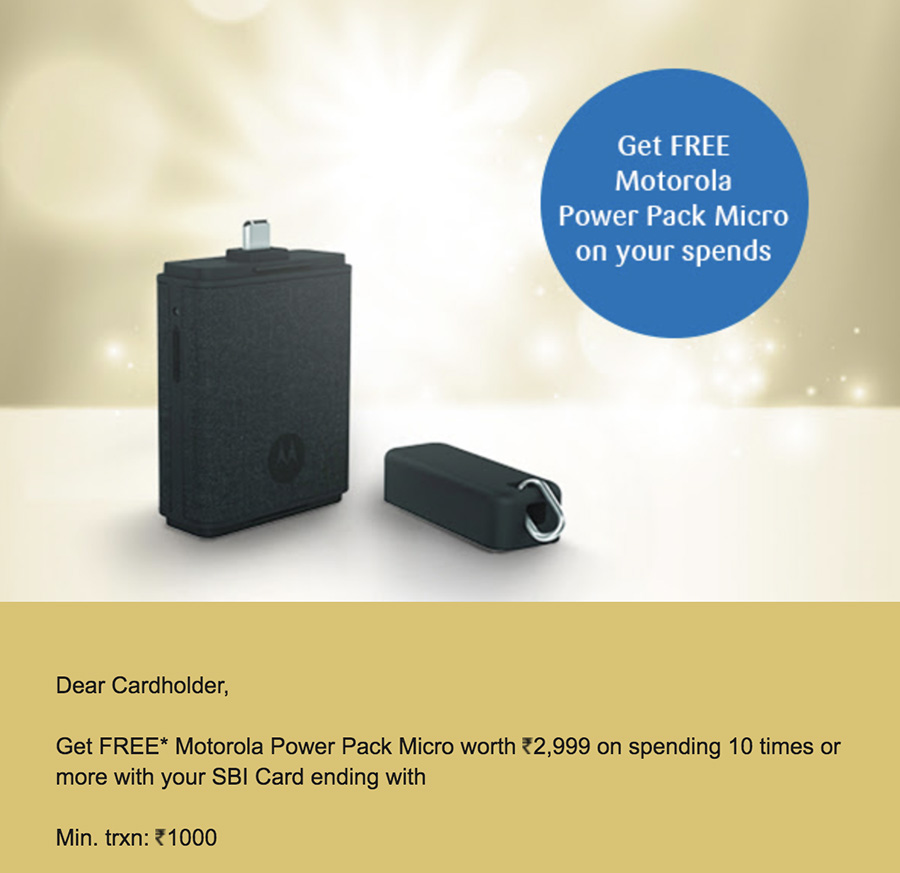

#2 Offer: Get FREE Motorola Power Bank worth Rs 2,999

Get FREE* Motorola Power Pack Micro worth Rs.2,999 on spending 10 times or more with your SBI Card.

- To Do: 10*1000 = 10,000 INR Spend

- What you get: Motorola Power Pack Micro Powerbank

- Fulfilment: 45 days from offer end date

- Retail Value: ~ INR 1000 (as on amazon)

- Reward Rate: 10%

Here’s terms & conditions, same for both offers.

My Experience in redeeming the Gift:

So i took the challenge for the first offer and made the txn’s as required. I was sent a link to redeem the gift on exactly 45th day from the offer end date. The offer was fulfilled by “Gift Ease” and they’ve a SBI specific landing page to redeem the gift.

Within 10 days of redeeming it, i got the motorola headphones at home. The design/colour is just OKAY. But the sad part is one side of the headphone doesn’t work. So this is how they’re able to do this whole stuff? by selling the defective products as a part of promo.

Anyways, they’ve accepted for replacement after 2 followups and i’m currently waiting it to be picked. Will update when i receive the replacement product.

Bottomline:

As you can see, the reward rate in such spend based promos are super high, as good as 23% once and 10% on the other, which is a great number. But what you need to know is, will you actually get this product if not through this promo? If the answer is no, the reward rate really doesn’t actually apply to you.

Remember, there is no point in getting things you don’t want, even if you get it at 50% discount/reward rate. For me as well, i wont be interested in getting this product if not through this promo, but i felt its a good gift to give to the family/friends 🙂

That all being said, such spend based promos certainly helps to increase the overall value that you get from SBI Cards. And so its wise to have an SBI card in your wallet, probably the most popular SBI Prime or SBI Elite if you’re a movie buff.

Have you received any spend based offers from SBICard? Feel free to share your experiences in comments below.

I have already crossed Rs.1L milestone in sbi simply click very quickly. Its been 8 months since card setup and i havent received any offer.

Same way icici has also extended its dineout offer on the amex cards.

Consider seasonal spending, like spend 2L and leave the card for ~6 months.

Thanks for the update on Dineout. Helps!

My wife’s simply click is used 50% of its limit every month. Yet she received the offer for power bank. I think the card should be old ( like 10 months ) to receive such offers.

I am having simplyclick card and my usage is also pretty high but never received such offers 🙁

AFAIK, You wont be getting offers when the usage is high. I got this offer when my last ~6 months spend is <5000.

I have downgraded my SBI Elite card to SBI Simply Click last week. The processvwas completed over a phone call. Not finding the Elite card useful enough anymore since i wanted to shift all my spends on to HDFC Regalia and Yes First Preferred. Hopefully i ll get the Dinersclub Black and Yes First Exclusive by the year end.

Ah finally you too moving out of Elite 😀

Hey

I also received the similar mail for my SimplyClick. It was for Motorola Headphones. Later on, received another mail for some duffle bag worth 3k with 10 txns.

I did completed the offer for headphones and received them in good condition. This offer is really good in my opinion as almost all of us uses headphones now a days and getting something like this for such low txn value is a nice thing.

Good to know that you’ve availed the headphone as well.

@vinod,

Dear do let me know if you get upgraded to diners black by the method(sending itr with computation of income) u had mentioned in diners april 2018 update post.

Hi Dhruvil Patel!!

Nope. They rejected my request saying income was not sufficient. They did not consider my Annual Turnover it seems. Anyhow, I did not even have a regular savings account with HDFC when I requested for Diners Black Upgrade . So They have no reason to give me their highest tier card. But, My sister Holds a HDFC Preferred account. So, I opened a Savings account with HDFC immediately and we have asked my sister’s RM TO Convert my regular savings account to Preferred status ( Upto 5 family members can share one’s Preferred status). She promised me dat i ll get Preferred status in 4 working days. When I told my sister’s RM about the Upgrade, she told me dat she ll get my IT docs after my account has been converted to Preferred Status and dat she ll look at what she can do about it. Will keep everyone posted.

Hi Vinod,

Bro thanks a lot for the reply, appreciate that.

Yeah i was wondering too if on basis of turnover if they can do it then it’s a great news for people like me and you.

Anyways wish u best of luck for next time. Whenever u get the upgrade just let me know by which means u got it. That will help me go do it for mine.

Hi Vinod,

I have Imperia relationship (through my brother’s account) but even then the DCB upgrade is not happening LTF 🙁

Pls keep us posted here.

Why are people moving out of the SBI elite?

Not everyone can spend 10L to hold it for free. Moreover, Prime is equally attractive.

Because before devaluation 5L spends was enough to earn 18000 rupees on SBI Elite. Now it’s 10 Lakhs. If we distribute those 10 lakhs on other cards, Eg: 4L on Amex Travel Card = 29500 Rs, and 7.5L on Yes First Preferred = 20000 Rs. So, u can earn nearly 50000 Rs by shifting those 10L spent on SBI Elite to other cards.

That’s My reason for moving out of SBI Elite… Isn’t it right Sid?

Certainly. For non-movie addicts, they should add additional milestone for 10L spend for the card to look attractive.

It is definitely linked to the usage. I have 2 SBI cards, one i use regularly and other very rare. I Got 2 times headset offer in the past 3 months and now got the amazon voucher offer on the card I use very rarely. No offer on the other card.

@Sid,

I hold Prime Card with just 84k limit from last 14 years, its my very first credit card with 4-5 times limit enhancement requests turned down in recent years they just don’t increase the limit with all the documents and ITR Proofs and also however I hold a SBI FBB Card with 5l limit. SBI FBB is a useless card. I am planning to close my current Prime Card and Get the SBI FBB Card converted to SBI Prime. What do you suggest?

I never closed my SBI Card just because it was my very first credit card and also the oldest cards I hold which again also helps keeping my CIBIL Score .

Do you suggest any Co-Branded SBI Credit Card which is worth the swapping with current FBB SBI Card ?

I assume both are unsecured cards. If so, then thats the reason why they aren’t considering your requests, as the other one has high limit. Yes, you can do that and maybe apply for new card later.

Btw, did you apply for second card online? I’m planning to attempt for second card via branch shortly.

I applied one in a Big Bazaar Outlet few months ago and received within 3 days. Though few years back SBI didn’t allow customer to hold two cards even if its a co-branded.

BTW can you suggest a good co-branded SBI Card other than Air India which is again a useless IMO

Only AI Signature for now. Its still good if you want to explore other Biz class products under star alliance.

Jus a doubt. Prime card was launched recently and you told

“I hold Prime Card with just 84k limit from last 14 years”

Hows this possible?

Dear, is it possible to hold 2 credit cards from Same lender as u mentioned u holding SBI prime and SBI FBB card?

I am using SBI Prime since 4 months which is pretty good but Simply Click seems to be better for online spends. Do I need to wait for few more months to apply for another SBI card?

And if I use Simply Click card to top up Amazon Pay (not direct spending), what will be the rewards rate 10X or 5X ? And if I load my Paytm wallet, will it be 5X or 1X ?

// SBI Simply Click e-shopping rewards

Earn 10X rewards on online spends with exclusive partners –

Amazon / BookMyShow / Cleartrip / Foodpanda / UrbanClap / Lenskart / Zoomcar

Earn 5X rewards on all other online spends

Earn 1 reward point per Rs. 100 on all other spends //

I also got this offer of “Get FREE Motorola Power Bank worth Rs 2,999 with your SBI Card” during Offer Validity: 25 Feb – 20 Mar ’18. Even after spending 12 times more than 1000, I didnt get the coupon email. Last time when I got such offer they offered 1000Rs. Bookmyshow voucher for 10 transactions worth 1000 in the defined timeline. I am following up with customer care about the issue this time..