Its in my wish list for quite sometime to start a relationship with Citi and the Citibank Premier Miles Credit Card is indeed a decent credit card with Travel benefits to start with, except the renewal fee part. Also, there comes Rs.1000 cashback offer (still up) that was running for a while and so its the best time to apply for the Citibank Credit Card.

Hence i applied online for the same just to know that i was rejected due to internal policy criteria. This is infact after address verification and document collection, which is common with other banks as well.

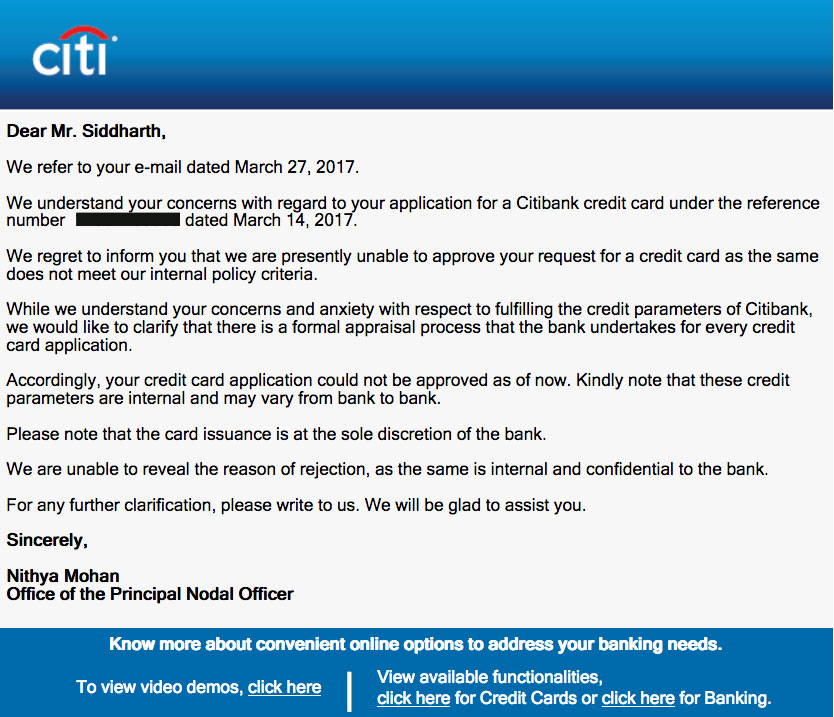

Reason for Rejection of Citibank Credit Card Application:

I tried to email the Nodal Officer to find more info on the so called internal policy but again got an email response stating the same reason. It’s obvious that they don’t disclose the actual reason, but well, it’s clear when it comes to my account.

So what is the actual reason? All my documents were perfect and the sales guy was 100% sure that the application will go through if CIBIL is okay. Now this is where the problem comes. I checked CIBIL to see an inquiry by Citi and the CIBIL score was well above 800 without any over-dues or blackmarks, but hey there are hell a lot of credit card accounts on the report. Flags Raised!!

It’s obvious that some banks consider it to be risky when a person has too many active unsecured accounts like credit cards & personal loans as this exposes the customer to a very large credit line which is considered risky than those accounts having fewer cards.

Too Many Credit Cards are sometimes Bad:

Before all these, i visited the Citibank branch to see if they have any offline offers. And when i mentioned him in the conversation that i have about 5+ cards, his tone went down. He mentioned that he had seen many applicant’s cards getting rejected when they have many other cards with them.

Hence it’s obvious that CITI Bank has rejected my application for the same reason. However, I believe they’ll approve it if I apply for the second time, probably in 6 months or so. Though, they might expect a good repayment pattern and no other new cards added in meantime. Let’s see how it goes!

Have you ever been rejected for Citibank Credit Card? Share your experience in comments below

Well mine got rejected Thrice with citibank despite having a great cibil score of more than 800. The third time, i came to know that it was because of the number of enquiries with cibil in the past year (bankbazar and paisabazar screwed it) and the number of active credit cards i had. So i waited for 8 months and applied again. Finally got it approved on the fourth time. Also the interest free credit period was 48 days rather than 50-52 days as with other credit card companies. Other than that its a very good credit card with an Earn rate of 1.8%.

Sounds good, did you apply both online?

Sometimes, they are approving easily if applied via branch, have experienced with HDFC, unsure of Citi.

Ya… I applied it online everytime…

My application was rejected as it was on card to card basis and I was asked to submit proof of income. Then it was processed comfortably..

But coming to Rejection, SC and Yes are becoming notorious for this. There field executives who often physically verify do not send a favorable report. AND often multiple visits are made and they wish to meet the applicant during office hours..

Be careful about yes bank verification executive. For simple road or cross missed. They will send negative report . Yes bank verification executive team are very bad and nonsense.

I didn’t have ANY problem getting an SCB card though…After applying, I got the card in my hand within just 10 days…

But Yes is always NO to me lol….Their name should have been NO BANK… 🙁

Agree… Yes bank CC was the only time ever my CC application was rejected. They have great product but pathetic, unprofessional people. They want to call the office number and they expect us to be seated at the desk whenever they call. May be they have been dealing with high school kids prior to this.

Stan Chart went through without much fuss when I applied 4 years back. But they certainly have a long memory…. they knew that I earlier had Standard chartered card (5-6 years before that) which I had cancelled after using for 1 month (as I was misinformed of some features)… but there was no problem as such…

Probably this is the reason why my yes bank exclusive application was rejected. I have 7-8 credit cards.

Not sure if Yesbank too has this criteria. Exclusive is getting tough for many, tried for Preferred?

No i havent and dont want too. i have 8 credit cards…..will get difficult to manage :-). btw completed Rs.4L milestone on Amex platinum travel yesterday. Thanks to you i really have made some good money since i followed you.

Great!

Glad to know that 🙂

My Yes exclusive also got rejected

Prashant/Sid et al,

That is true. My guru, who got me interested in CCs also had his application rejected ‘cos he had too many cards. In his case more than a dozen. I sympathise with YBL in this case.

Regards

@AllYesBank card users.. How good credit limit has been provided to you by Yesbank, coz in my case the limit provided is 1/3 of the limit I have on most cards

Further, they expect High usage on low limit.. LOL

Yes bank is very bad in giving the CC limits. I have received a limit of 1.2L where as the card using which I have applied for had a limit of 5L.

My yes first preferred approved immediately, card on card.

Against 2.70 lacs credit limit on Citibank rewards card, yes preferred gave me 80k credit limit only.

They gave me 55k on C2C basis

I got 1 lacs on yes first preferred C2C basis on HDFC having CL of more than 6lacs

Siddharth, what is the Rs 1000 cashback offer on Citibank premier miles card ? Its annual and renewal fees are Rs 3000 ?

Renewal Fees remains same but Rs.1000 Cashback is for first year alone. Check their website, its flashing almost everywhere 🙂

Here’s a quick look:

Special offer: Rs. 1000 cash back on online credit card applications

– The Offer is valid for online applications between 31st Dec 2016 to 31st July 2017.

– The customer should have spent a total at least Rs 5000 on all transactions put together within 60 days of the receipt of a credit card to be eligible for the offer; Cash back of Rs 1000 would be credited within 120 days of receipt of the credit card for such customers on best effort basis. The time line provided for effecting credit is only indicative of expected period and may vary from the actual date of credit.

I got the 1000Rs cashback for taking Citi Rewards card. I took the card in December & I got the cashback 5 days back. It took nearly 5 months to get the cashback . 1000Rs for taking the card was a good deal.

In Amex Gold also I got 1000Rs as welcome bonus(neither welcome reward points nor joining fee). Also got it reduced annual fee: 2250 per annum.

Yes First preferred I got 1 month back as LTF on C2C basis on Regalia. But it took almost a a month to get processed.

Now I use Diners Premium for almost all transactions. Then sometimes Regalia. Very rarely Citi/Yes bank. Amex for fuel purchase & 4x 1000Rs transactions.

Thanks for your wonderful blog. Before coming to the blog I had no idea about the credit card games & i was just holding hdfc platinum edge

Glad that i was able to help 🙂

@siddarth and others.

Many of my Friends have got citi cards by going a different way, they opted for Citi Shoppers Stop card, which is easily approved and then swapped it for any card of their choice..

It may help someone..

Sounds interesting but i don’t really think a card type can override the internal criteria in a bank that has Global standards.

Any idea how it actually differs going this way, like, was it instantly approved or kind of?

Yes it was approved in a week after submitting the docs, which was done at shopper’s stop itself

Good to know, i may try this way then 🙂

I am using CITI card from 2008. And its a really interesting story on how banks used to issue CC very liberally those days. They don’t have any documents of mine with them, not even my photo!. All I did was filled the application on their website and I receive the card in 15-20 days to my address. I was like WOOW, how come they have processed it. BTW all the banks are very strict on their internal rules these days. Now I hold 13 credit cards!

I used the same thing , first applied for Indian oil card then asked customer care to give a primer miles card . And it worked

Cool.

Getting a Citi Card is really very difficult initially. They have a few policies. They’ll almost NEVER issue you a credit card if you don’t have a credit card from some other bank already. The only Exception to this is IF you have a salary bank account with Citibank. I have a LifeTime Free Citi Rewards Card. I got rejected twice. On the third occasion I din’t want to apply but somehow I got an email from them that told me that my application had been rejected (This is almost 2-3 months after the actual previous rejection) as I did not meet their internal policy criteria. However, if I want my application to be reviewed then click here and there was a link. When I clicked there it asked me a few details. After about 1 week I got a call, documents were collected and they delivered the card within 7 days of picking my documents. That was simply unexpected. Their criteria is very tricky.

That’s strange, now it looks like i should be prepared to be rejected after 6 months 😀

Naah. It’s very difficult to say. Even, they have separate criteria (This is from the Document Collection and Verification Team) based on the region from where you are applying. I applied for this card when I was in Mumbai. I was told that I won’t be give the card. The reason they gave was pretty wierd- That I don’t have a company email address. I told them I work in a govt. setup and the govt doesn’t provide corporate email addresses but they didn’t budge. This happened on one occasion out of the 3 rejections. They didn’t even process my credit card application because of this deficit. Pretty strange right? Some might think that I am making this up but no, this is what I was told. Next time they gave me a different reason.

My wife applied for the Card when she was in Kolkata. She got the card within 7 days. No rejections at all. I was just shocked. And when my application was finally approved, that time even I wasn’t asked for any corporate email or anything. I got my card within 7 days. So, God knows what they do and how they approve your application. Until you get the card, you cannot be sure if they’ll accept your application or not. Pretty weird.

Why would someone apply for a personal card from a corporate email ID.

That’s really weird!

Looks like getting US Visa is easier than getting approved for Citibank credit card 😛

I got the same reason for rejection- not having a corporate email ID (being in a Govt setup). Strangely enough when my husband applied for a card (with a corporate ID) his got rejected for some “internal” godforsaken reason! He holds 2 active credit cards! So Ive no idea how citi evaluates applications!!

I understand this plight, I’ve very good credit rating and do have other cards, my application was twice rejected saying becuz of their internal policies, i too work for a PSU

How about the Redemption options available with Yesbank credit cards? I think its very very limited right?

Yes its limited. Redeeming for Flight tickets would be the best option.

They have increased the options now. I redeemed the points for amazon vouchers last month.

Hi Siddharth,

I had an Jet Airways Citi card and when they cancelled that association sometime in 2011 i think, i was given an offer for PremierMiles from Citi with annual fees of 1k instead of 3k for lifetime. At that time, i had all LTF cards only, so i thought for a while and accepted. So they gave me another card- rewards as LTF which i recently closed.

When i applied for Yes Preferred, i gave citi as card on card basis and i had 6 CC’s already and when i recently applied for Amex Membership rewards i had 7 CC’s (7th was yes cc).

I like the rewards on the citi PM card, since as a welcome gift, they gave all JP miles i earned till date as rewards and that was approx 14k worth which covered 14 years of fees. And also redeemed all my JP miles for free flights.

But now the redemption is 40 % instead of 50% when they started. Booking on their websites always gives 10x points, and fares are reasonable (sometimes lesser than other websites).

Hope this helps, and citi accepts your application next time around. Maybe have yourself referred from someone via citi referral?

Hopefully, lets see.

Referral doesn’t make any difference in this approval process though.

Citi bank has very weird criteria, I had Hutch citi credit card for a long time, since the product was discontinued I was offered rewards card LTF during renewal process in 2011 everything was going great and one day I got a sms stating due to change in internal policy my card has been deactivated and asked for full payment to be cleared in a month as per conversation with nodal officer was informed that my residence area is blacklisted.

I had using the card since 2007 without any late payment; don’t understand how the bank can just cancel the card without any prior information. Again after a year or so I got a call from citi offering me the same card LTF without any documents based on my past record which I agreed but my bad luck in 2015 again citi cancel my card for the reason residence area is blacklisted and again had offered me the card last year in December but this time I was completely fed up.

I leave in Mumbai suburbs works for MNC all other credit cards providers have no issue with my residence area but only citi.

Blacklisting area is also used by amex. Some of my relatives lives in an area in jaipur which somehow is blacklisted by amex and its in main city.

Hi Sid,

First of all Kudos! for this superb blog, the way you have maintained this place with so much knowledge for credits cards is really awesome, this has helped a novice like me a lot, who is new to the world of Credit Cards

Apparently after reading all the rejections stories for Citi CC, I feel lucky enough that my card was approved in the first try itself, even though it is my first credit card. (Neither I hold a salary ac with them)

I just filled the application online, the documents were collected in next 3 days and I got the card in 10 days.

I think so Citi’s criteria for CC approval differs from city to city (I’m based in Pune), as I didn’t face any problem in getting the card.

Glad that i was able to help.

and Congrats on your first card!

yes, it seems Citi approval process is as mysterious as Gal’s mind 😉

Can you please tell me which credit card you applied?

is it CITY Reward or CITY Cash Back.

I want my first credit card too…

Please someone suggest.

It was Citi Cash Back card.

Being a Citibank customer for about 10 years now, I can confirm the following:

1) Holding too many cards isn’t seen as a positive. It shows too much depence on credit.

2) If you put in enquires for credit cards very often (online or through the bank branch), it’s counted as a ‘hard enquiry’. Too many of those and it negatively impacts your credit score.

3) The trick that someone mentioned about swapping a lower card to a higher one is TRUE. Apply for a lower tier card and make sure it comes with a credit limit of 2L or more. Then wait for a few months and then ask them to ‘swap’ the card for the premier miles card.

Good luck.

I applied for citybank but, still no revert from them…

how they revert back ? what is procedure ?

I applied through online and its been 3 days.

Hi Siddharth,

First up, excellent site, there’s a lot of helpful information here. I would like to know your views on applying for multiple credit cards within a short span of time. I currently hold Regalia First, which is my regular card. I’m a regular traveller on Jet Airways and want to collect JPMiles quickly, so I recently applied for the ICICI Sapphiro Card (to make use of their double miles offer), and have just got it approved.

I also see that the Jet Airways Amex Card is offering a double JP Miles joining bonus to those who apply on the JetPrivilege website. I’m tempted to apply for this card too, but I’m not sure whether doing so will adversely effect my credit rating/CIBIL score. What are your thoughts on this?

Its okay to apply for approx 3 cards in 6-9 months time.

My HDFC Diners Premium Credit Card application got rejected today. I had submitted all docs on 3rd June itself. Salary and other credentials were meeting HDFC criteria. I have no loan and credit card history. Field executives were insisting on verifying local address during office hours. I had raised this concern to nodal officer. It is still pending. Don’t know if it was rejected due to address verification or no credit score or any other reason. HDFC mail mentions generic reason (not meeting internal criteria) for rejection.

Is there any way to get specific reason for rejection ? Please help

Escalations to Nodal officers might help sometimes.

Open a bank account with Citi to get your card approved next time.

Does anyone got renewal fee waiver for citi miles? If yes let me know.

Mine Citi Credit card application was also rejected this year in Feb-March….

Dont know exact reason… Only had 2 Credit cards at that time… Plus, good Cibil score >800

I assume Citi se ekk rejection to zaroori hai ….

Don’t know but if Citi allows Card-on-Card basis, may try next year against my HDFC regalia

I have no loan, credit card on my hand. My annual income is complied to the minimum requirements. Therefore, I applied citibank clear visa credit card, but at the end my application is unsuccessful. I have no idea why my application rejected. It is because i am working under contract with one year so they reject my application? I hope to get an answer from banker.

No.It is because you don’t have another credit card and most probably dont have a credit history

I have a cibil score of 810 and a great payment history for my 2 credit cards with Citi and ICICI. No late or over due payments. No loans record. Limit is 1 Lac only on each card

Yet my application for HDFC card is rejected twice now in 2 years. Applied online both times, documents collected, field executive was certain it will be approved.

I got an SMS from HDFC within 3 days that my card has been approved ” in-principle”.

And then after 4 days an email came saying your application is rejected because you don’t meet bank’s internal criteria!!!

Not sure how this works. Anyone know the trick to get a HDFC card?? I have No a/c with them.

Recently I enquired citi for credit cards. The sales team said that currently they are not requiring any kind of income proofs, no salary slips or ITR or other bank card statement. They are only taking id and address proof. I guess they are currently issuing card solely on the basis of CIBIL history

Interesting. Anyone else heard about it guys?

Yes, they are only collecting ID and address proof.

This must be in response to Yes bank’s similar aggressive stance of approving credit card with Aadhar, Pan.For me they gave Yes preferred same way, although i did hold a savings account with YBL.

Siddharth, I have recently started following your card reviews – appreciate the wonderful analysis and discussions from you & your team!

I have been interested about Citi PremierMiles card for quite some time and called up their customer care for swapping my existing rewards card only to be told that sign up bonus of 10K miles wont be applicable while doing this. Has anyone done a card swap earlier and did you face such a situation. If yes, I believe we may have to apply for a new card to get this offer

I recently swapped from Citibank cashback card to premier miles card. I had to pay the card joining fees on a proreta basis(MEMBERSHIP FEE – NOV-17 TO SEP-18

2,750.00

ANNUAL FEE REV – SWAP(reversal of existing card charges)

458.33 CR)

After my first transaction of Rs 10k, my account was credited 10k points.

Thanks for the reply, looks like the CC executive may have provided wrong info. It happens sometimes, but let me try giving a call once again and hopefully they will give correct info this time. Keeping my fingers crossed…..

Sid, did you apply again? If yes is it approved?

Might apply sometime in 2018. Will keep the article updated if i do.

I have Citibank salary account but my credit card was rejected due to low salary when I contacted to bank person they told your income should be 20k plus and my income is just 19,975rs.

Apply when u meet the criteria. Else if you have any other credit card let them know about that also.

Why don’t you ask for a raise in your current job first 😉 or better still change to a better paying one?

I currently have Citibank Cashback card n I hold Citi cc since 2007. Every person should have 1 Citibank credit card as they run quite frequent offers for online shopping. Every 2-3 months you will see 10% cashback offer on Flipkart and Amazon.

Citibank is also giving 20% cashback on Bigbasket for purchase above INR 1500 upto max 500 cashback since May 2017. This offer runs for 1st to 5th day of every month and cashback is supposed to be credited within 90 days. Though I have received cashback credit within 60-70 days most of the time. They run weekly offer on Makemytrip as well as Reliance digital offers from time to time.

This 20% cashback did not get credited for me last year-have to again chase customer care guys. 🙁

Citibank seems to have a tricky process for credit card approval. I already have a home loan and 2 credit cards(HDFC & SBI). My application for Indian Oil Card has been rejected for the second time. Firstly, they told that I don’t have enough credit score and at the same time, HDFC approved my application for Regalia First with a decent limit(I had no prior relationship with HDFC Bank while applying for the card).

After waiting for 6 months, I applied again and this time they’ve rejected again by stating the application does not meet our internal credit acceptance parameters.

Has anyone any idea about their credit acceptance parameters?

Maybe because of your (emi + credit limit) to Salary ratio.Can you share that?We may get some better insight into the algorithms that go into approving or rejecting citi card applications.

Citi bank approval criteria is quite mysterious. I applied for a citi rewards card through referral. The only documents they asked were id proof and address proof(no income documents) . It took them quite a while to collect the documents as my residential address wasn’t under the service area.

After waiting for almost 10 days I got an email stating that my application has been rejected because of internal policy, although my cibil score was more than 820 and the verification guy told me that citi needs a cibil of 750+.

What came as a surprise to me was that after 3 days I got a text message stating that I have applied for citi bank credit card (this time with different application number) and it takes 7 days to process it. However, the very next day I got another text message from citi stating that my card has been approved and it’d be dispatched in 2 days. Luckily I got the card in next three days.

@ Himanshu

Maybe your city is not in their list or your area pincode is blacklisted due to past default in payment by some of their cc customers.

One thing you can do is open a savings ac with citibank and maybe apply again after 6 months. Ofcourse do this only if you want a Citicard badly.

@Satish Agrawal

I really doubt that they’ll blacklist Delhi-01. I will try once again after 6 months by applying through a branch this time.

I think opening an account with Citi just for the sake of credit card would not be a good idea. HDFC already has some great offers these days.

@Himanshu

I hold Citibank Cashback cc and getting cashback points even for wallet topups. Also the t&c tells I will get 1 point worth Re 1 on spending 200/-. This becomes 0.5% cashback, but almost all the times I get 2-4% cashback points. Once 500 points gets accumulated, 500 is adjusted against next month statement. So I am having full of cashback with this cc. This is despite me not spending on any of their 5% cashback categories like utility bills or dining spends.

@Satish Agrawal

Recently, HDFC had a similar goof up where they gave extra points on their Platinum Debit Card and now they have deducted all the extra points from the existing points. Now my account is showing total available points as -500.

Moreover, after Citi rejected the application for IOC Card I applied for the Amex MRCC and they have approved the application within a week.

@ Himanshu

As Citi is crediting more RPs every month for me since more than 4-6 months, I am less worried about any goof up taking place in my case. More so bcoz 1 RP is equal to Re 1 in Citi Cashback cc. Their basis for RPs calculation is as mysterious as approval of their cards it seems. Citibank cc was my first cc.

Congrats for your Amex MRCC. I can’t apply for this bcoz my city is not in their serviceable area.

I hold HDFC DCB with 7 digits limit and AMEX, IndusInd with 9l digits limit each but still Citibank is rejecting my application from last 3 years. This was the 4th time I applied and got rejected. May be they don’t care for small businessmen. Same with SBI, stuck with 50k limit from last 8 years and they just don’t increase my limit even with all the documents.

Did you try applying for the basic cards or trying for PM/prestige in first shot? Later might be tough unless IT is very high.

SBI LE is easier now. I got LE after 1 yr on SBI, in 48 hrs of submitting the docs online.

Siddhart have you applied again for Citi card ?

Hopefully soon.

Dear Sid

Very happy to let you and others know that my credit limit on Citibank Cashback CC is increased today from 45K to 2 lacs directly.

My cibil score is above 800 but having 6 credit cards at the moment and in the past (8-10 Months back) my citi bank credit card application was rejected. Few days back i visited bankbazar applied Citibank Indian Oil card. After two days i received a call for document collection but before the executive collect document i received an email from CITIBANK saying sorry due to some internal reasons, we are unable to process your credit card application. When executive came, he said still give me documents, it will be processed, and surprisingly after approx 6 later i received sms from CITIBANK that your card is approved and will reach you in next 2 working days. This is when i am holding 6 credit cards, out of which one (HDFC Club Milles) was issued last month after spliting the limit of my regalia First and yes bank’s credit card 4 months back. The only difference was last time i applied directly through CITI bank site and this time through BankBazaar.

Congrats Mr Narinder.

Satish from how long you hold citibank card?

How much is your annual spends ?

Hello Mr. Satish Kumar Agarwal did you provide any documents for your citibank card limit enhancement ?

You got a really big jump. I got citibank card this month. What should be my way of approach for limit enhancement ?

Hi friends I recently got a Citibank First Citizen credit card. I was fortunate to get a Citibank card in my first attempt ( even though they so not serve my city) . Limit is 75 k. Friends I need your valuable suggestions. What should be my best strategy to get credit limit enhancement in future ?

Dear Captain

I am holding Citibank CC since last 11 years approx.

It was my 1st credit card. Annual spends on Citi CC is approx. 1 lacs pa.

Dear Captain

I provided last 3 months salary slip as well as latest ITR scanned copy to Citi on email.

Wait at least 6 months for LE. Citibank is not good at providing LE outside metro cities AFAIK.

Did you apply for Citi cards again @siddharth?

Not yet man.

One of my friend applied for Citibank Rewards Credit Card on 22 Aug and she got a call from citibank regarding document pickup (Photo & Adhaar only not even copy of pan card) and office verification was done on 31 Aug and received an email on 04th Sep that “We regret to inform you that we are currently unable to process your application as it does not fulfill our internal policy criteria.”

After that, she immediately escalated this issue (to review her application as her cibil score is 796 ) with Citibank Consumer Banking Head and on 6th Sep received an another email that

“Based on your representation, we are reprocessing your Credit card application. Issuance of a Credit card is subject to your application meeting all the credit acceptance parameters of the Bank. We will keep you informed of the application status latest by September 14, 2018”.

Finally today on 10 Sep received SMS “Congratulations! Your application for a Citibank Credit Card has been approved. You card will be dispatched within 2 working days”.

It seems like the process of approval in Citi Bank has been simplified now.

I applied for the Rewards Card via BankBazaar. Here is the timeline of events:

Monday, 17th Sep 2018: Applied via BankBazaar

Wednesday, 18th Sep 2018: Got a call from Citi for document collection(Only Aadhaar was asked even though I am working in different city). The document was picked up on the same day.

Thursday, 20th Sep 2018: Got one verification call from Citi.

Friday, 21st Sep 2018: Got a text stating that application has been approved.

Monday, 24th Sep 2018: Card delivered.

First of all Siddharth , excellent site and resource for cards ! Kudos !

Citibank is ridiculous. I applied for their lowest category card – Citi rewards card simply because vodafone had some offer of 50% on my postpaid and I just clicked it. They called asking all the details and then I get an email my application has been rejected ! due to “overdue outstanding”. Which is BS at best.

Background:

My CIBIL score is 826. My overdue or even due on any of the cards is 0. Never crossed more than 50% CC usage ever.

I hold an HDFC Infinia and a Kotak Privy League. I don’t have a single active or otherwise loan in my name. I bank with 5 banks and am the highest tier customer will all of them.

Yet, I got rejected for a card that has annual spend requirement of INR 30k, its just laughable. I am going to write to them with my accurate details and let them know I surely DO NOT require their card. 🙂

PS: Above being said, I did find in my CIBIL report lot of loan inquiries which were never done by me, some were as frivolous as loan of INR 1k ! I think CIBIL and other rating agencies need to be strict about whose access is allowed and who can upload data that needs to be verified.

I applies for citi rewards card and verified by 2 times. I was told one more call will come. How many time they verify for the card.

Each bank has its own eligibility criteria before even they look into your CIBIL. This criterion is more stringent for Self employed people.

I recently applied for a Citi rewards card as they had some great festive offers on Amazon. I received a call after a few days who asked for my Name, DOB and Income. After this, he said due to some internal criteria we are unable to forward your card application but is not in the position to disclose the reason. I knew my income or CIBIL score was not an issue here (I hold Amex Platinum Charge Card from 2010 onwards). Infact my CIBIL was not even checked as per the recent CIBIL report generated. However, they still rejected the application at the first stage itself. I got no email or SMS. It was denied on the phone by the person who called me. Later I came to know the actual reason for rejection was that I mentioned same address for residence and office!!

If I reckon the process of getting Amex card back in 2010, I do remember my first application was rejected just because I did not have a landline number to provide in the application. Same was approved after 6 months when I reapplied after getting landline (which I got with Airtel broadband). Within 10 days I had my card delivered!

That being said its far more easier for Salaried person working in a reputed MNC to get a card. I remember during my early 20s when I was working with a big MNC, I was offered Citi card just on the basis of my ID card. Many people got it, but that time I did not choose to apply.

Dear Mr ALLADI PAVAN SAI KUMAR,

Thank you for your application for a CITIBANK REWARDS CARD.

We have reviewed your application and the documents provided, in line with the bank’s internal policy guidelines and operating processes. We regret to inform you that we are currently unable to approve your application, as the application does not meet our internal credit acceptance parameters.

If you require any further clarification or assistance, please contact our 24-hour CitiPhone helpline (applicable across India) at 1860 210 2484 or +91 22 4955 2484, and we will be happy to help you.

Kindly remember to quote the application reference no. (as mentioned above) in all correspondence .

Assuring you of our best service at all times.

P.S: Previously I do not hold any credit cards, this was my first credit card application .

Warm Regards,

Manager – Customer Service

For Citibank, N.A.

my app also rejected for reason

“”you have exceed the maximum unsecured credit exposure prescribed by the bank”

not sure what that mean

it means you either have more number of cards active than they like , or your total credit exposure is above their comfort levels

Does anyone here knows how to get a citi bank credit card with self employed tag, as they aren’t providing cards to self employed, any tricks or way?

Hardik you can apply in Shopperstop store for citi cards. I have ITR of Rs. 3.40 lakhs an d I stiol got approved in 1st attempt. They don’t need ITR. You are suppose to have Shopperstop First Citizen loyalty card

Which Shoppers Stop store? Which part of the country are you talking of? No offers here anywhere (Chandigarh)!

@Shivi

Here in Lucknow also this card is not offered via Shoppers stop. But First Citizen desk guy told in metro cities like Delhi one can apply in Shoppers stop’s FC desk.

Shivi if Citibank do not have branch in your city than they will not issue credit card. I applied in Kolkata’s Shopperstop Store.

We have Cutibank in Chandigarh, Captain. Just didn’t find any Citi Stall in Shoppers Stop here!

Even in NCR in every shoppers Stop. Citi guys are ready to give you cards.

Buy the membership here

Once you’re enrolled, go ask the store reception that you want to get the Citi card.

Just keep in mind that getting a co-branded card is not the best way to step into Citi ecosystem, for future benefits like credit limit enhancement and qualifying for better products. Try for PM card direct if you think you’d qualify.

Hey amex guy, actually i dont qualify for their cards because i am self employed and they don’t provide cards for self employed individuals and i want citi cards because of the value they hold, secondly can you please explain me can i swap this card for citi rewards or indian oil card in coming future, is that possible?

Can the Citi rewards card be applied on the basis of existing credit card statement?

Hello captain, can you please help me in detail as i don’t shop in shoppers stop and never will mostly, secondly how to make shoppers stop first citizen card?

@Hardik

Almost all metro cities shoppers stop have this facility. Shoppers stop loyalty card is called First Citizen & have a desk for them exclusively in each store. Goto First Citizen desk and ask for the Citibank First Citizen card. They will provide details n complete formalities for this card. Check your city Shoppers stop for details.

Hardik if you buy any item from Shopperstop than you can get the loyalty card by paying a fee of about Rs. 299 ( not sure) . Just ask the guy in billing desk. But before that you have to find Citibank credit card guy in the store because Citibank operates in very limited number of Indian cities.

Hardik,

You can request it online by visting shopper stop website or from store( but you need to make purchase via store i think)

Captain,

I visited shopper stop store yesterday. i am first citizen member, they refused for such offer. Which city do you live in?

Hello captain, today i visited shopper stop mumbai for shopping and made a purchase of 2k(only needy stuff merely not for card) and spent another 300rs for first citizen membership and at counter i was approached by citi bank employee and he said as you are self employed you aren’t eligible for card (as he further told before 6 months citi stopped providing any cards to self employed) and if you are eligible by first citizen membership, citi bank will call you by your purchase history, 😒😕. Seems like getting a city card gor business person like me is hectic or impossible let’s see what future has, till then happy with other cards in bucket 😀

Sir I want to know first citizen city bank credit card is good …and wats the minimum limit provided in this card

Received 50% auto le offer on my Citi Cashback cc. This is 8 months after I got LE from them, though that was payslip based.

Congrats Satish.

I have a doubt. If it is auto LE than we are not suppose to provide income documents right ?

How much and where was your spends ?

How much was your income if I may ask ?

I have completed exactly 6 months on my Citibank Shopperstop First Citizen credit card and spends are more than 2 lakhs. Don’t know when i will get aut LE .

Dear Captain

I was talking about my previous LE 8 months back which was payslip based.

For this LE I was not asked for any documents.

Now coming to your questions–

Approx spends 5-10K per month, all online spends.

ITR 17L

Citibank Cashback cc limit enhancement took 4 working days after acceptance of the auto LE offer.

HDFC just requires otp verification on netbanking for the same and does le within minutes. Even RBL auto le took less than 5 minutes to reflect in app.

Citibank’s offers aren’t really auto LE, and they never say so. A system detects that you maybe eligible for a particular enhancement. When you accept, a real human looks over your file and approves. Not really auto. You can get denied.

Amex Guy do you think I can get LE in my citi card ? I have only Rs. 3.40 lakhs ITR.

OK. Thanks for this valuable insight.

Hey amex guy, actually i dont qualify for their cards because i am self employed and they don’t provide cards for self employed individuals and i want citi cards because of the value they hold, secondly can you please explain me can i swap this card for citi rewards or indian oil card in coming future, is that possible?

I faced this same issue previously. Then I read online somewhere saying that Director of a private limited company can apply as a self-employed. I tried applying it again, and I got my hands on a PremierMiles Credit Card. Just received it today.

Hey sid, Did you applied for card again as i can make out by post you too are self employed, if you can get one possibly other self employed too can get one, i have my uncle too even he is self employed and holding amex and other cards, before 2 months city guys called him and offered card without any income documents and just adhar and pancard, we met in marriage and i even suggested them your site, Does citi guys have provided them on basis of their cibil right or anything other, please shower some light so i can know 🙂

Hi Hardik, last year I applied for Citi cash back CC. They never asked any income proof. Only they collected my aadhaar and pan only and offered card. But am a employee and CITI collected my company and salary details through cibil report and gave me the limit of 2x of my salary. I didn’t inform my company details but in the card delivery address they mentioned both of my residence and company address.

That’s because they already had your company information and cibil checked while offering you credit card,in my case i have self employed marked on my cibil with my shop address on it,so I can’t avail citi bank cards as of now😞

Can anyone please respond to above 2 replies of mine and help me? Eagerly waiting

I got my card as self employed, but it was years back. I would not worry too much about the CIBIL employment information. Most banks put incomplete stuff on it, and report only retains the last update. Banks know this and I don’t think they care.

What you actually need to care about — keep enquiries to 0 for 6-8 months. Usually let Citi be one of your first 2 cards. Definitely you won’t get it as your 4-5th card unless your ITR is extremely large. A lot depends on your PIN code too with Citi, as well as the report the field guy sends.

And also have a bank account with them helps!

Here is a interesting way of getting declined.

I held Citi PM card between 2013-2016 and it had to be closed since I moved out of the country. At the time I didn’t have any other relationship but PM card.

Fast forward, 2019 Aug, I am back to India and open up their Citi Priority banking and apply for the card due to fee waiver for first year and behold a decline.

Other than this, HDFC gave me regalia (am sure there was a pull) and I closed it out and applied/approved for Diners Black with 5L limit. So 2 Hard pulls.

How do I go about getting Citi reconsider my application.

Is there a number I can call?

Also I hold Citi Prestige from US and was hoping to cancel it out and eventually get the Citi Prestige here as an upgrade from Citi PM. Does anyone have suggestions if this would work?

Citi does not like to change their decision. So, do try after after the stipulated time period which should be mentioned in your rejection letter.

As far as the number of hard pulls and the number of cards held with you prior applying for any or Citi PM are concerned, I got the PM as my 8th card with 3 hard pulls couple of months before applying for the PM.

Quick update, reached out to RM at Citi and they spoke to relevant team I guess. I got a text in a day that it was approve and will be shipped while checking the status on the Citi website using applicaiton number still shows ” Not approved”

Hey Sid, Three times my CITI card was rejected and this time I had escalated this to the country head of credit cards. I received a call from the response unit and informed that the card was rejected because simultaneously other financial institution had checked my CIBIL hence it was rejected. As per them, chances of getting CITI credit card approved out of 10 application will be one because of their stringent rules. Anyway lost hope with CITI bank and never gonna apply again.

I got rejected twice on applying for premier miles. So I stopped making any hard enquiries. One year later I reapplied, this time through Bank bazaar. I got approved and recieved my cars in 10 days. Try applying through bank bazaar or paisa bazaar instead of directly

Worked for me too via Bank Bazaar.

My case some years ago was exactly opposite

Being self employed, I found it very difficult to get HDFC/ SBI credit card. Somehow got approved Citi rewards card with lower limit, which has increased now but very slowly.

Currently HSBC is promoting their cards and they clearly mention that self employed applications will not be processed.

“I checked CIBIL to see an inquiry by Citi and the CIBIL score was well above 800 without any over-dues or blackmarks, but hey there are hell a lot of credit card accounts on the report”

@Sid: How does someone check the Cibil report? And does checking his/her own report, count as a Cibil hit?

You can simply visit CIBIL site and register there with all your bank specific details and proper PAN no.You will see one option for free credit score (Yearly once free ..if you want more subscribe to their plan).Pro tip- You can get monthly CIBIL via wishfin site and they are CIBIL authorised.

Coming to second qn whether credit score checking hits cibil score ..NO..ITS NOT.As they are called soft hit not hard hit which actually hit your query .hard hit happens when you requested for any credit card/home loan/ Consumer loan etc and respective lender will search CIBIL to see your finnacial status via CIBIL report and that’s called hard hit which hits cibil score .Hence it always recommended to Not apply multiple credit/loan requests in small span of time as it shows in CIBIL reports as if you are credit hungry or can’t manage your finance well.

Guys, my Citi Credit Card application got rejeced recently. Will they allow me to apply for Citi Credit Card before 6 months via Citi bank Branch or i am supposed to wait for atleast 6 months to apply Citi Credit card again anyway ?????

You will have to wait for 6 months.

hi how do i apply if i dont have residential landline number, secondly if my job is transferable, do i have to intimate them everytime i change my location . Being in Army i dont have office address and landline number of the official address too

please guide me

Hi to all from my side. I have read all the comment and post related to citi card application rejection reasons, after reading this I decided to apply for citi credit card and below is the timeline of my citi card application.

12 sep 2019:- There is an offer running on Amazon that apply for a citi card through Amazon and get 1000 rs amazon voucher after spending 2500 within 30 days. I read this on Amazon and applied on 12 sep got a call from citi customer care with in 15 minutes and the executive take my each and every details (home and office) and applied for citi reward card.

13 sep 2019:- I received application reference number through sms.

14 sep 2019: received a call from local branch(delhi ncr) for documents and KYC. I asked them what documents you need? The lady on the other side said that we need your aadhaar card and pan card, one photograph and signature on some papers. At that time I was out of city so asked them to collect my papers on Monday 16 sep 2019.

16 sep 2019:- A city bank guy come to my house and asked for aadhaar card and pan card and one photo I just give him the papers he give me some papers for signature. I give him a glass of water and a glass of fruit juice. I asked him do you need any income documents he said no i don’t need any other documents except pan and aadhaar. I live on rent and even citi bank does not ask me for local address proof. I asked the guy that anybody else come for verification on my home and office the guy said no nobody will come for anytype of verification form citi bank.

19 sep 2019: In the evening i received a text msg from citi bank: congratulations! Your application for a citi bank credit card has been approved. Your credit card will be dispatched with in 2 working days.

21 sep 2019:- my citi reward redit card delivered by blue dart in the morning 11 am. I got the limit of 80 thousand. Great.

Before applying for citi bank I have 6 credit cards 2 from sbi, 2 from icici bank, 1 from hdfc, 1 from standard charterd. SC also take my kyc documents only. Fastest credit card I received from standard chartered with in 7 days without any physical verification.(I don’t have any prior relationship with either citi bank or SC.) And this case I am thinking that my last 3 credit cards are still not updated in cibil. My cibil score is 856. SC and citi both checked my CKYC I have CKYC number. My both address (local and permanent) are updated in CKYC and the same address I give in the SC and Citi credit card application.

I don’t give any landline number of office or home neither asked by citi bank.

No verification on office. No income document only aadhaar and pan card and one photo.

I am self employed but told citi that am salaried.(but I give them office address)

@Abhijith Singh

Hi Abhijith, First of all thanks for the valuable information..I have two small doubts

1.”SC and citi both checked my CKYC” how do you know ,they checked your CKYC..?

2.Yes bank sent me CKYC number and all that while applying Credit card, where can I find my CKYC details..?

Thanks..

Same experience for me with CITIBANK but CKYC check is something thats irrelevant my current address and ckyc address different still got the card.

Hello pals, Today after my shopping at shopper stop a citi guy stopped me and said about citi first citizen card,as being a self employed and can’t get a citi card so told him i would be rejected as they have rejected me earlier few times,he said you will get it surely if cibil is above 750, guys i have 9 credit card from different banks and this seems huge risk to any bank, any one of you have got citi first citizen card being self employed? A reply is most welcome 🙂

It’s been 10days since the application of Citi first citizen cc, received only one verification call from a mobile number on 13th of December and she told a verification call will be coming to you and after than in 7 working days your card would be delivered, since 10days no calls nothing is received and applications number provided is of 9 digits and they need application reference number which i Haven’t received of 11 digits so can’t track application too,can anyone let me know what’s going here in Citi bank?

Call CiTiBank Customer care and ask!

I tried,they say we haven’t got any application on the said number and application number is invalid!

Hi all,

So after getting rejected by Citi Bank card 2 times as being self employed i was really annoyed being rejected for such a basic card while having other premium cards in my kitty, So as suggested by some i also tried getting a citi card by getting a cobranded citi first citizen card So here is my application process!

Already being shopper stop regular customer and having being in Their loyalty program from past 2 years ,one day on 11th December I was being approached by a citi agent at shopper stop and i already needed card so applied through him!

14th December 2019 received a verification call from them confirming my details!

3rd January 2020 again received a verification call from them!

6th January received a sms with application number and was said within 7 days they will let me know regarding approval but the next minute I checked mail ,i have received rejected mail due to internal criteria!

I immediately checked my cibil and saw no CIBIL inquiry so my cibil wasn’t checked so i understood they rejected me on basis of proffession as being self employed!

But i needed card anyway as it was ego or anything you can assume!

Droped them a mail to nodal desk and received a response like internal criteria and bla bla bla

Again replied them as per RBI notification you have to give me exact reason for decline and so on,they were like now we have to give them exact reason,so they played a game and told we are re proccesing my application and i would receive update by 21 st January 2020 and now on 20th January a CIBIL check was done and reflected on report too, so now i was like 50-50 i might get card,now on 25th of January 2020 receive a call from lady of nodal desk asking my financial and i shared with them and received a mail in evening sir you are rejected on basis of income and all,i was like are you guys serious ,i hold amex and all cards and i am rejected on basis of income! I lost all the hope and ignored the matter now!

Days passed!

On 11th February was checking Citi site and a idea came on mind why not escalate to CEO and give a try and i gave sent mail to them and i received a revert we will update you by 17th February 2020, now surprisingly on 15th receive a sms from Citi bank as my application is approved and card would be dispatched in 2 days and. Next day received a dispatch sms and on 17th February received the card, Citi bank really delivers card super fast and this was my fastest delivered card by any credit card company after approval sms and the longest time taken approval which took my so much patience!

Secondly,i already have 11 Credit card from other banks before applying for Citi this time,so the mystery of let Citi be 1-2 of your card is wrong and as long as you are salaried you can even get it as your 15th card,,for self employed even 2nd card be a task !

Finally my luck and good escalation technique worked to get me a card for which i was rejected 3 times and approved in 3rd attempt too! hahah

So a happy end after struggle!

Thanks!

Interesting. Thank you very much for sharing this experience. Hope it helps many, for years to come.

Most welcome Sid,means alot from the guy whom i learned alot how to use credit card in right way , now it’s your time to get a Citi card so we can learn something new about it 🙂

I applied for Paytm First Card which has all Citi bank offers on it and that was the first time I applied for any Citibank card ever. Luckily got approved with a good limit as well. And the time taken from application to delivery was just 8 days.

I applied for the card after reading about the card on this blog in the comments section. Next day I received a call from Citibank verification team. And next day the executive came for KYC and documents. Within the next 2 days I received verification calls for documents verification and all that. After that got sms for card approved and next day dispatched. And one day after dispatch it was received. So total 9 days including a Sunday in between.

Hello Samir,

Whats the credit limit for Your PAY TM first credit card.

Thanks & Regards.

SUNIL

Hello Siddharth,

I cancelled ICICI credit card one year back I want to apply once again whether they will approve or not? I have good credit history.

I also applied for Paytm First Citi Bank Credit Card. My kyc documents were collected long back on 14 July, and home and office verification was also completed by 24th July and when I checked my status online on 29 July on citibank website it says application cannot be processed as I do not meet their internal quality criteria. Yet on 31 July I got an sms from them that my card has been approved and will be dispatched within 2 working days. Till now as of today 3rd August I have neither received the card nor any further communication from them. The online status still shows that its rejected. I just don’t know what’s going on?

Hi Alok, I am in the same situation. Did you get the card eventually?

What happens when a bank doesn’t approve credit cards to Cardexpert’s?

They have to leave the country. 😀

They rejected my application even when I was a Citi employee. Beat that! Their internal criteria certainly werent at par with icici, hdfc, sbi, StanC and several other cards which I held at that time.

And now past 2 years they have been chasing me with ‘An offer you cant refuse’ with 3-6K cashbacks on applying for a pre-approved Citi card. And I just say ‘huh’.

They had the first mover advantage in India but this is where they got their act all wrong and lost share to competition even in a booming market.

What is the easiest way to get citi bank credit card?i have already 5 cards from other banks

I applied citi 3 times and everytime getting rejected.

Getting a Citibank card right now isn’t recommended IMO. Citi is trying to sell its consumer arm (includes retail credit cards and savings accounts); I’d suggest wait till that happens, because you never know if they change the products / terminate them altogether.