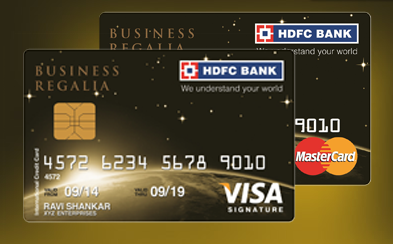

My HDFC Business Platinum Credit Card has been recently upgraded to Business Regalia and i’m enjoying host of its benefits already. The credit card comes with a Priority Pass membership card which has to be used to avail complimentary airport lounge access across the world and a shiny few pages catalog. The card looks rich enough to get compliments quite often. 😀

Typically, all the features and benefits are as same as the retail variant of regalia credit card except that the business variant can be availed only by business owners. And a nice feature in HDFC business cards is that you can put your company name below your name as displayed on the picture. I was initially given without the company name but was said i can avail it if required.

One additional advantage of “Business Regalia” credit card is that, it gives extra 2 lounge visits/quarter through Visa Signature program apart from the priority pass membership. That is 8 additional visits/year. I’ve availed one recently and it works pretty good 🙂

Lessons learned during HDFC credit card upgrade, so you can avoid:

- While upgrading from cashback card to points type card, you need to chase the bank to fix the points issue during the migration. Its better not to spend anything during this migration cycle.

- They sent me MasterCard by default. Looks like i should have mentioned VISA in up-gradation form.

Before i went on with the upgrade i was said that the business regalia credit card usually comes with a better credit limit than the retail card, yet i din’t get high limit.

The major reason for me to own this credit card now is that the Foreign currency markup fee is lower (2%) with decent reward points system. Also it serves as a testing platform to try out complimentary airport lounges which is gonna help me a lot in the future. And the final reason is, it makes things easy to upgrade to the next level of card which is Infinia Credit card, the one i love the most for obvious reasons 🙂

- CardExpert Rating: 4/5 [yasr_overall_rating]

Wanna say something? Drop your comments below.

I have seen many online / instore offers available for credit card holders (smartbuy website ) offer upto 5x reward points… Eg. dmart offer , bpcl fuel offer….they specifically mention that 5x rewards only applicable to retail cards and not commercial cards ( which business regalia is ) … So wondering commercial card is worth or not since its similar to regalia retail card which only have person name not the business name on it… Correct if I m wrong… I recently got regalia businesa life time free…. But was disappointed after find drawbacks on business card in accelarated reward point gaining…

Deepesh,

Yes, that’s true.

Most offers these days are not for Regalia Business variant.

Note: Business & corporate cards are diff .

For ex, 5x points on Payzapp is not avail on Corp card, but avail on Biz variant.

Btw,

I got my card replaced with my company name later. You can request the same as well.

I inquired the bank, and they mentioned that they issue Retail Regalia to only salaried person only not to selfemployed person , incase the person is selfemployed or having business… than they will only issue BUSINESS REGALIA and not the Retail version of REGALIA. The Retial version only consist the name of the owner on the card and BUSINESS regalia consist both the name of the owner and as well as the name of his own firm… in my case my busiess regalia has both my name and name of my company… and must say the card looks damm glittery and premium…

Hi i have a regalia card (personal card), and by profession i am self employed.

So the question is am i eligible to apply for a business regalia since i already have a personal credit card.

I have tried applying it online but it could not process at that time. I have been told sometime back by the bank that if you hold one personal card you cannot apply for one more card from the same bank (even a business card).

Hi siddharth

Right now i having hdfc bank visa platinum business money back card and bank is offering me an upgrade to visa business regalia first should i go for it or not.

please help

Thanks in advance

You have to 🙂

Hi Siddharth, I had applied for retail regalia but they have given me a business regalia by mistake (or maybe cause I am self employed) and now I am stuck with this card because it doesn’t have any of the retail benefits that I had actually got it for. Could you pl share how to go about changing this to the retail variant?

Its not a mistake, they have given purposefully 🙂

I’ve heard i can change it but i have not tried it though.

Hi,

I applied for regalia card and got business regalia instead. Whats difference between both? Any loss in future upgrade for business cards vs normal card? Pls help. They asked to spend 60000 for fyf. But if i do autopay any bill , and dont spend 60k , will it be ltf? Its my first cc

@siddharth

My dad received a business regalia credit card with annual charges. Is it possible to convert it to LTF card?? If yes, then how do i go about it?

Also, if i get an add-on card on business regalia card, will the add-on card have airport lounge facility available or is it only for primary card holder??

Talk to bank for LTF.

Addon is free, Priority pass is free, but can be used in Intl lounges only.

Just to confirm…. addon card holder can use intl lounge only and cannot share the 12 domestic lounge access??

I received my Regalia First Card today after renewal from expired superia card and after I spoke to HDFC guys to issue Diners Black/Premium card they are saying I can get in exchange for current card i Hold to Diners Club Rewardz variant card, should I exchange my Regalia First card to Diners Club Rewardz card ? or stick with Regalia First card ?

However I don’t travel by flight. The 10x rewards program is too tempting. 🙂

If you spend with 10X partners, yes you can get Rewardz. Acceptance is another thing you need to be aware of.

I have applied for Regalia on card to card basis. My CIBIL is 875 and my standard chartered card limit is 2.5L. What are the card approval chances and will I get regalia?

The only problem is that my home address and office address are same and I don’t have a landline number.

HDFC Needs a LL number.

Thanks for this wonderful blog.

What is the typical procedure after filling up an online hdfc credit card application and getting e-approved? Just submit income and address docs?

A friend told me that few months ago after his online application was approved, the rep who visited to collect documents made him sign a paper form, asking questions like “which card was your application for”. In the end, the application was rejected despite proper docs (so he says).

But I wonder if such a paper form is necessary after completing the details online, or if the rep made him sign another application under his code.

Best way to apply for HDFC card is via branch.

Dont go for Business Regalia card if you are looking for points or exclusivity or something like that i got this card few days ago and u wont find any 5x points or discounts for this card i spoke to the bank representative he said we have withdrawn the Air Vistara Silver membership aswell its just Priority Pass they are providing these days which is pretty normal u can get it with any credit card. Can someone tell me any bank offering card to card credit card?

Got an upgrade from moneyback to regalia first this march. Though its better than moneyback card, it is nowhere near regalia to be called even as regalia first. 3 PP access only per year? And the rewards point redemption value is low too. Only by looks, this card is similar to regalia… otherwise it is just ome step ahead of moneyback rather than being mentioned as one step below regalia. I am a student and am not salaried and they issued me a moneyback creditcard last year and based on my usage they increased my limit from 50k to 1lakh in 10 months. Subsequently was upgraded to regalia first. When can I expect an upgradation to regalia? PS. Like the editing software you use to blur sensitive credentials of your card. Mind sharing the name of the software?

Thanks.

Upgrades are a/c specific and has lot other factors, contact your RM. My VA does it for me.

Update on HDFC website for HDFC regalia credit cards :

Effective 1st July’2017,

a. EasyEMI and e-wallet loading transactions will not accrue Reward points.

b. Reward points accrued will be reversed if a retail transaction is converted into SmartEMI.

c. Reward points accrued for Insurance transactions will have a maximum cap of 2,000 per transaction.

what is the difference between reward points using SmartBuy and Regalia website?

Regalia website booking will fetch 8 points per 150 spend, smart buy says 10x reward points i.e. 40 points per 150 spend? Can someone please confirm if above is correct?

What is the difference between Business regalia credit card and Business corporate regalia credit card?

Business regalia – Proprietors/partnership

Business corporate regalia – Limited companies.

Its issued based on the type of entity you hold.

Siddharth, i have a credit limit of 3.9L with regalia so am I eligible for upgrade for diners club black cc? Also what is best stay with regalia or upgrade to dcb? I am a doctor by profession and i had good loan relationship with bank and also classic hdfc account since 3-4 years…so what are my chances for upgrade to dcb? Please reply as soon as possible

Depends on NRV with bank, “investments” are important than “loans”. You need to be at-least Preferred to make a case for DCB. Better to check with RM to see if he can help.

Hi Siddharth,

Could you please write an article on – Best ( value) business credits for small business limited companies ( not large corporates).

hdfc bank provided me ltf business regalia with 3l limit.As this is my first card I don’t have any idea about personal and business variant.Now I a realized that I cannot avail 10x rewards.How to change card from business regalia to regalia(personal)?

You can get 10X point on business regalia also

I cannot earn 10x points on flipkart and amazon

hi

@harsha

@Sid

yes you can get offer for amazon and flipkart also for business credit card they have special offer from Feb 1st check on hdfc some are

Special Sign-up offers on MMT myBiz , Amazon Business

5% Cashback on Telecom, Electricity, Government/Tax, Railway, Hotels & Dining and Taxi

Note: Maximum cashback of Rs.500

10X points on smartbuy , redbus, amazon business , uber , MMT ETc

Yeap. Business variant of the credit cards are usually not approved for rewards.

Hdfc bank recently upgrade my buisness regalia first to buisness regalia with 5 lack limit tell me the way of upgrade my credit card to infinia i want infinia card

Read the write up on HDFC Infinia card on the site!

i have an add on card for my wife along with priority pass ,is 6 priority pass lounge visit applicable for each member or is it combined for us both.

Combined.

Hello Sidharth

I am Sidharth from Bangalore , I am a self employed I have an ICICI Bank credit card with 7,40,000 limit Hdfc is offering me card to card basis business regalia or dinners club black which one should I go for my primary requirement is rewards n lounges n I travel within India

HDFC Regalia or Hdfc Business Regalia, which one is best. and can add on member gets free access to domestic lounge in these cards?

I m getting both cards

Thanks for the good article. How can we get our card upgraded ? I mean what is the correct procedure ? I want to get my Business Regalia upgraded to Infinia or Diners club . Is it advisable ? and if yes then whom should i approach?

Hi Siddarth

I have regalia first credit card now

And today shown business regalia card.please telll me about business regalia card.it is worth this upgrade.please advice me

Hi Sid

I have regalia first credit card now

And today shown upgrade to business regalia card.please telll me about business regalia card.it is worth this upgrade.please advice me

Hi Sid,

I’m holding a regular regalia for last 1.5 years with CL of 4.8 lacs. Now netbanking shows upgrade offer to Business regalia. Is there any benefit or downside for this upgrade? I was hoping for Diners Black.

HI Jai,

Don’t go for the offer. You never able to get Diners black once you move business card.

@sid

I need your clarification for this one pls reply…if this is true if I upgrade business regalia and can’t upgrade diners black in future

HDFC as such don’t have a rule that applies/works for all.

Have seen this issue with some. So better to stay with the regular Regalia.

But in NetBanking only shows upgrade to business regalia . Otherwise I will send my itr to chennai office. What I do now

I upgraded to Diners Black from Business Regalia about six months ago.

How much limit when u upgrade regalia to diners black card bro…

Any benefits

Isn’t business Regalia the FD based version of regular Regalia? I don’t understand why they’re calling it an upgrade. May be I’m missing something

@sid or anyone

In business regalia is not getting spend based offers is true anyone know

If my annual spend is 15 lacs , which card do I get better value back , the standard chartered Ultimate or the HDFC Business regalia credit card ?

@Sidhharth Sir or anyone..

If my priorities are not Lounge access n Infinia Upgrades.

Then

Millennia is better or what for cashbacks than Regallia??

Do you Regallia/Business Regallia Card users always receive like once or twice a year”Spend Based targets like spend xxxxx amount to get 7000vouchers or 1000 voucher”

If this spend based target is regularly or yearly nor half yearly given then I’l stick to Regallia Business otherwise get back to Millennia Bcoz Millennia is more rewarding with Limited spends like 5x Smartbuy+extra 5% Amazon cashback, same 1% Smartbuy+5 % extra FK cashbacks n more..