Waring: 7.5% rate is used to calculate the monthly repayment amount. The above rate of interest translates to 13.57% p.a. reducing interest rate and is used to calculate the amortization schedule of Flexipay.

I received this super targeted email from SBICard yesterday which was mind blowing. SBI is ready to offer 7.5% interest rate on EMI conversion of a particular transaction of mine with 100% processing fee waiver if i convert Rs.50k or more to EMI. I received this offer on Air India SBI Credit Card which i received recently. I’ve been receiving couple of EMI offers from SBI on my other SBI Signature Card as well, but it was never as attractive as this one.

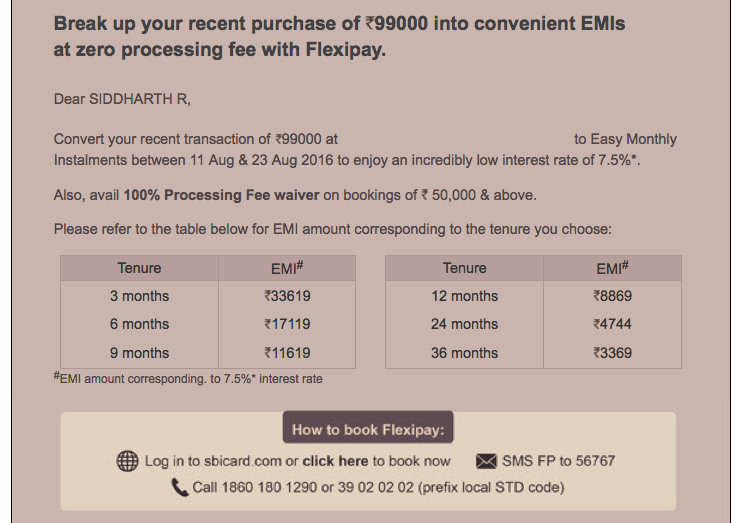

SBI Credit Card EMI Offer at 7.5% Rate of Interest

How the hell!! Even housing loans are anywhere around 9.5% and this looks so much fake (It is Fake number). Maybe they have some interesting business model on high value transactions. Its understood that there will be additional 15% service tax component on this interest rate but I still wonder!

I’ve never seen such kind of low interest rates in the industry ever and had always thought HDFC has the lowest interest rates on credit card with all its Insta loan and EMI offers that they refresh from time to time. The lowest with HDFC i’ve seen in past 2 years is 11.99% with 100% processing fee waiver.

Looks like SBI is now up in captivating the EMI on credit card market which HDFC is taking advantage since long time now.

Update: 7.5% (Flat interest rate) number is used to lure customers. The actual number is 13.57%(reducing rate of interest). Good enough, but not as good as HDFC’s 11.99% which i’ve even opted for once on my Dad’s card as mentioned in above link. Thanks for everyone who put some light on this via comments. I could see how easily SBI can make people fools 🙁

While the offer is eye catching, i received it when i don’t need it. Have you ever received such offers with attractive interest rates? Do share your experiences in comments below.

do not go in trap and do some calulation with mind 12*8869=106428- 99000=7428 this shows that bank says 7.5% rate but accutual rate is 13.2% understand for proof go to emi calulator and fill 99000 as principle and 12 month as tenure and interest rate as 13.4% and see the calulation i am also a card expert and knows everything very deeply

7.5% is customized offer and i cross verified after logging into the a/c and the numbers are correct. Maybe its not a public offer to everyone 🙂

go to hdfc bank site and avail insta loan for 99000 for 12 month @13.4% and check emi amount and note that emi amount is same 8869 +-1

True with HDFC, but this is SBI offer bro. Something new with SBI.

you say it is not a public offer this is a trap and everyone recevie this type of offer with good credit histry

bro i know this is sbi offer i give u example of hdfc bank and you are so smart to understand that maths principle is always same for every bank on this world i am a infinia card holder and you exactly knows the infinia value this type of offer is not come to infinia like card please reply fast

Lemme re-confirm with SBI and update the thread 🙂

Hey Sid, 7.5% is a flat rate of interest. It converts to 13.57% pa on reducing balance. U can see that in your Flexipay confirmation page. HDFC offers 0.99% per month on Reducing balance. So this is a useless offer

Vinod,

I don’t know where i’m missing.

To find it, i tried to convert 10k to EMI and my installment is: 895.83 INR on final page.

896*12= 10,752 INR

Forgetting processing fee, that’s just 752 INR which means its far less than the standard 12%(yearly) / 1%(monthly)

Where am i missing the point?

Maybe i’m very bad at mathematics, apologies 😀

Lemme know, so i can update the post accordingly 🙂

Consider a loan of Rs. 100 for a period of 12 months at 8℅ flat Interest and 15℅ reducing interest rates.

A. Flat Interest:

Rs. 100 principal at 8% flat Interest rate means Total interest payable for 12 months is Rs. 8.

Total Payable: Rs.108.

This can be converted to a monthly installment of Rs. 9 (9×12=108)

B. Reducing balance:

Using the EMI calculators, you can see that an interest of 15℅ on Rs.100 actually translates to an EMI of Rs. 9.

So, you can see that an offer of 8℅ flat interest is pretty much the same as 15℅ interest calculated using the reducing balance method.

OMG. SBI is playing with Flat interest rate. Never knew this. Updating thread. Thanks for the info.

Thanks a lot UK!

You are missing at the point that, after paying emi for first month, you would be paying emi on 10000-895 rupees in second month and 10000-895-895 in the third month and so on and so forth. So that’s the reducing balance. So now if you calculate the interest component of each month considering 7.5% interest only than it can be calculated as

(10000-N*X) * 7.5/12 this should be your interest component. where N is the number of month, 1st,2nd,3rd…… and X is the EMI installment.

If you calculate the total interest by calculating through the above formula and some it up the entire year , it will come less than the 752 or to be exact 411 rupees. EMI per month would be 868 rupees per month if the rate of interest is 7.5%.

Hope it clarifies the doubt.

Rahul,

Thanks for the detailed info.

Yes, i do understand the difference. between Floating Interest & Flat interest rate.

Updated the post accordingly.

Again this is not flat and floating interest rate.

Flat rate is that interest rate which remains same through the tenure of loan, even if interest rate increase or decrease in other segments due to RBI repo rate.

Floating interest rate is which might vary through the tenure of loan, mostly long term, 10-20 years loans, as interest rates rise or fall as per repo rate and banks pass on the same to customer.

What CC charge are flat interest rates only, but on reducing monthly balance.

No CC charges floating interest rates, as credit period is not long enough like 10-20 years oF CC emi.

Hope it clarify the things more clearly.

Hi is there is any method to convert credit card balance into cash without swipe

You can check if they give loan on card.

Tks Siddharth.

Even today when I closely monitored it, actually its a trap.

On a related note, Bajaj Finserv guys fooled me with a similar trick when I took a furniture loan quoting flat interest rate of 4%. A day later my wife realized that they haven’t used the reducing balance method. One has to be very careful with the math before availing loans from these publicized offers.

Hi guys, I have read your posts, thank you for the information.

However, I have lot of confusion on this now.

I have made a transaction of Rs.38000 on my SBI Platinum card.

When I contact the customer support, they said it is 14.5% and later I got a message that convert your transaction into Flexiplay at an Interest of 7.5%.

Please help me what will be my Interest now.

Thanks in advance

Reducing rate: 14.5% (this is what the bank has to say and this is what is charged on your outstanding)

Effective Flat rate: 7.5% (this is what you actually pay, it is lesser as your outstanding gets reduced over time)

Hi Guys,

I would require a piece of suggestion from experts, can I Transact amount of 100000 in to my Savings Bank A/C, what is the amount of interest rate that I would be availed, I am in a Financial glitch so I was planning to avail a credit card and transfer the amount o my Saving Bank A/C will it help me or should I get a personal any suggestions would help.

Thanks

You might need to check loan on credit card for this.

I want to convert my transaction amount Rs 20200.

In 6 Emi please send me conformation..

Once again, I need to clear my doubt since I just now got this offer of 7.5%.

Even if it is about 13% by reducing balance principal, is it advisable to opt for the offer since I can get almost 8% on any company FD. By using the EMI option, am I making/saving money.

Please reply ASAP.

Offer is true .But,7.5% is reducing interest.processing fee is waived till 30.06.2017.GST is 1% and there is service tax as before.There is 3.35% interest till flexipay approval. (from date of purchase).So,you have to pay interest,fee,GST and service charge.

clarification

3.35% on revolving balance and 7.5% is fixed

FOR RUPEES 30000 YOU HAVE TO PAY 10187 PER MONTH PLUS TAX for 3EMI

sir i had received my credit card from 1 july and i make a payment of 14999 on flipkart on 6th of july but whent i make it emi using flexipay its show that ( Sorry! Your FlexiPay booking was unsuccessful. Please try again later or call SBI Card helpline at 39020202 (prefix the STD code of your city). ) now what i do plzz help me with that

because i have just only 30 days to make it emi …..

Hi Siddharth,

Its good i have been reading it all and its educational . I just want to you , is it all same for all the cards of sbi ? or just the one mentioned above ?

Right now i am using SIMPLY SAVE.

Please reply asap.

Thanks

I have received the similar offer from the SBI. should i go for it or not in my HDFC i am getting the interest rate of 16% which is too high.

I have a question

If i want to convert 50k into emi what is the maximum tenure in sbi. for instance 12moths

so just wanted to know what is the maximum months for the emi

hi iam using sbi credit card my question is can i convert gold purchase into flexi pay previously garments i converted in to flexi pay but my doubt regarding gold purchase please help me with answer

i have booked an amt of 50k for 24 months.

Now every month emi is Rs2395.83 having IGST 72.08 every month.

Again checked they have deducted LOAN INT AMORTIZATION (EXCL TAX 72.08) Rs 400.06

Can anyone explain about this amount please?